Company Update : Spicejet Ltd by Prabhudas Lilladher Ltd

Ungrounding & damp leases key to revival

We attended analyst meet of SpiceJet (SJET IN) wherein management shared the progress over ungrounding and updated on fleet induction timelines. While SJET IN operated 19 aircrafts as of 2QFY26, 14 aircrafts have already been inducted via damp lease so far and the operational fleet is set to double by Dec25. While damp lease inductions will help to boost capacity temporarily; the key to long term revival is ungrounding (8 Boeing’s expected to be back into service by April-26) and fresh inductions. On the other hand, negotiations for lessor liabilities (~Rs24bn) are underway and any material haircut should aid in cash preservation (Rs2.1bn of free cash as of 1HFY26). Revival of AoG and pace of damp lease inductions is key to revival. Not rated.

Damp lease arrangements provide temporary respite: SJET IN’s operational fleet stood at 19 in 2QFY26. In Oct and Nov 2025, the airline added 14 aircrafts via the damp-lease route, with two anticipated to be added in the month of Dec 2025. Moreover, one Boeing 737 MAX that was grounded was successfully brought back into service. These additions have increased the operational fleet countto 34. Fleet expansion will significantly strengthen the airline’s operational capacity. However, given most of the aircraft inductions are on a damp lease mode, the plan lacks long term stability. Nonetheless, revival of AoG (8 Boeing’s expected to be back into service by April-26) lends better comfort from long term perspective.

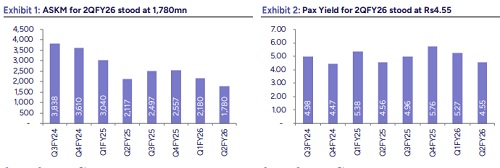

ASKM set to increase multifold: As SJET IN has received 14 aircrafts under the damp-lease model, with two more expected in Dec 2025, ASKM is likely to witness a multi-fold increase. By end of 2025, ASKM is set to rise 3x. Given that new aircrafts are being added via damp lease route and ungrounding plans in place, ASKM is likely to rise from here on.

Liabilities set to decline further post restructuring: As of Nov’25, SpiceJet’s total liabilities have come down to ~Rs40bn. Of this amount, ~Rs24bn relates to lessor liabilities, while ~Rs7.4bn represents bank debt. In addition, the company owes ~Rs2.4bn in airport charges, ~Rs2bn in interest on statutory dues, and~Rs3.7bn to sundry creditors. Negotiations on lessor liabilities are underway, and once the restructuring is completed, total outstanding amount is estimated to decline by an ~30-35%.

Other key highlights from the analyst meet:

* ~8-10 grounded aircrafts are ready to be deployed if the engine problem gets resolved.

* SpiceJet is expected to receive 4 Boeing 737s by May-26E.

* Usually, Boeing 737 is ~15-16% less fuel efficient compared to Boeing 737 MAX.

* Currently SpiceJet operates ~10-11 flights to Dubai.

* OTP figures for SJET IN have been low over the last few days, not due to shortage of pilots.

* SpiceJet Express’s monthly revenue is ~Rs150mn-160mn with an EBITDA of ~Rs100mn.

* Roughly ~Rs1.7-2bn is required for ungrounding.

* There are no outstanding contingent liabilities on books.

* Cash on books is Rs3.9bn (free cash is Rs2.1bn)

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271