Reduce Cera Sanitaryware Ltd For Target Rs. 6,000 By JM Financial Services Ltd

Operational miss; cautiously optimistic in 2H

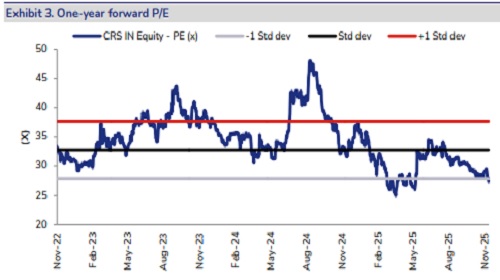

Cera Sanitaryware’s (Cera) reported weak operating performance in 2QFY26 with standalone revenue remaining broadly flat YoY/ increasing ~16% QoQ to INR 4.9bn. (JMF: INR 5.2bn). EBITDA declined ~4% YoY/ rose 27% QoQ to INR 671mn, ~6-10% below our and consensus estimates, while EBITDA margin declined 44bps YoY/ increased 111bps QoQ to 13.8%. The management remains on track with its roadmap to operationalize 45-50 Senator brand outlets by FY26-end; 28 stores already operational. In the near-term, company doesn’t have any immediate plans for price hikes; while remain cautiously optimistic for demand recovery in 2HFY26. Factoring-in 2Q performance and continued near-term weakness, we cut our EPS estimates by ~13-17% for FY27E-28E. In line with our new rating system, we change our rating from HOLD to REDUCE with a revised TP of INR 6,000/sh based on 29x Dec’27 P/E post quarterly roll-over.

* Result summary: Cera’s standalone revenue remained broadly flat YoY/ grew ~16% QoQ to INR 4.9bn (JMF: INR 5.2bn). EBITDA declined ~4% YoY/ rose 27% QoQ to INR 671mn, ~6-10% below our and consensus estimates, while EBITDA margin declined 44bps YoY/ increased 111bps QoQ to 13.8%, in line with estimates. Adjusted PAT declined ~17% YoY/ grew 22% QoQ to INR 566mn. In 1H, the company has generated FCF of INR 607mn post w/cap blockage of INR 26mn and capex spend of INR 96mn.

* What we liked: Lower-than-estimated cost

* What we did not like: Lower-than-expected topline growth

* Earnings call KTAs: 1) The management guided for 7-8% topline growth and expects EBITDA margin to maintain in range of 14.5-15.5% in FY26. 2) Project sales accounted for 39% of the topline in 2Q and expected to remain in this range (39-40%) for FY26. 3) The company remains confident on retail demand to gradually improve and normalise over time, supported by underlying market fundamentals and strategic initiatives. 4) The company is on track to roll-out its target of 45-50 stores, with 28 stores already operational. 5) Gas cost slightly declined in 2QFY26 with an average cost at INR 33.8/CuM. 6) Recently launched Senator and Polipluz have contributed revenue of ~INR 50mn in 1H and targets revenue of ~INR 400-450mn in 2H. Over the next couple of years, it expects revenue of INR 1.5bn from both the brands. 7) The management expects EBITDA margin of 25% and ~20-22% from Polipluz and Senator respectively. 8) It will be focusing on getting the showrooms ready and work on getting the influencers onboard for promotional activities. Total budget stands at INR 100-120mn in FY26 and further to increase in FY27. 9) The capacity utilisation in Sanitaryware/ Faucetware in 2QFY26 stood at 85%/ 97% vs. 89%/ 93% YoY respectively. 10) New products contributed ~33% of total revenue in 2Q; 11) The sales mix for 2QFY26 in Entry/ Mid/ Premium categories was 22%/ 36%/ 42% vs. 25%/ 34%/ 41% in 2QFY25. 12) Retail discounts have now started coming off on sequential basis in 2Q. 13) Brass prices have moved to INR 630/kg in Oct-Nov’25 vs. INR 590/kg on sequential basis. Clay & feldspar prices have seen some increase. 14) Cera plans a capex of INR 230mn which will include routine capex, brand building and expanding retail footprints. 15) Cera dealer management system (DMS) initiative made a strong progress with 200 dealers, enhancing visibility, accountability, and data-led decision-making across its channel network. It will expand to more dealers going forward.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361