Buy Eris Lifesciences Ltd For the Target Rs. 1,450 By PL Capital- Prabhudas Lilladher

In-line quarter; debt reduction ahead of guidance

Quick Pointers:

* The company expects to be in the first wave of launch for the Semaglutide.

* Guided for net debt of Rs 21bn/17.5bn by FY25/H1FY26 vs Rs30bn as of FY24

Eris Lifesciences’(ERIS) Q3FY25 EBITDA was in line with our estimate (Rs2.5bn; 43% YoY). Eris has opted for inorganic route to diversify and scale up existing portfolio. This has been implemented without diluting margins. We expect margins to sustain at +35% as revenue scales up from recent acquisitions, which are currently operating at sub-optimal profitability. The company has multiple growth levers such as broad-based offerings in the derma segment, opportunities in the cardiometabolic market with patent expirations and benefits of operating leverage, as revenue scales up from these acquisitions. Our FY26 and FY27E EBITDA broadly remains unchanged. We maintain ‘BUY’ rating with revised TP of Rs1,450 (valuing at 15x EV/EBITDA on FY27E).

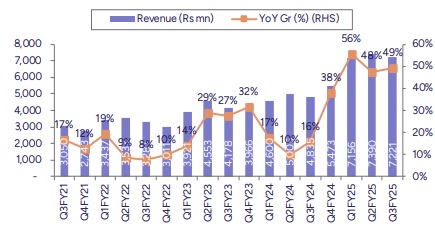

* Growth in base portfolio aided performance: ERIS reported strong revenue growth of 49.6% YoY aided by integration of Swiss Parenteral and synergies from Biocon’s portfolio. The management cited base organic business growth was at 12% for Q3FY25. Among the businesses acquired in FY24, Biocon acquisition reported revenues of Rs1.1bn in Q3 (down 21% QoQ), and Swiss Parenteral reported Rs760mn revenue (down 7% QoQ).

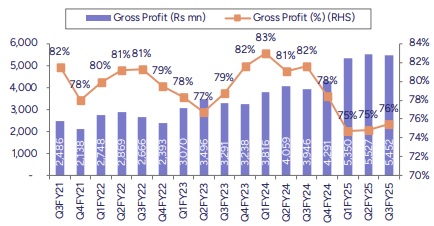

* In line EBITDA, steady margins: EBITDA came in at Rs2.5bn (up 42.6% YoY), in line with our estimate. OPM declined both sequentially & YoY at ~34.4% given change in product mix. Base business OPM stood at 39% down 200bps QoQ. Overall GMs came in at 75.7%, up 80bps QoQ but down 600bps YoY. The YoY impact on GMs was largely on account of change in product and business mix due to integration of new businesses. Depreciation & finance charges came in higher due to consolidation of new businesses. Resultant PAT came in at Rs 836mn (down 19% YoY), marginally below than our estimate.

* Key concall takeaways: Domestic formulations business: The base business recorded a 12% YoY growth in Q3FY25 (11% YoY excluding the Biocon 1 portfolio), driven by new product launches and price increases. The company is strategically positioned to tap into the GLP-1 market, having entered into a partnership for the launch of Semaglutide. Expect GLP-1 to be first line of treatment. Levim has completed preclinical studies for recombinant Semaglutide and received approval to start human trials in Q1FY26. The Bhopal facility is preparing for the form-fill-finish of this product, with operations set to begin in Q1FY26, targeting EU GMP and RoW approvals. The company holds a 10% market share in the insulin space, generating 60% gross margins. Management also announced the launch of Pegaspargase next month for domestic market, while Liraglutide has reached a Rs 10mn/month run rate. Swiss Parenteral: RoW injectable business is performing well. Clocked 32% EBITDA margins, business is on track to deliver its FY25E guidance of Rs 3.3bn in revenues. Q4FY25E to remain stronger due to the seasonality factor. Initiated necessary groundwork to commercialise Levim's products across Swiss' existing client base Insulin: Demand supply mismatch has led to shortage in the market. Other: EPS growth to be +50% in FY26. Targeting 2 diabetic injectables by FY27E. Intends to generate 80% of revenue from in-house manufacturing vs 60% currently. Company have seen sharp reduction in debt for 9MFY25. Guided for Net debt of Rs 21bn by FY25E vs Rs26bn earlier and Rs17.5bn by H1FY26.

Above views are of the author and not of the website kindly read disclaimer