Neutral Amara Raja Ltd for the Target Rs.891 by Motilal Oswal Financial Services Ltd

Weak performance in 3Q

Earmarks fresh investments for the BESS opportunity

* Amara Raja’s (ARENM) 3QFY26 PAT at INR1.8b came in well below our estimate of INR2.1b. The earnings miss was due to a slower-than-expected demand and sustained margin pressure.

* Given the continued margin pressure seen in 3Q, we cut our FY26/FY27 EPS estimates by 5%/4%. While the market is optimistic about ARENM’s Li-ion initiative, we are cautious about its potential returns. We believe the stock, trading at around 17.8x FY27E/15.7x FY28E EPS, appears fairly valued. We reiterate our Neutral rating with a TP of INR891, based on 15x standalone EPS and INR92/sh value of the investment in the New Energy business.

Margins continue to be under pressure

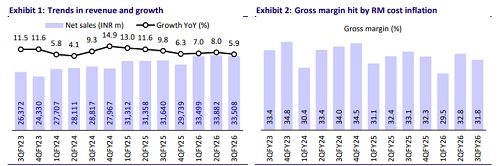

* ARENM’s 3QFY26 revenue grew ~6% YoY to INR33.5b, below our estimate of INR35.1b. Revenue growth was muted due to a 40% YoY dip in telecom, slower replacement demand over a high base, and weak export demand.

* New energy business revenue doubled YoY to INR1.2b, aided by robust demand for Li-ion telecom battery packs. The revenue from lead acid and allied products was flat YoY at INR31.7b.

* While the 4W OEM segment saw a healthy 25% YoY growth, overall auto replacement growth was muted over a high base. Exports also witnessed weak demand due to heightened competition. The industrial, ex-telecom segment, posted a 2% YoY growth.

* EBITDA margin dipped ~200bp YoY to 11.2%, below our estimate of 12.2%. The margin miss was led by higher input costs, adverse mix, and higher provision for warranty and EPR. EBITDA declined ~10% YoY to INR3.7b.

* During the quarter, AMRJ faced a one-time extraordinary expense of INR438m as provisions against changes in the labor code.

* Adjusted for this, PAT declined 20.1% YoY to INR1.8b (well below our estimate of INR2.1b).

* The 9MFY26 revenue/EBITDA/PAT stood at +7%/-9.3%/-17.5% at INR101b/ INR11.7b/INR5.9b.

Highlights from the management commentary

* ARENM’s 3Q growth was muted due to a 40% YoY dip in telecom, slower replacement demand over a high base, and weak export demand.

* Margin pressure continued in 3Q due to higher input costs, adverse mix, and higher provision for warranty and EPR.

* To mitigate the rising cost impact, the company has taken ~2% price hike with effect from the first week of January.

* Over the medium term, management reiterated its intent to restore operating margins toward the 13–14% range, subject to normalization in input costs

* Capex guidance for FY6 stands at INR 7.5-8b for the lead acid business. For FY27, lead-acid business capex is expected to normalize to INR3-4b, while new energy capex could increase to INR10b.

* Market size for the BESS application is expected to be 30 GWh by FY31. For the same, they are setting up a battery pack assembly line of 5GWh to cater to this demand at an estimated capex of INR 2.8b.

Valuation and view

* ARENM’s venture into the lithium-ion business is strategically sound, given the opportunities in the segment and risks facing its core business. However, there are notable challenges: 1) market opportunities are limited by existing OEM partnerships; 2) the low-margin nature of the lithium-ion business is likely to dilute returns; and 3) the long-term viability of the technology remains uncertain despite the large capital investment.

* While the market is optimistic about ARENM’s Li-ion initiative, we are cautious about its potential returns. We believe the stock, trading at around 17.8x FY27E/15.7x FY28E EPS, appears fairly valued. We reiterate our Neutral rating with a TP of INR891, based on 15x standalone EPS and INR92/sh value of the investment in the New Energy business.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412