Buy Bharat Dynamics Ltd For Target Rs. 1,965 By Choice Broking Ltd

Missile Momentum Ignited

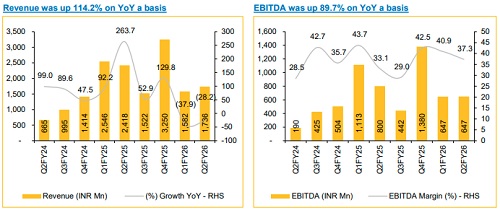

BDL delivered a strong topline performance in Q2FY26, with revenue surging 114.2% YoY and 396.4% QoQ. It’s way ahead of street estimate, driven by accelerated execution across missile programs and a favourable delivery schedule. The company’s execution momentum highlights its strengthened operational capabilities and improved supplychain coordination, following recent modernisation efforts.

We believe that multiple high-value indigenous programs, such as Astra Mk-2, Akash NG and ATGM, are expected to move into production. Hence, BDL remains one of the most credible beneficiaries of India’s growing missile modernisation agenda. Its established infrastructure, close collaboration with DRDO and proven execution capability across complex missile systems provide it a clear competitive advantage. These upcoming projects are poised to significantly expand the orderbook, driving sustained revenue visibility and margin accretion over the medium term.

BDL’s robust orderbook of ~7x FY25 revenue, coupled with an incremental pipeline of INR 500–600 Bn, provides multi-year earnings visibility and operating leverage tailwinds. As execution scales up, we expect strong cash generation and profitability improvement through FY28E. Given the company’s strategic positioning and healthy financials, we maintain our BUY rating with a TP of INR 1,965, valuing the stock at 35x average of FY27–28E EPS.

Explosive Growth; Margin Takes a Tactical Pause

* Revenue for Q2FY26 up 114.2% YoY & up 396.4% QoQ at INR 11,471 Mn (vs CIE Est. INR 7,579 Mn)

* EBIDTA for Q2FY26 up 89.7% YoY, stood at INR 1,875 Mn (vs CIE Est. INR 1,516 Mn). EBITDA margin contracted by 211bps YoY, stood at 16.3% (vs CIE Est. of 20.3%)

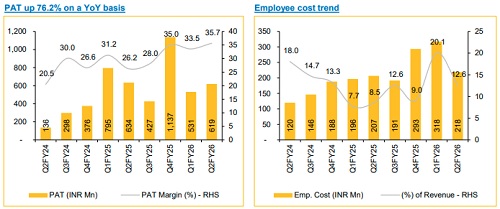

* PAT for Q2FY26 up 76.2% YoY and up 1076.5% QoQ at INR 2,159 Mn (vs CIE Est. INR 1,582 Mn). PAT margin contracted by 406bps YoY, reaching 18.8% (vs CIE Est. 21.2%)

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131