Neutral Mahindra Logistics Ltd for the Target Rs.400 by Motilal Oswal Financial Services Ltd

High operating expenses weigh on earnings

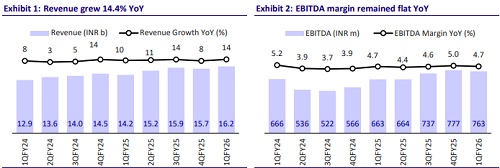

* Mahindra Logistics’ (MLL) revenue grew ~14% YoY to INR16.2b in 1QFY26, in line with our estimate.

* EBITDA margin came in at 4.7% (flat YoY and down 30bp QoQ) vs. our estimate of 5%. EBITDA grew ~15% YoY to INR763m (8% below estimate).

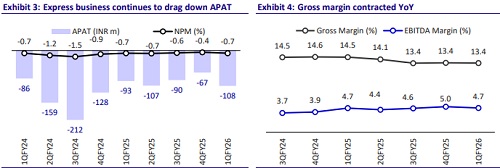

* Adjusted net loss decreased to INR108m in 1QFY26 from INR93m in 1QFY25 (our estimate of INR93m profit).

* Supply Chain management recorded revenue of INR15.4b (+15% YoY) and EBIT loss of ~INR103m. Enterprise Mobility Services (EMS) reported revenue of INR819m (+2% YoY) and EBIT of INR46m.

* MLL appointed Mr. Hemant Sikka as MD & CEO for a tenure of five years, effective May’25.

* MLL reported decent revenue growth in 1QFY26, driven by strong performance in Contract Logistics, Express, and Warehousing. The Express segment crossed INR1b in revenue with healthy volume growth, though yields remained under pressure. New facilities in Pune and Agartala supported network expansion, while the Mobility business improved profitability through better operational efficiency. While we reduce our FY26 APAT estimates by 44% to factor in higher depreciation and finance costs, we increase our FY27 estimates by 9%. We estimate a CAGR of 21%/30% in revenue/EBITDA over FY25-27. Reiterate Neutral with a revised TP of INR400 (premised on 17x FY27E EPS).

Warehousing and Contract Logistics remain strong; volumes pick up in B2B Express, though challenges persist

* MLL reported 14% YoY growth in consolidated revenue in 1QFY26, aided by strong performance in the Contract Logistics (up 18% YoY) and Express segments (up 11% YoY) and improved profitability in the Mobility business.

* Express business crossed the INR1b revenue mark for the first time, with volumes rising 10% QoQ, though yields remained under pressure, affecting profitability.

* Warehousing operations continued to scale up, with new facilities going live in Pune and Agartala and revenue rising 18% YoY in 1Q to INR3.1b. MLL remains focused on optimizing existing capacity before expanding further.

* To strengthen its balance sheet, MLL launched a rights issue of INR7.5b, with INR5.6b allocated for debt repayment, aiming to become debt-free.

* Strategically, MLL is sharpening its execution through a vertical-led business structure, ROCE-focused capex decisions, and leadership changes, including the integration of Whizzard with Last Mile Delivery under a new head.

Highlights from the management commentary

* B2B business saw strong volume growth, but yields were soft. Going forward, MLL focuses on increasing yields even if it has to let go of certain volumes.

* The company continues to expand its warehousing footprint, with new sites in Pune and Agartala going live during the quarter. A 3.4m sqft facility for Cummins was also inaugurated.

* Consumer and manufacturing remain the key end-markets, with the company planning to appoint dedicated vertical heads for a sharper business focus.

* As part of its deleveraging strategy, MLL launched a rights issue of INR7.5b, of which INR5.6b will be used for debt repayment. As of Jun’25, total borrowings stood at INR6b. The remaining fund of INR1.9b will be used for general corporate purposes.

* The recently signed warehousing contract with Mahindra & Mahindra (0.3m sqft in Nashik) is expected to go live in Sep’25.

* Capex discipline remains strong, and future investments will be ROI-led, with normalized capex targeted at 1.5% of revenue.

Valuation and view

* MLL reported revenue growth in 1QFY26, driven by strong performance in Contract Logistics, Express, and Warehousing. Looking ahead, the company remains focused on strengthening execution, optimizing existing capacity, and improving profitability in Express business.

* With a sharper vertical-led structure and plans to become debt-free after the INR7.5b rights issue, MLL aims to sustain growth momentum and enhance returns through disciplined capex and margin expansion. While we reduce our FY26 APAT estimates by 44% to factor in higher depreciation and finance costs, we increase our FY27 estimates by 9%. We estimate a CAGR of 21%/30% in revenue/EBITDA over FY25-27. Reiterate Neutral with a revised TP of INR400 (premised on 17x FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)