Sell Orient CementLtd For Target Rs. 225 By Elara Capital Ltd

Open offer provides near-term floor

Orient Cement (ORCMNT IN) delivered mixed results, with largely in-line net sales, but EBITDA below our/Consensus estimates, due to miss on realization and cost front. Net sales fell ~14% YoY but rose ~18% QoQ to ~INR 6.4bn, largely-in-line with our/Consensus estimates of ~INR 6bn each. EBITDA declined ~50% YoY but increased ~31% QoQ to INR 581mn, below our/Consensus estimates of INR 760mn/738mn, respectively. PAT was down ~78% YoY but surged ~335% QoQ to INR 101mn. While a busy construction season and lack of elections-led disturbance in the core market of Maharashtra bode well for ORCMNT’s Q4FY25 volume growth, we believe its sizeable exposure to oversupplied South India will limit any meaningful improvement in its overall performance, going ahead. Therefore, we reiterate Sell. We cut our EBITDA by ~14% for FY25E, ~24% for FY26E and ~27% for FY27E, to reflect weak Q3FY25 performance and thus, lower our TP to INR 225 from INR 314.

No arbitrage opportunity in open offer:

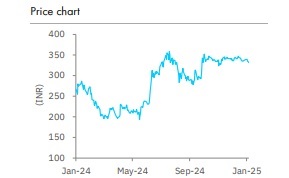

Currently, ORCMNT is trading at 13.8x FY27E EV/EBITDA. We expect the stock to settle at 9x FY27E EV/EBITDA following the open offer. The share price could decline to our one-year TP of INR 225. Assuming full participation in the open offer, the estimated rejection ratio stands at ~51%, while the acceptance ratio would likely to be ~49%. In the near term, the stock is expected to hover around a weighted average price, calculated based on the acceptance ratio multiplied by the open offer price and the rejection ratio multiplied by the fair value. This suggests that in the near-term, the stock may hover around INR 308. We do not expect any open offer price upgrade as the Ambuja Cements will have a majority stake post open offer. Overall, we believe not much arbitrage opportunities exist. As the CMP is above the weighted average price discussed above, we recommend investors to sell shares in the open market to avoid the rejected share even from short-term perspective.

EBITDA/tonne down ~46% YoY but up ~11% QoQ:

Sales volume declined ~7% YoY but rose ~18% QoQ to ~1.3mn tonnes, ~3% above our estimates. However, this benefit was offset by weak realization and higher operating cost. Realization was down ~8% YoY and flat QoQ at INR 4,983/tonne, ~2% below our estimates. Operating cost declined ~1% YoY/QoQ to INR 4,534/tonne, ~1% above our estimates. Consequently, EBITDA/tonne fell ~46% YoY but increased ~11% QoQ to INR 450, below our estimate of INR 605.

Reiterate Sell; TP pared down to INR 225:

While a busy construction season and lack of elections-led disturbance in the core market of Maharashtra bode well for ORCMNT’s Q4FY25 volume growth, we believe its sizeable exposure to oversupplied South India will limit any meaningful improvement in its overall performance going ahead. Therefore, we reiterate Sell. We cut our EBITDA by ~14% for FY25E, ~24% for FY26E and ~27% for FY27E, to reflect weak Q3FY25 performance. We switch our valuation methodology from EV/tonne to EV/EBITDA. We roll over to March 2027E from September 2026E and lower our TP to INR 225 from INR 314, based on 9x FY27E EV/EBITDA. Strong demand, recovery in cement price and further correction in fuel price are key risks to our call.

Please refer disclaimer at Report

SEBI Registration number is INH000000933