Buy Prestige Estates Projects Ltd For Target Rs. 2,040 by Motilal Oswal Financial Services Ltd

Zero launch for residential segment dents performance

Significant guidance miss possible due to lack of launch visibility

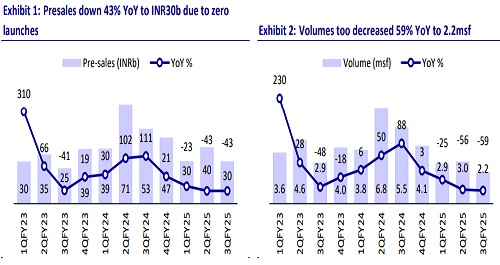

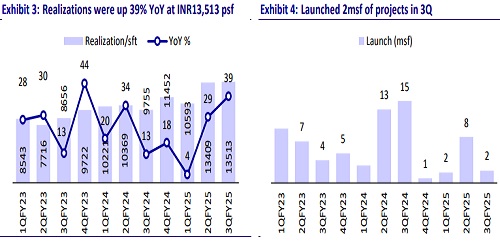

* Prestige Estates Projects (PEPL) reported bookings of INR30.1b, which was down 43% YoY and 25% QoQ (54% below our est.) on account of muted residential launches in 3QFY25 and lower inventory. Average realization improved to INR13,684/sft, up 40% YoY, during the quarter.

* PEPL launched 8.2msf vs. 1.9msf in 1QFY24 and 0.8msf in 4QFY24.

* Sales volume also dipped 59% YoY/26% QoQ to 2.2msf, while realizations were up 40% YoY to INR13,684/sf. In terms of value, the contribution from Bengaluru/Mumbai/Hyderabad was 58%/22%/17%.

* Total collections were up 6%/20% YoY/QoQ, which led to an OCF of INR8.7b in 3QFY25. Net debt mounted to INR59.6b (0.37x of equity) after spending on land and because of capex (INR23.5b) in 3QFY25.

* P&L performance: PEPL reported an 8% YoY decline in revenue to INR16.5b (41% below our estimate) for 3QFY25, while revenue was up 2% YoY at INR58b for 9MFY25. In 3Q, about 59% of revenue was contributed by the residential segment, followed by hospitality (16%), office (11%), retail (7%), and the remaining by others.

* EBITDA came in at INR5.9b, up 7% YoY (22% below our estimate), with an EBITDA margin of 35.7%, up 496bp YoY. For 9MFY25, PEPL reported EBITDA of INR20.2b, up 21% YoY, with a margin of 34.7%, up 542bp YoY.

* PEPL reported an adjusted PAT of INR177m, down 85% YoY, with a margin of 1%. For 9MFY25, the company reported adj. PAT of INR4.4b, down 22% YoY.

Upcoming launches and pipeline

* PEPL plans to launch The Prestige City Indirapuram NCR, Southern Star & Sunset Park Bangalore, Pallava Gardens Chennai, Prestige Spring Heights Hyderabad, Beach Gardens Goa, and some small projects in Bangalore and Hyderabad earlier to be launched in 3Q, which are now deferred to 4QFY25. Nautilus would also be launched in 4Q. The total GDV of upcoming launches up to FY26E stands at INR569b. 3

* Office assets: Leasing activity was robust with occupancy at 90% across the operational assets. With the completion of Lakeshore Drive Phase I and Trade Center DIAL by the end of FY25, the exit rentals will be INR7.2b. Further, with the commissioning of all the ongoing and upcoming assets, the exit rental will reach INR33.1b by FY29.

* Retail: Asset leasing was strong, and footfalls surpassed 14m, with a gross turnover (GTO) of INR17b and occupancy of 99.2%. The current exit rentals for the retail business were INR2.2b, which are expected to touch INR9.9b once all the 12 ongoing/upcoming assets are commissioned.

Key highlights from the management commentary

*? There were no new launches in 3QFY25 for the residential segment. Launches in Retail, Commercial, and Hospitality were seen in 3Q, with a total area of 1.3msf, 0.3msf, and 0.7msf respectively. About 2msf of sustenance sales were executed during the quarter. Stock in hand stood at 10msf from Bangalore, Hyderabad, and Mulund.

* Approvals: Approvals are underway on the new launches. Significant delays hit 3Q sales.

* Upcoming launches: Management is confident in achieving the upcoming launches in the mid-income and luxury segments, with an estimated GDV of INR300b across geographies in 4QFY25. The GDV breakdown is as follows: Southern Star in Bengaluru with INR36b GDV (ticket size INR15-30m), Indirapuram in NCR with INR115b GDV, Pallava Gardens in Chennai with INR31b GDV, Spring Heights in Hyderabad with INR32b GDV, and Nautilus in Mumbai with INR87b GDV (ticket size of INR250m+)

* An additional GDV of INR500b is in the planning stage and will be reflected in the pipeline in the upcoming quarters.

* Discussion is ongoing regarding the 5.5msf commercial land near Mumbai Airport. Management will comment more on this in the future.

* In Mahalaxmi, the rehab tower is ready, and the handover of turf and green estate has started. The targeted year of competition is 2028. The rehab tower in BKC will be handed over by Jun’25 and the commercial buildings will be completed by 2028. Trade Centre DIAL in Aerocity is likely to be completed by the end of CY25.

* Fresh borrowings of INR3.4b were made in 3QFY25, thereby increasing the net debt to INR59.6b with a Net Debt/Equity ratio of 0.37x and a reduced borrowing cost of 10.65% (vs. 10.69% in 2Q).

* In the long run, construction spending per quarter will be in the range of INR15- 16b, and while some projects will be near completion, construction costs might inch up.

* Further, collections would scale up to INR160-180b per year once the projects in the pipeline are launched.

* PEPL bought land on the Dahisar-Mira Road stretch, which has an area potential of ~1msf; the company has already applied for the approvals.

* The BKC project will be completed by 2028. The Aerocity office space is fully leased out and will be completed by the end of CY25.

Valuation and view

* While the delay in approvals affected launches for 3Q, PEPL is hopeful to achieve INR30b launches in 4Q, thus will miss the annual guidance. We have cut our pre-sales and collection estimates to INR201b and INR173b for FY25, INR262b and INR220b for FY26, and INR315b and INR294b for FY27 respectively.

* PEPL also reported a sharp jump in leverage, but the INR50b of capital raised and intended monetization of the hospitality portfolio will allay concerns about leverage and ensure improvement in the balance sheet position over the course of the year. ? As the company progresses with its growth trajectory in both the residential and commercial segments and unlocks value from its hospitality segment, we believe the stock will further re-rate. Reiterate BUY with a revised TP of INR2,040, indicating a 50% upside potential.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412