Buy TATA Steel Ltd for the Target Rs.240 by Motilal Oswal Financial Services Ltd

Strong domestic outlook; improvement in Europe to drive consolidated earnings

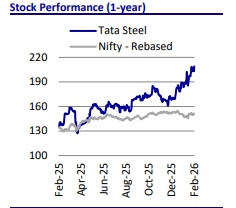

We upgraded Tata Steel (TATA) to BUY in Oct’25 at INR177 and reiterated our positive stance on the name in our detailed steel thematic report in Jan’26. While the stock has performed well after our upgrade, we remain constructive on the stock on the back of a strong domestic demand outlook, safeguard duty-led price support, ongoing capacity expansions and a gradual turnaround in the EU business.

Capacity expansion to drive earnings amid demand upswing

* India's steel demand is projected to grow by ~8-10% over FY26-30, backed by a robust demand environment, policy support, and ongoing recovery in industry fundamentals. TATA is aggressively expanding its capacity in India to capitalize on rising domestic demand, scaling from 26.5mtpa in FY25 to 40mtpa by FY31 over the medium term, with an annual capex commitment of ~INR160b.

* Recently, TATA commissioned 5mtpa integrated capacity at Kalinganagar, increasing the plant’s total capacity to 8mtpa (INR270b investment), with phase-III expansion targeting 13mtpa.

* Other key projects include scaling NINL from 1mtpa to 5.8mtpa. The board has approved the expansion under Phase-I of its long-term plan with expected timeline of 3-3.5 years. Ongoing commissioning of 0.75mtpa scrapbased EAF in Ludhiana by FY27 will focus on high-margin retail products.

* The board has approved establishing a ~1mtpa demonstration plant in Jamshedpur, based on Hisarna low-carbon technology.

* TATA is transitioning into green steelmaking in Europe, where it is converting Port Talbot (UK) to a 3mtpa EAF from conventional BF route steelmaking. The company is also exploring a gas-based DRI + EAF route at IJmuiden (the Netherlands), subject to policy clarity.

Steel prices to recover, backed by safeguard duty + CABM + China’s supply discipline

* As per the Joint Plant Committee (JPC), India’s crude steel production rose 10% YoY to 123mt in 9MFY26 and imports declined 39% YoY to 4.4mt due to tighter import controls, while exports increased 34% YoY to 4.8mt.

* Domestic HRC prices rebounded from INR47,500/t in 3QFY26 to INR53,500/t in Feb’25 following the government’s definitive safeguard duty, supporting our expectation of stable domestic steel prices over the medium term. TATA remains well-placed to benefit from India’s structural growth. In 4Q, notable price recovery is expected and will be driving margin expansion.

* Under CBAM, EU steel importers will progressively bear carbon costs (from 10% in CY26 to 20% in CY27 and higher thereafter), narrowing the carbon cost gap between EU and non-EU producers. This will support EU steel prices to improved NSR (higher industry floor price) than direct cost savings.

* Weak domestic demand in China had led to global steel oversupply. Multiple countries have imposed trade barriers to restrict low-cost Chinese steel. Meanwhile, China’s crude steel production declined 5% YoY to ~950mt in CY25, following production curbs and export restrictions. With lower Chinese production, global steel prices are expected to stabilize.

Breakeven for European operations – TSUK breakeven on track; TSN cost restructuring to drive profitability

* Europe continues to face structural challenges from weak demand, excess imports, elevated carbon costs, and policy distortions, suppressing spreads. However, CBAM implementation and tighter import quotas after Jun’26 are expected to provide medium-term structural support, potentially lifting regional steel prices.

* Tata Steel Europe (UK & Netherlands) remains challenged by high energy/operational costs, subdued demand, and decarbonization obligations. The INR115b cost transformation program (India, UK, and the Netherlands) is on track, with the UK targeted to break even in the next few quarters.

* Europe operations are making visible progress toward breakeven, with recent quarters showing a narrowing of losses from USD42/t in 3QFY25 to USD10/t in 3QFY26 despite weak NSR, which reflects strong cost reduction. ? We expect further improvement to be driven by cost optimization, softer energy prices, and benefits from the legacy BF shutdown in the UK. This could lift Europe EBITDA to ~USD70/t and consolidated EBITDA/t to ~INR13,000 by FY28E (vs. INR8,376 in FY25).

Valuation and view: BUY

* TATA is one of the largest players in India's steel sector and we maintain a constructive stance, supported by a strong domestic demand outlook and safeguard duty-led price support.

* In Europe, while near-term profitability remains contingent on spread recovery and energy costs, structural measures such as CBAM and tighter import quotas should gradually improve pricing discipline and reduce import-led margin pressure.

* India business is expected to continue its strong performance, and an improvement in the EU performance to support overall earnings. Net debt stood at INR818b as of 3QFY26, which includes cash of INR108b. This translates into a net debt-to-EBITDA ratio of 2.59x as of Dec’25.

* At CMP, TATA is trading at 7.7x EV/EBITDA and 2.3x FY27E P/B. We maintain our BUY rating with an SoTP-based TP of INR240 per share on Sep’27 estimate.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412