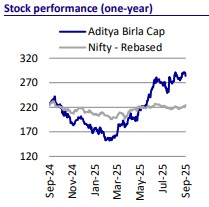

Buy Aditya Birla Capital Ltd for the Target Rs. 340 by Motilal Oswal Financial Services Ltd

Driving growth and stability through retail acceleration

* Aditya Birla Capital (ABCL) has steadily evolved into a digitally enabled, customer-focused financial services platform with a diversified presence spanning lending, insurance, and asset management. The company has sharpened its strategic focus on expanding its retail and MSME lending portfolio, enhancing productivity through proprietary digital platforms, such as the ABCD App and Udyog Plus, and strengthening its omni-channel presence to boost direct customer engagement.

* In recent quarters, the company has implemented several strategic initiatives, including tightening underwriting standards, deliberately reducing exposure to small-ticket loans, and recalibrating digital partnerships in its personal and consumer loans (P&C) segment. These measures have helped it maintain asset quality, which is significantly stronger than that of its peers.

* With credit quality stabilizing and business momentum gaining traction, ABCL has started accelerating growth in its P&C segment. Provided the macro environment remains supportive, this momentum is likely to sustain in the coming quarters. Notably, the renewed focus on the P&C segment should also strengthen its overall profitability, given its structurally higher yields and margins.

* The housing finance subsidiary has posted robust growth over the past two years, underpinned by strategic investments that are now translating into tangible outcomes. Its strategy centers on maintaining a well-diversified portfolio, with a balanced emphasis on both prime and affordable housing, along with a significant presence in construction finance. Looking ahead, we expect the subsidiary to sustain its strong growth trajectory, supported by the capacity built in recent years and further reinforced by cross-selling opportunities across the ABG and ABC ecosystem.

* ABCL has successfully amalgamated its wholly owned subsidiary, Aditya Birla Finance (ABFL), with itself, creating a unified and larger entity with strengthened financial capacity and greater operational flexibility.

* With its key building blocks firmly established and a vast market opportunity ahead, the company is well-positioned to achieve the next phase of growth. Looking forward, it aims to sustain the strong momentum built over the past three years by leveraging its diversified business model and strengthening its digital capabilities to simplify financial services and deliver an enhanced customer experience.

* We expect a consolidated PAT (pre MI) CAGR of ~26% over FY25-27. The thrust on cross-selling, investments in digital platforms, and leveraging ‘One ABC’ will lead to healthy return ratios, even as we build in a consolidated RoE of ~14% by FY27. Reiterate BUY with an SoTP (Mar’27E)-based TP of INR340.

NBFC: Recovery in unsecured lending; focused growth with caution

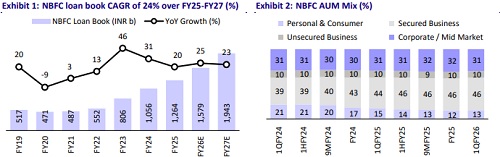

* Over the past three years, the NBFC business has more than doubled its AUM, delivering a robust CAGR of over 30%. Notably, around 74% of the portfolio remains secured, underscoring the company’s prudent risk management framework, which continues to anchor its growth strategy by balancing expansion with capital protection.

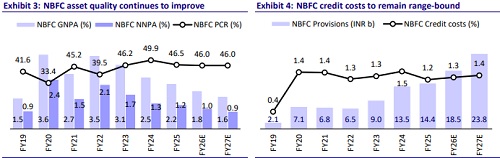

* In FY25, ABCL adopted a cautious approach by tightening its underwriting standards, reducing exposure to small-ticket unsecured loans, and recalibrating sourcing from select digital partners to mitigate risks such as customer overleverage. These measures contributed to sustained asset quality, with 30+dpd improving by ~75bp YoY to ~3.7% as of Jun’25.

* With most lenders flagging stress in small-ticket unsecured MSME lending, the company remains relatively well positioned owing to its portfolio mix. Within the MSME portfolio, which forms 55% of the total loan book, ~46% is secured, while just 1.3% constitutes of small-ticket unsecured loans, an area where the company continues to remain cautious.

* The recalibration of the P&C business brought down its share in the overall loan mix from ~20% to ~13% over the past two years. However, having made the necessary course correction, the company is now confident of scaling up this segment, which should support NIM improvement given its structurally higher yields. In addition, the ~1pp rate cut is expected to lower funding costs. Together, these factors are likely to drive margin expansion, with management guiding for margins to stabilize at ~6% and subsequently expand further.

