Buy Castrol (India) Ltd for the Target Rs. 260 by Motilal Oswal Financial Services Ltd

Volume growth remains strong

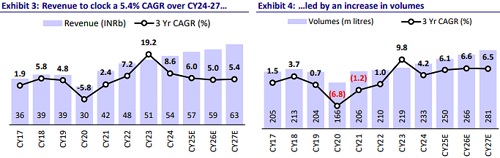

* Castrol (CSTRL)’s 3QCY25 performance was in line. EBITDA margin expanded 150bp YoY/30bp QoQ. Volumes were in line at 59m liters (up 7% YoY).

* Management highlighted that it remains focused on brand building, widening the distribution network, and launching new products, all of which we believe will drive volume growth and market share expansion.

* CSTRL has always enjoyed a strong brand legacy, and we are confident in its ability to maintain profitability through an improved product mix, stringent cost-control measures, and the launch of advanced products that command better realization. We reiterate our BUY rating with a TP of INR260.

Stable 3Q performance

* CSTRL’s 3QCY25 revenue came in at ~INR13.6b, in line (up 6% YoY).

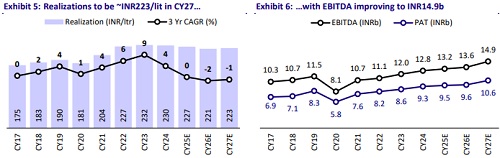

* EBITDA came in above our estimate at INR3.2b (up 13% YoY).

* EBITDA margin expanded 150bp YoY/30bp QoQ.

* Gross margin expanded 200bp YoY/140bp QoQ.

* PAT also came in 7% above our estimate at INR2.3b.

* Other income came in above our estimate.

* Other key highlights:

* CSTRL expanded its footprint and strengthened market presence:

* It expanded national network to ~1,50,000 outlets across India.

* Service network now encompasses over 750 Castrol Auto Service centers, around 33,000 independent bike workshops, and about 11,500 multi-brand workshops.

* With nearly 40,000 rural outlets and 500 Rural Express points, the company continues to deliver consistent double-digit growth in rural markets.

* The full Auto Care product range is now accessible via e-commerce platforms, modern trade channels, and more than 67,000 physical outlets nationwide.

* Signed an MoU with VinFast Auto India to provide reliable and easily accessible after-sales support for EV customers through select Castrol Auto Service workshops.

* CSTRL is building momentum through new launches and localization:

* Expanded the Auto Care portfolio with the introduction of Castrol All-in-One Helmet Cleaner.

* Localization of high transmission EV fluids and industrial products Alusol SL 41 XBB and NPI-Spheerol SM 00.

* Upgraded Castrol Magnatec to align with the latest API SQ specifications.

* The company is driving brand preference:

* Conducted large-scale city activations across key markets, engaging over 5m biking enthusiasts under the Castrol POWER1 brand.

* The ‘SuperDRIVE with Castrol EDGE’ initiative enabled around 10,000 consumer trials across 10 major cities.

* The Super Mechanic Saptah program garnered participation from more than 5,000 mechanics nationwide.

Key takeaways from the management commentary

* Volume stood at 59m lit (up 7% QoQ)

* Volume split in segments: Personal mobility/CV/Industrial segment – 48-50%/38- 40 %/13-14%

* Segment-wise growth in volumes: Personal mobility/CV/Industrial segment – 6%/8%/double-digit (%) growth.

* The company deals in industrial lubricants such as high-performance lubricants, rust preventives, and metalworking lubricants. These contribute around 12 to 14% volumes.

* About 50-55% of the base oil is imported, while the rest is sourced domestically.

Valuation and view

* Our EBITDA margin assumptions are already within the company’s guided range of 22-25%.

* We value the stock at 26x Dec’27 EPS to arrive at our TP of INR260. We reiterate our BUY rating.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)