Buy Kirloskar Oil Engines Ltd For Target Rs. 1,150 by Motilal Oswal Financial Services Ltd

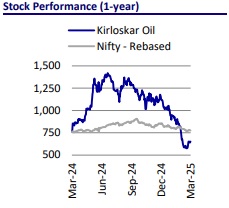

Favorable valuations; close to bottoming out

We recently interacted with the management of KOEL to gain insights into the growth drivers for both B2B and B2C divisions. The company’s performance during last quarter was impacted by low demand and its selective kVA focus in the powergen segment, as well as shifting of its facility for the B2C division. Demand in the powergen segment has now started improving sequentially and operations have stabilized at the B2C division as well. Despite near-term volatility that may exist in the powergen marketdue to high base of last year and increased competition, we expect KOEL to benefit from 1) a shift in focus towards mid to high kVA segments in powergen, 2) increased focus towards new areas in the industrial segment, 3) improved touchpoints in the distribution segment, and 4) better profitability of B2C division over next few years. The company’s initiatives are aligned with these areas, and we expect results to be visible over next few years. We trim our estimates by 4%/6% for FY26/27 to bake in slightly lower margin and continue to value the company at 25x Mar’27 earnings. urrent stock price is factoring in extreme pessimism related to growth and margins, which we believe is unwarranted. We reiterate BUY with a revised SoTP-based TP of INR1,150.

Key investment thesis

Powergen market scenario and positioning of KOEL

The powergen market demand over last two quarters was impacted by a steep increase in pricing and pre-buying ahead of the CPCB 4+ implementation. Demand has now started to improve sequentially and industry volumes are expected to improve to 36,000-38,000 units for 4QFY25 from 32,000 units in 3QFY25 Within this, KOEL is strategically not chasing low-kVa volumes particularly from telecom market where market is highly commoditized. This approach, we believe, would have resulted in other players gaining market share in the powergen market during 3QFY25. Company is focusing on increasing share of volumes in mid to high-kVa ranges. It is planning to increase share of HHP sales in powergen revenues by 400-500bps in next 1-2 years. KOEL is already executing orders upto 2,500kVA and would also plan to increase presence in project business on HHP side over time. We, thus, expect KOEL volumes to start reflecting an improvement over next few quarters first from 250-750kva nodes and later from HHP nodes. We expect powergen revenues to get impacted in FY25 and expect it to recover from FY26 as powergen market stabilizes.

Industrial segment growth drivers for KOEL

Industrial segment revenues during 9MFY25 grew 20% YoY, led by strong demand from the infrastructure and construction sectors. KOEL will continue to maintain its focus on construction, concrete handling, railways, mining, and defense, and is optimistic about the growth prospects from existing and new segments. The company has recently launched 1) BSV engines for various construction applications like backhoe & wheel loaders, cranes, material handling, and road & concrete equipment, 2) Air-cooled engines, including India’s first CNG-powered air-cooled engine for concrete equipment, 3) India’s only 1100 HP engine for mining applications like dump trucks, dozers, and excavators, and 4) Advanced futuristic technologies, such as hybrid engines and hydrogenfueled internal combustion engines. The company’s newly launched CEV BS-V engines meet stringent emission norms. With these initiatives and a focus on the construction and infrastructure sectors, we expect a 14% revenue CAGR for the industrial segment for KOEL over FY24-27.

Distribution reach better than smaller and new players in the industry

The distribution reach of KOEL is much better than other players in the industry. The company has 430+ service touchpoints. KOEL is expanding its presence in the retail channel by focusing on a wider product portfolio catering to both urban and rural needs. With introduction of electronic products across powergen and industrial, the company is focusing on upskilling channel partners. Growth in the distribution business over past few years has been driven by increased touchpoints. Going forward too, the company expects growth to be driven by both spare parts and AMCs with the increasing complexities of electronic products. Our discussion with channel partners also indicated that while other players in the industry are catching up on product availability, they lack the wide distribution network, where KOEL and KKC lead.

Export growth will be largely driven by US and Middle East

The export segment growth of KOEL has not panned out in line with the initial vision of the company. Along with this, improving power supply scenario in South Africa impacted offtake on powergen exports. While we may see near-term weakness in exports for the company, KOEL intends to scale up the business sustainably, with a strong foundation already in place. KOEL is working on establishing exclusive Kirloskar Genset Original Equipment Manufacturers (GOEMs) in key markets worldwide. It has successfully identified and appointed GOEMs in two key regions: the US and Middle East. Kirloskar Americas Corporation (KAC) acquired a 51% stake in Engines LPG LLC, dba Wildcat Power Gen, in the US market. KOEL had appointed Myspan Power Solutions as an exclusive GOEM for GCC countries

B2C segment stabilizing following the facility shift

Our analysis of financials of key players that are focused on the pump industry indicates that scope of margin expansion is significant for KOEL. Its B2C division’s performance was impacted by the facility shift. B2C losses at PBIT level had widened during the quarter, with a -9.3% EBIT margin due to initial ramp-up issues from consolidation of five of its plants into a single unit in Ahmedabad. With the normalization of volumes in B2C from Dec’24-end, KOEL expects margins in the B2C segment to revert to previous levels. Additionally, the company aims to bring these margins to around 8-10% over time. With improved volumes from B2C, we expect a better absorption of costs and higher margins for the company as a whole.

Financial outlook

We slightly trim our revenue growth and margin estimates in line with the industry’s growth trend. We expect 12%/17%/19% CAGR in revenue/EBITDA/PAT, driven by 11%/14%/14%/12% CAGR in powergen/industrial/distribution/export revenues in the B2B segment, while we expect B2C to start ramping up and post a 10% CAGR over FY24-27. We expect EBITDA margin to expand to 13.0%/13.5% by FY26/27.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)