* ABCL aims to double its NBFC loan book over the next three years, along with steady expansion in RoA. The improvement in RoA will be driven by a gradual margin expansion, gains in operating productivity, and a favorable shift in the underlying product mix.

HFC: Full-stack player with presence across prime and affordable segments

* Aditya Birla Housing Finance (ABHFL) is focused on building a digitally enabled, analytics-driven retail housing finance franchise that caters to salaried individuals, self-employed professionals, and micro-entrepreneurs across Tier-I suburbs and Tier-II/III cities, while maintaining strong credit quality. As a result of its disciplined underwriting and risk controls, 30+dpd has improved significantly, declining ~130bp YoY to 1.35% as of Jun’25.

* The company is looking to accelerate growth in both prime and affordable housing segments, with a target ATS of INR2.5-5m. This growth strategy is expected to be supported by synergies from the broader ABG ecosystem.

* Over the past three years, the company has made substantial investments in capacity building and branch infrastructure. With these investments now largely in place, it expects a significant improvement in operating leverage, which should contribute meaningfully to RoA expansion.

* ABHFL aims to sustain its growth momentum and expand its market share. As the portfolio scales up, it expects operating leverage to improve and profitability to strengthen. It has guided for RoA of ~2.0%-2.2% over the next 6-8 quarters.

AMC: Strong AUM growth with focus on retail expansion and digital integration

* ABSL AMC’s fund performance has improved consistently since Jan’25, with ~67% of equity AUM appearing in the top two quartiles on a one-year return basis in Jul’25 compared to average of ~20% in the preceding 12 months.

* The company is expanding its product pipeline across alternatives (private markets and real estate), passives (ETFs, index funds, FoFs), and offshore strategies, reinforcing its multi-asset platform beyond its core MF platform.

* The company reported 21% YoY growth in total QAAUM to INR4.43t in Jun’25. Mutual Fund QAAUM rose 14% YoY to INR4.03t, with a market share of ~6.2%, supported by improved fund performance and strong sales momentum.

* The company continued to strengthen its retail franchise and expand its geographical reach, now operating in over 300 locations, with more than 80% of its presence in B30 cities.

* In FY25, the company strengthened its distribution network by expanding its empaneled base to over 89,000 MFDs, 330 national distributors, and 90+ banks. It added 10,500 MFDs during the year.

* Going forward, the AMC aims to strategically scale its retail franchise while diversifying product offerings. Growth will be driven by strengthening direct and HNI channels and accelerating SIP inflows to ensure long-term AUM stability.

* Digital capabilities are in focus, with continued investments to ensure seamless service delivery and customer experience. The company also aims to expand its geographic footprint, strengthen multi-channel distribution, and deepen synergies through One ABC locations to drive cross-sell and up-sell momentum.

Life and health insurance segments scale up with market share gains

* Aditya Birla Life Insurance (ABSLI) emerged as the fastest-growing life insurance player in FY25, with individual first-year premium (FYP) rising 34% YoY to INR41.1b, significantly outpacing 15% growth for private players and 10% growth for the industry. Management has guided for a CAGR of 20-22% in individual FYP and VNB margins of over 18% in the next three years.

* Aditya Birla Health Insurance (ABHI) is one of the fastest-growing health insurers, with GWP rising 33% YoY to INR49b in FY25. The company achieved breakeven in its eighth full year of operations, reporting a net profit of INR50m. As of Jun’25, the combined ratio stood at 111% (vs. 112% in 1QFY25). We are optimistic about the long-term outlook of the health insurance sector. ABHI aspires to be the fastest-growing health insurer and targets to achieve a combined ratio of ~100% at the earliest.

Valuation and view

* ABCL continues to demonstrate healthy growth in its core businesses, NBFC, HFC, AMC, and life and health insurance, supported by improving profitability, operational leverage, and strong customer acquisition momentum. Its ‘One ABC’ strategy enhances cross-selling opportunities, increases wallet share, and improves cost efficiency. Its focus on digital transformation and expansion of distribution reach should also support long-term growth.

* We estimate a consolidated PAT (pre-MI) CAGR of ~26% over FY25-27. The thrust on cross-selling, investments in digital, and leveraging ‘One ABC’ will lead to healthy return ratios, even as we build in a consolidated RoE of ~14% by FY27. Reiterate our BUY rating with an SoTP (Mar’27E)-based TP of INR340.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412