Buy InterGlobe Aviation Ltd for the Target Rs. 7,300 by Motilal Oswal Financial Services Ltd

Muted performance; outlook remains positive

Operating performance below our estimate

* InterGlobe Aviation (INDIGO) reported a 64% YoY dip in EBITDAR to INR8.7b (est. INR25.8b) and a net loss of INR26.1b (est. net loss of INR6.6b) in 2QFY26. However, EBITDA (ex-forex loss on lease liabilities) was INR34.5b (up 86% YoY), as forex loss stood at INR29b vs. INR2.4b in 2QFY25.

* Due to higher-than-expected currency depreciation, slower reduction in aircraft on the ground, and additional damp leases, the company expects an early single-digit increase in unit cost (ex-fuel and forex) in FY26 vs. FY25. However, management remains confident about a healthy international as well as domestic demand outlook, backed by an under-penetrated aviation market with favorable long-term demand.

* Hence, looking at the long-term tailwinds, the company has upgraded its FY26 capacity growth guidance to mid-teens from double digits. Further, the capacity expansion is focused more internationally to provide geographical diversification against foreign exchange losses. We cut our FY26 earnings estimates by 23% (due to forex losses), while we largely retain our FY27/ FY28 estimates. We value the stock at 11x FY27E EBITDAR to arrive at our TP of INR7,300. Reiterate BUY.

Forex losses hurt operating performance

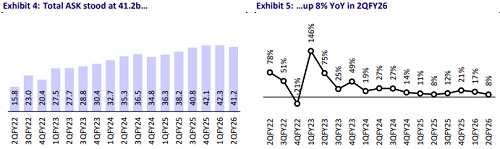

* INDIGO’s yield stood at INR4.69 vs. our estimate of INR4.5 (down 3% YoY). Revenue Passenger Kilometer (RPK) was at 34.0b (our est. of 34.5b, +8% YoY), with Load Factor at 82.5%. ASK grew 8% YoY to 41.2b (our est. of 41.1b).

* Consequently, revenue stood at INR185.5b (est. INR183.2b, +9% YoY). EBITDAR stood at INR8.7b (est. of INR25.8b, down 64% YoY) with EBITDA at INR5.5b (our est. of INR21.1b) +64% YoY.

* However, INDIGO’s EBITDA (excluding forex loss) stood at INR34.5b (up 86% YoY), as forex loss stood at INR29b vs. INR2.4b in 2QFY25.

* The company incurred a net loss of INR26.1b (est. net loss of INR6.6b) compared to a net loss of INR9.9b in 2QFY25.

* For 1HFY26, INDIGO’s revenue grew 7% to INR390.5b, while EBITDA/adj. PAT declined 19%/15% to INR65.6b/INR57.5b.

* INDIGO’s CFO was INR106b as of Sep’25, as against INR84.3b in Sep’24. Further, gross debt stood at INR639b in Sep’25 vs. INR567b as of Mar’25

Highlights from the management commentary

* Capex: Management upgraded its capacity growth guidance from doubledigit growth to mid-teens growth in FY26. Further, management expects the capacity to grow in the high teens for 3QFY26

* MRO strategy: The company is planning to establish an MRO facility in Bengaluru for narrow- and wide-body aircraft in the next 2-4 years with a planned capex of INR10b. Currently, INDIGO’s 90% MRO work is outsourced to third-party international MRO players.

* Guidance: Due to the higher-than-anticipated currency depreciation and a lower-than-anticipated reduction in aircraft on the ground and induction of some additional damp leases, the company is estimating an early single-digit percentage increase in its unit cost. This excludes fuel and forex for FY26 as compared to FY25.

Valuation and view

* Despite near-term challenges in the form of rupee depreciation and rising damp leases, Indigo remains confident in its growth strategy as India’s domestic network remains the backbone, with expanding international connectivity.

* Going forward, stabilizing fuel costs, the return of grounded aircraft to service, and improved demand are likely to drive performance in the coming quarters.

* Backed by mid-teens capacity growth coupled with rising demand, stable yields, and a rising international mix, INDIGO is well-positioned to sustain healthy profitability. We expect its revenue/ EBITDAR/Adj. PAT to clock a CAGR of 11%/18%/14% over FY25-28. We value the stock at 11x FY27E EBITDAR to arrive at our TP of INR7,300. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

Ltd.jpg)