Buy Ashok Leyland Ltd For Target Rs. 165 By JM Financial Services Ltd

Margin expansion to continue driven by non-truck business

In 2QFY26, Ashok Leyland (AL) reported an EBITDA margin of 12.1%, up 50 bps YoY and 40 bps above JMFe. The company expects 2HFY26 to outperform 1HFY26 in terms of volumes, with LCVs outpacing MHCVs, supported by GST rationalisation, higher government capex, improved fleet utilisation, renewed construction and mining activity, and RBI rate cuts. While concerns around input tax credit (ITC) persist, particularly in the MHCV segment as LCV owners are mostly single operators or small fleet owners, strong freight demand should help offset the adverse impact. A healthy defence order book and robust export momentum should further aid volumes. We forecast ~8% volume CAGR over FY25–27E, driven by GST rate cuts, favourable macroeconomic conditions, new product launches, and expanding touchpoints. Margins are expected to benefit from an increasing share of high-margin non-MHCV, disciplined cost control and export segments. Accordingly, we revise our EBITDA margin estimates upward by ~40bps/50bps for FY26E/27E. We roll forward and apply a 21x PE multiple (versus 20x earlier) on average FY27E/28E EPS to arrive at a target price of INR 165. We maintain BUY.

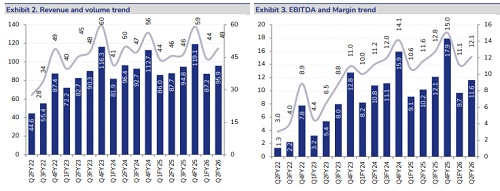

* 2QFY26 – Margin above JMFe: In 2QFY26, AL reported net sales of INR 95.9bn (+9.3% YoY, +9.9% QoQ), in-line with JMFe. Blended realisations grew by 1.6% YoY (-1% QoQ). Total volume grew 7.7% YoY (+11% QoQ). EBITDA margin stood at 12.1% (+50bps YoY, +100bps QoQ), 40bps above JMFe. EBITDA stood at INR 11.6bn (+14.2% YoY, +19.9% QoQ), 3.9% above JMFe. PAT came in at INR 8.1bn (+24.3% YoY, +36.6% QoQ), 14.6% above JMFe owing to higher-than-expected other income.

* Demand outlook: AL highlighted that MHCV industry volumes grew by 4% YoY in 2QFY26, while LCV (2–4T) volumes increased by 13% YoY, driven by GST rationalisation which boosted freight demand. AL’s domestic MHCV market share stood at 31% in 1HFY26 compared to 30.5% in 1HFY25. In the LCV (0–7.5T) segment, market share improved to 13.2%, up 90 bps YoY. The company expects 2HFY26 to outperform 1HFY26 in terms of volumes, with LCVs marginally outpacing MHCVs, supported by GST rationalisation, higher government capex, stable freight rates, improved fleet utilisation, renewed construction and mining activity, and RBI rate cuts. Overall, aided by GST rate cuts, favourable macroeconomic conditions, new product launches, and expanding touchpoints, we expect AL’s volumes to deliver a CAGR of approximately 8% over FY25–27E.

* Rising contribution from domestic non-truck segments: Non-truck segments now contribute approximately 50% of revenue, compared to 42–45% earlier and 40% in FY22. Within this, buses account for 13%, LCVs for 12%, spares for 10%, and exports for 7–8%. These segments have higher margins than MHCVs, which has led to a significant reduction in breakeven levels - from 6,000–7,000 monthly units earlier to 1,000–1,200 units currently. Additionally, defence revenue grew 25% YoY in 2QFY26, and the order book remains healthy for FY26, ensuring steady contribution from this segment.

* Exports outlook: On the exports front, volumes grew by approximately 45% YoY in 2Q and 35% YoY in 1HFY26. The company expects this strong momentum to continue, supported by demand recovery in the GCC, SAARC, and Africa regions. Management aims to increase export volumes to around 18,000 units in FY26 compared to 15,000 units in FY25, with a medium-term target of approximately 25,000 units.

* Profitability outlook: During 2QFY26, EBITDA margin improved by 50 bps YoY to 12.1%, driven by a favorable product mix supported by an increasing share of non-MHCV business and sustained cost-control initiatives. The company successfully passed on additional costs arising from AC norm compliance. Raw material costs are expected to improve in Q3FY26 compared to Q2FY26, which may support further margin expansion. Additionally, margins are expected to benefit from the launch of new heavy-duty trucks.

* Product launch pipeline: The company is set to strengthen its product portfolio with significant launches in 3Q/4Q, including a new range of heavy-duty trucks featuring 320 hp and 360 hp engines. In line with its strategic shift toward alternative powertrains, the company is expanding its non-diesel offerings with two light electric CVs, three MHCV electric models, and multiple buses. Upcoming bus launches include 13.5-meter and 15-meter models with the highest sleeper capacity in the segment. The recently introduced LCV model Saathi has exceeded expectations, contributing 22 to 25 percent of the ~4,000 monthly units, with minimal cannibalization. The company maintains strong coverage in the 2 to 4 ton segment, which represents over 50 percent of industry volumes, and plans to address the bi-fuel gap with a launch expected within the next two quarters, currently in the testing phase.

* Update on EV business: Switch Mobility sold 600 e-buses and 600 e-LCVs and is currently EBITDA and PAT positive, with free cash flow breakeven targeted by FY27. The company has an order book of over 1,650 buses. AL’s e-MaaS arm, OHM, operates 1,100 buses with fleet availability of more than 98% and aims to scale up to 2,500 buses within the next twelve months.

* Other highlights: 1) HLFL delivered strong performance with AUM for HLF/HHF at INR 526bn/149bn (+26%/20% YoY). The HLFL reverse merger is expected to conclude in the coming quarters. 2) Lucknow plant slated for 3QFY26 commissioning and post it the total buses capacity including Andhra Pradesh plant will reach to 20k per annum versus 12k now. 3) Net cash stood at INR 10bn (vs. net debt of INR 5bn in 2QFY25), 4) Capex to be INR 10bn in FY26 (~INR 6.6bn already done).

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361