Buy JSW Infrastructure Ltd For Target Rs.375 By Motilal Oswal Financial Services Ltd

Capacity expansion to aid growth; well-positioned to gain higher market share

Volume growth trajectory to remain strong

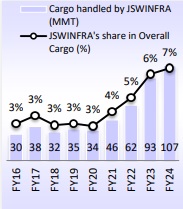

* Second-largest private port operator with improving market share:

JSW Infrastructure (JSWINFRA), with an aggregate capacity of 170MMT as of Sep’24, is the second-largest private port operator in India after Adani Ports (having a capacity of ~633MMT). The company has reported a 22% cargo volume CAGR over FY18-24 (13% YoY growth in 1HFY25), far outpacing the industry growth rate of ~4% over the same period.

* Focused on ramping up capacity to 400MMT by 2030:

JSWINFRA has embarked on a massive capex plan of INR300b (INR150b over FY25-28) towards expanding the total cargo handling capacity from 170mtpa currently to 288mtpa by FY28 and eventually to 400mtpa by FY30, banking on the rise of India’s cargo movement. In line with its capex program, the company has undertaken brownfield expansions at its Jaigarh and Dharamtar ports (two of its largest ports in terms of capacity and volumes), adding a combined 36MT with an estimated capex of INR23.6b, which is targeted for completion by Mar’27.

* Diversified customer and cargo base:

JSWINFRA has a diversified customer base that includes third-party customers across geographies, and it has expanded its cargo mix by leveraging its locational advantage and maximizing asset utilization. The company’s effort to expand its customer base has led to an increase in cargo handled for third-party customers in India, which posted a 55% CAGR from 11MMT in FY21 to 43MMT in FY24. Third-party cargo mix (by volume) improved to 48% in 1HFY25 (36% in 1HFY24) from ~25% in FY21.

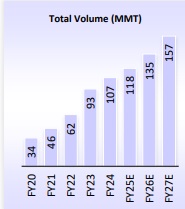

* Volume growth to remain robust; reiterate BUY:

Leveraging its strong balance sheet, JSWINFRA aims to pursue organic and inorganic growth opportunities, strengthen its market presence, and expand its capacity to 400MMT by 2030, up from the current capacity of 170MMT. As utilization and volumes continue to ramp up, we expect strong growth to continue. We estimate a volume/revenue/EBITDA/APAT CAGR of 14%/19%/20%/19% over FY24-27. Reiterate BUY with a revised TP of INR375 (premised on 25x Sep’26 EV/EBITDA).

* Key downside risks:

A slowdown in domestic and global trade.

Building a pan-India logistics network with a focus on last-mile connectivity

* JSWINFRA, through its wholly owned subsidiary, JSW Port Logistics, acquired a 70.37% stake in Navkar Corporation (NAVKAR). The objective of the acquisition was to provide diverse logistic solutions for last-mile connectivity along with access to large land resources.

* JSWINFRA also received an LoA from Southern Railways, Chennai Division, for the construction and operation of Gati-Shakti Multi-Modal Cargo Terminal (GCT) at Arakkonam, Chennai. This would help establish a pan-India logistics network, enhancing last-mile connectivity.

* JSWINFRA also has a slurry pipeline project (under development) from JSW Utkal Steel for INR17b. This is a 20-year, long-term, take-or-pay agreement for using the pipeline to transport iron ore. The project will start contributing materially to revenue from FY28.

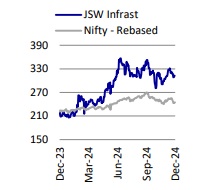

Stock Performance (1-year)

Strategic location of ports to support long-term growth

All of JSWINFRA’s ports and terminals are well connected to the industrial hinterlands of Maharashtra, Goa, Odisha, Tamil Nadu, Andhra Pradesh, and K arnataka. The company’s offerings incorporate a range of specialized, high-efficiency cargo handling solutions that cater to various client requirements. With a focus on operational excellence and financial prudence, JSWINFRA is consistently expanding its cargo handling infrastructure, including recent ventures into container cargo operations. It has also enabled the company to en sure sustainable growth and diversify its cargo profile.

Port privatization to benefit private port operators

* The government is actively working on port privatization efforts, which include: a) divesting existing terminals (owned by port authority/port trusts) to private players; and b) setting up new terminals by private players; thus, Port Authority/Port Trust became landlord ports.

* We believe JSWINFRA is extremely well poised to participate in this. The company’s strong balance sheet would also allow it to add new ports to its portfolio.

Well-positioned to surpass its FY25 guidance

* With a focus on expanding capacity, improving third-party mix in overall cargo, and improving utilization levels at existing ports and terminals, we expect its volume growth trajectory to continue.

* Considering stable growth levers at its existing ports and terminals, a higher share of third-party customers, sticky cargo volumes from JSW Group companies, and an expanding portfolio, we expect JSWINFRA to strengthen its market dominance, leading to a 14% volume CAGR over FY24-27. This should drive a 19% CAGR in revenue and a 20% CAGR in EBITDA over the same period. We reiterate our BUY rating with a revised TP of INR375 (premised on 25x Sep’26 EV/EBITDA).

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)