Buy Delhivery Ltd For Target Rs. 380 By Emkay Global Financial Services Ltd

Awaiting growth uptick in B2C segment

Delhivery’s Q4FY25 print was a mixed bag, with revenue missing our estimate by 4% while EBITDA registered an 18% beat. The B2C segment continued to track its muted trajectory, growing only 3% YoY due to subdued demand and insourcing by Meesho. The PTL segment delivered yet another strong quarter, and the management is confident of gaining market share in FY26 as well. With Delhivery’s acquisition of Ecom Express, the management is hopeful of pricing sanity prevailing in the 3PL B2C industry. As such, some pick up is being seen in Q1FY26 volume, owing to this consolidation. With Meesho’s slated goal to continue insourcing, we expect only a gradual recovery in B2C volumes. Baking in the Q4FY25 miss, we cut FY26E/27E revenue by 5%/6%, respectively. We maintain BUY while trimming Mar-26E TP to Rs380 (by 5%; DCF methodology) from Rs400 earlier, as we expect the company’s scale and inherent lower cost structure owing to its integrated logistics offerings to disproportionately benefit from the industry consolidation.

Robust margin performance

Revenue grew 6% YoY to Rs22bn, driven by the PTL and cross-border service segments (up 24% and 10% YoY, respectively) in Q4FY25. The Express business grew 3% YoY, while parcel volumes grew only 1% YoY and realization per parcel was up 3% YoY. PTL revenue was up 24% YoY, continuing its growth trajectory, as volumes grew 19% YoY along with realization-per-ton increasing 4% YoY. EBITDA margins came in at 5.4% (beat on our estimate of 4.4%), as COGS increased a mere 3% YoY and employee costs were flat YoY. Depreciation decreased 29% YoY due to change in the depreciation policy (from WDV to SLM) undertaken in Q1FY25, without changing the useful life and residual value of assets. This led to PAT coming in at Rs726mn. Net cash stands at ~Rs53bn.

Outlook and risks

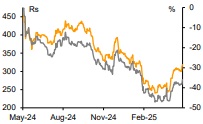

The acquisition of Ecom Express (pending CCI approval) fortifies Delhivery’s scale and market leadership in the 3PL B2C industry. However, despite mounting losses of captive logistics units (Exhibits 6, 7), e-commerce marketplaces continue to insource; and with Meesho’s slated goal of increasing insourcing, volume growth for 3PL operators, including Delhivery, is unlikely to see an immediate turnaround. Delhivery’s diversified revenue base, strong net cash position (Rs53bn pre-acquisition of Ecom Express), and reducing capex intensity (3.5-4% by FY27) are likely to help it ward off industry headwinds better vs competition. Improving PTL volumes without sacrificing realizations, and benefits of operating an integrated network should aid the margin trajectory in the long term, in our view. We retain BUY on the stock and cut Mar-26E TP by 5% to Rs380, based on DCF methodology (13% WACC, 5% terminal growth). Key risks: Slowdown in e-commerce due to quick commerce; operational risks due to dependence on contractual labor; pricing pressures in a fragmented market.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354