Neutral Exide Industries Ltd for the Target Rs.341 by Motilal Oswal Financial Services Ltd

Weak 3Q due to headwinds in exports and telecom

Exports likely to pick up in coming quarters

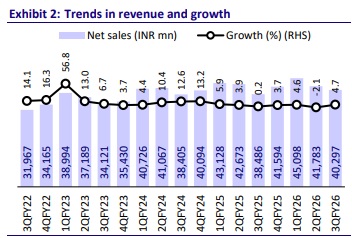

* Exide’s 3QFY26 PAT at INR2.6b came in below our estimate of INR2.8b due to lower-than-expected revenue growth even as margins were largely in line with our estimates. Despite the boost in auto sector demand after GST rate cuts, Exide’s revenue grew just 5% YoY, mainly due to weak exports and a continued decline in the telecom segment.

* Given the underperformance in 3Q, we have lowered our earnings estimates by 5%/7% for FY26/FY27. The outlook for lead acid is positive for the auto segment and the industrial business (excl. telecom). However, we remain cautious about the long-term returns from the lithium-ion business. Besides, the stock at ~22.6x/19.9x FY27/28E EPS appears fairly valued. Reiterate Neutral with an SoTP-based TP of INR341. We value the core (lead acid) business at 15x Dec’27E EPS (in line with Amara). We add INR59 per share value for the EV business (based on book) and INR52 per share for its stake in HDFC Life

PAT below estimate in 3Q due to export headwinds

* Exide’s 3QFY26 revenues missed our estimates, growing 4.7% YoY to INR40.3b (vs. estimated INR44.3b). Overall, domestic business (ex-telecom) grew 10% YoY, led by the GST rate cut boost. However, exports dipped due to significant tariff-related headwinds.

* The auto OEM business grew more than 25% YoY, leading to higher market share across multiple segments. 2W/4W replacement business grew in double-digit on a YoY basis.

* Industrial infra business (ex-telecom) also grew in double digits as order inflow and order execution picked up in railways, traction and other sectors. Inverters and solar businesses are back on the growth path after a monsoon-led slowdown. Their outlook remains positive ahead of the peak season.

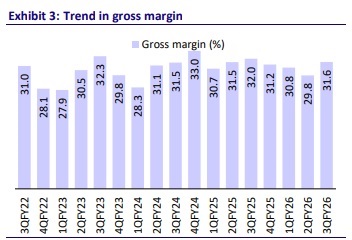

* EBITDA margin came in at 11.7%, largely in line with our estimate of 11.5%.

* Given a lower-than-expected revenue growth, EBITDA missed our estimates, growing 4.7% YoY to INR4.7b (estimate of INR5.1b).

* The company incurred a one-time exceptional expense of INR90.4m due to changes in the labor code. ? Adjusting for this expense, PAT came in at INR2.6b, up 7.9% YoY (below our estimate of INR2.8b).

* In the lithium-ion battery subsidiary, Exide has invested INR3.2b in 3Q and an additional INR500m in Jan’26. The total investment made to date stands at INR42.5b. Product validation is ongoing, with efforts to enter into collaboration with OEMs already underway.

Highlights from management call

* Exide has secured 100% share of business for key OEM programs, including Tata Sierra petrol (launched in Dec’25) and Kia Seltos facelift (4Q).

* Management indicated that export performance has largely bottomed out, with a recovery expected in FY27, supported by new channel partners, entry into newer geographies, and a favorable base effect.

* While the company did not increase prices in 3Q, it has taken a ~2% price hike in Jan to pass on the input cost pressure.

* Lithium-ion margins are expected to be superior to lead-acid, supported by indexed pricing, yield improvement, and local manufacturing advantages.

* Launched four new products in Feb: EL Ultra (premium automotive), Powerbox (mass segment), AGM batteries (premium PVs), and Solar Grid-Tie Inverters.

* Exide Energy has received cumulative equity infusion of ~INR42.5b, with the board approving an additional INR14b for FY27, ensuring adequate funding for capex, validation, and scale-up.

Valuation and view

* Given the underperformance in 3Q, we have lowered our earnings estimates by 5%/7% for FY26/FY27. The outlook for lead acid is positive for auto segment and industrial business (excl. telecom). However, we remain cautious about the long-term returns from the lithium-ion business. Besides, the stock at ~22.6x/19.9x FY27/28E EPS appears fairly valued. Reiterate Neutral with an SOTP-based TP of INR341. We value the core (lead acid) business at 15x Dec’27E EPS (in line with Amara). We add INR59 per share value for the EV business (based on book) and INR52 per share for its stake in HDFC Life.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412