Buy Ajanta Pharma Ltd for the Target Rs. 3,260 by Motilal Oswal Financial Services Ltd

Domestic formulation/US outperforms for the quarter

Efforts across segments to sustain growth momentum

* Ajanta Pharma (AJP) exhibited largely in-line operational performance for the quarter. Superior performance in Domestic Formulation (DF)/US was partly offset by the weak institutional anti-malaria business.

* The high base of the previous year impacted YoY growth in the branded generics export segment. That said, AJP continues to strengthen its positioning in the chronic portfolio across these markets.

* We largely maintain our estimates for FY26/FY27. We value AJP at 34x 12M forward earnings to arrive at a TP of INR3,260.

* Following a bottoming out of EBITDA margin at 22.6% in FY23, AJP reported strong improvement in profitability, achieving 28.3% EBITDA margin in FY25. Subsequently, it delivered 12%/19% EBITDA/PAT CAGR over FY23-25. AJP is enhancing its growth levers through: a) scaling up newer therapies/gaining market share in India, and b) increasing product launches particularly in chronic therapies in Africa/Asia markets, along with accelerating filings in the US generics market. Accordingly, we build in 15%/14% EBITDA/PAT CAGR over FY25-27. Reiterate BUY.

Segment mix benefit substantially offset by higher opex

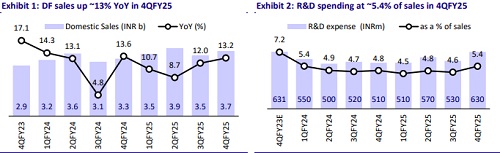

* AJP’s 4QFY25 revenue grew 11% to INR11.7b (our est: INR11.1b), led by growth across all key businesses.

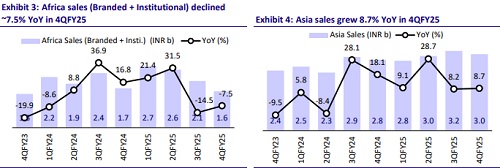

* India’s sales were up 13% YoY to INR3.7b (32% of sales). US generic sales grew 25% YoY to INR3.2b (28% of sales). Africa’s branded generic sales grew 17.7% YoY to INR1.3b (11% of sales). Asia’s branded generics sales were up 8% YoY to INR3b (26% of sales).

* Africa’s institutional sales declined 54% to INR280m (2% of sales).

* Gross margin expanded 90bp YoY at 75.8%, driven by a better product mix.

* However, EBITDA margin contracted ~100bp YoY to 25.4% (our est. 25.9%) as higher gross margins were offset by an increase in employee costs/R&D expenses (up 170bp/50bp YoY as a % of sales).

* Consequently, EBITDA grew 6.8% YoY to INR3b (our est. INR2.9b).

* Adjusting for the forex gain impact of INR71m, adj. PAT grew 16.4% YoY to INR2.2b (our est. INR2b).

* In FY25, Revenue/EBITDA/PAT grew 10%/12%/19% YoY to INR46.4b/INR13b/INR9.4b.

Highlights from the management commentary

* AJP guided for high-teen YoY growth in the US generics segment and lowteen YoY growth in the branded generics segment for FY26.

* Additionally, the company guided for an EBITDA margin of 28% (+-1%) for FY26, similar to that of FY25.

* Considering the high base, the African branded generics business is expected to remain soft in FY26.

* AJP is expected to file 10-12 ANDAs in FY26 (filed six in FY25).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412