Buy Endurance Technologies Ltd for the Target Rs. 2,976 by Motilal Oswal Financial Services Ltd

Steady quarter!

The India business continues to outperform industry growth

? Endurance Technologies (ENDU)’s 3QFY26 adj. PAT stood at INR2.3b and was in line. While standalone margins at 12.4% beat our estimate of 11.7%, the European business margin came in line at 18%. ? On the back of its healthy order backlog, we expect ENDU to outperform core industry growth, both in India and Europe. As a result, we estimate a CAGR of ~16%/16%/14% in consolidated revenue/EBITDA/PAT over FY25- 28E. The stock trades at 32x/28.4x FY27E/FY28E consolidated EPS. We reiterate our BUY rating with a TP of INR2,976 (based on 35x Dec’27E consolidated EPS).

Earnings in line

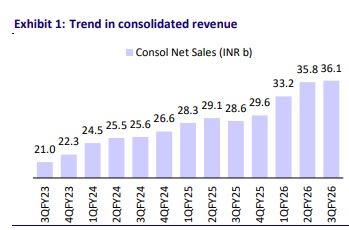

? ENDU’s 3QFY26 consolidated revenue grew 26% YoY to INR36b (in line), driven by ~23% YoY growth in the standalone (India) business and ~40% YoY growth in Europe (in INR; +20% in EUR terms), aided by the Stoferle acquisition (excluding which revenue declined 2% YoY in EUR terms). ? Maxwell revenue grew 53% to INR400m.

? The India business continued to outperform relative to 18% growth in the 2W industry. ? However, European business, ex-Stoferle, has underperformed relative to the 5% industry growth in 3Q. This is primarily due to higher tooling sales in the base quarter.

? Standalone margins remained stable YoY at 12.4% and were ahead of our estimate of 11.7%. Standalone margins were supported by the recurring incentives from the Maharashtra state government, while the benefits were offset by adverse commodity inflation and costs related to the ramp-up of new plants and capacity expansion.

? Europe's margins were largely in line with our estimate at 18%. Maxwell margins came in at 5.8% vs. 4.3% QoQ and 0.5% YoY.

? Overall, consolidated margins were in line with estimates at 13.2%. As a result, EBITDA grew 28% YoY to INR4.8b (in line).

? The company recorded an exceptional expense of INR210m on account of labor code changes. Adjusted for this, consolidated PAT grew 29% YoY to INR2.3b (in line)

Key highlights from the management commentary

? In 9MFY26, the company secured a total of INR12.8b in orders, with INR12.6b coming from new business.

? Going ahead, with an RFQ worth INR42b in hand, the company expects to win orders worth INR15b in the next 12-18 months.

? The company is awaiting regulatory guidelines on the proposed implementation of ABS on up to 125cc segment of 2Ws, which is expected in a quarter. If, instead of ABS, the authority decides to mandate CBS on up to 125cc 2Ws, even then ENDU benefits, as drum brakes would get replaced with disc brakes, and Endurance is amongst the key suppliers of disc brakes for 2Ws in the country.

? Standalone capex guidance for FY26E stands at INR 8b and is likely to be well under INR 8b in FY27E as it would look to sweat its assets from FY27 onwards.

? In Europe for 9MFY26, ENDU booked EUR15m in new orders, including large machine castings for Volkswagen and Porsche, as well as plastic injection molding parts for EVs. Stoferle had order wins worth EUR5m from customers like BMW and Magna with visibility of volumes extending through 2030-2032. Order wins in the EU have been at only EUR15m due to the poor market conditions in the EU.

? In the EU, capex guidance stands at EUR36m in FY26 after the payment for the Stoferle acquisition. ENDU plans to spend EUR25-30m in FY27.

Valuation and view

? On the back of its healthy order backlog, we expect ENDU to outperform core industry growth, both in India and Europe. As a result, we estimate a CAGR of ~16%/16%/14% in consolidated revenue/EBITDA/PAT over FY25-28E. The stock trades at 32x/28.4x FY27E/FY28E consolidated EPS. We reiterate our BUY rating with a TP of INR2,976 (based on 35x Dec’27E consolidated EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412