Neutral Oberoi Realty Ltd for the Target Rs.1,878 by Motilal Oswal Financial Services Ltd

Lower-than-est. collections hit revenue despite stable presales

Operational highlights – 1QFY26

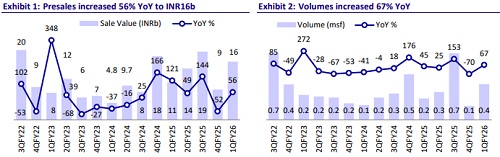

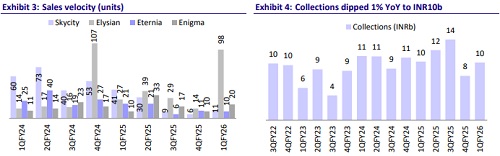

* Oberoi Realty (OBER) delivered pre-sales of INR16.4b in 1QFY26, up 56% YoY and 92% QoQ (in line), fueled by the launch of Elysian Tower D. Total units booked during 1Q jumped 30%/132% YoY/QoQ to 181.

* Collections were INR10b, down 1% YoY/up 30% QoQ (42% below our est.).

* Net debt-to-equity during the quarter was 0.01x (flat QoQ).

* OBER, along with Shree Naman Developers and JM Financial, has been selected as the successful bidder for HHPL under the insolvency process with a resolution plan of INR9.2b approved by creditors on 14th Jul’25. The plan involves the acquisition of ~0.08msf of sea-facing land in Juhu, Mumbai, through a new or existing SPV, which will subscribe to INR10m of fresh equity for 100% ownership of HHPL, subject to NCLT and regulatory approvals.

* P&L performance: In 1QFY26, its revenue declined 30%/14% YoY/QoQ to INR9.9b (31% below our estimate).

* The company reported an EBITDA of INR5.2b, down 36%/16% YoY/QoQ (39% below our estimate), and its margin contracted 5.3% YoY to 53%.

* Consequently, OBER’s PAT declined 28%/3% YoY/QoQ to INR4.2b, which was 30% below our estimate.

Annuity portfolio to be fully leased out by the end of FY26

* OBER’s overall annuity portfolio rose 70% YoY in revenue to INR2.6b, with an EBITDA margin of 92%. ? Office: Occupancy at Commerz I and II was stable at 96%. Following the augmentation of Commerz-3 in 1QFY25, occupancy improved to 83% in 1QFY26 from 54% in 1QFY25, resulting in a revenue growth of 88% YoY to INR1.2b. This brought the total office revenue to INR1.7b (+60% YoY), leading to an EBITDA margin of 91%.

* Retail: Oberoi Mall delivered an 8% YoY increase in revenue to INR507m at an EBITDA margin of 96%, while the newly opened Sky City mall delivered revenue of INR404m with an EBITDA margin of 89%. Oberoi Mall was 99% occupied, while Sky City was 50% occupied.

* Hospitality: In 1QFY26, The Westin hotel witnessed a flat YoY growth in revenue to INR426m, although ARR increased 22% YoY at INR14,858. The flat revenue growth was due to a decline in occupancy to 72% during the quarter from 83% YoY and 79% QoQ. EBITDA came in at INR160m with a margin of 38%.

Key highlights from the management call

* Launches: OBER’s 1QFY26 witnessed the launch of Elysian Tower D, Goregaon, which propelled sales. In FY26, management expects to launch one tower in Borivali and two towers in Forestville (Thane), Peddar Road, and Gurugram. Additionally, it may also launch projects such as Adarsh Nagar, Worli, and Tardeo in the year. One more tower in Goregaon and Alibaug to be launched in FY27.

* Annuity portfolio: The company is witnessing strong leasing traction across all three office assets and the newly launched Sky City mall. Commerz I and Commerz II are fully leased out following an increase in occupancy in Commerz III to 83% in 1QFY26. Both Commerz III and Sky City Mall are likely to be fully leased out by the end of FY26.

* Gurugram project: Demolition work has commenced at the site, and an office has been set up in Gurugram. The design has been completed, with contract negotiations nearly finalized and issuance expected shortly. The land and license are in the company's name, with all licensing approvals in place.

* The private equity transaction in I-Ven Realty Limited was completed, and INR12.5b of investment was received in the joint venture entity.

Valuation and view

* While OBER's current valuation does not suggest significant near-term gains, we foresee a strong 48% CAGR in its presales over FY25-27. The key to a future rerating lies in the company's ability to reinvest the substantial cash flow derived from its completed and near-completion projects.

* OBER's residential segment is presently valued at INR295b. This valuation accounts for recent business development activities and incorporates a future outlay of INR30b towards prospective land acquisitions. Reiterate Neutral with an NAV of INR683b or INR1,878 per share (vs. INR673 or INR1,850 per share earlier).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412