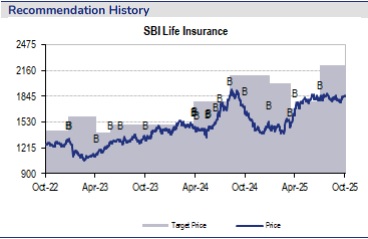

Buy SBI Life Insurance Ltd For Target Rs. 2,222 By JM Financial Services

Margin beat despite GST 2.0 hit, growth guidance maintained

SBI Life reported 2Q VNB of INR 16.6bn, +14.5% YoY, +3% JMFe, with a growth of 7%/10% in individual APE/total APE and a 100bps expansion in margins (against JMFe 56bps expansion). Margin expansion was led by a favourable product mix – non-par, annuity and individual protection grew 41%/50%/24%, countering an 80bps impact from GST 2.0. Of the 80bps, only a 20bps impact was due to the post-22nd September policies, implying a 174bps impact on fullyear basis, with the major chunk due to change in assumptions for policy renewals. Management expects to counter this VNB impact without changing distribution or customer benefits, and maintained its previous guidance of 13-14% growth in individual APE and 26-28% VNB margins. We hardly change our estimates, continue to value the insurer at 2.3x Mar’27 EVPS of INR 972 to get an unchanged target price of INR 2,222. We maintain BUY.

* FY26 growth has been volatile so far, but management maintained its growth guidance: SBI Life has seen weak inconsistent growth in FY26 so far – with 14%/15% growth in June/September being the only decent months. With the strong September, individual APE of 7% was 2pps ahead of JMFe, while group business growth, while strong at 48%, was below JMFe 55%. Agency disappointed with a 3% growth in 2Q, while other channels grew 33% on a low base, banca growth was in line with company level growth of 7% in individual APE. Management maintained its growth targets for the year at 13-14% individual APE growth. Given the strong track record of delivery and a business tilted towards 3Q, we expect SBI Life to achieve the targeted 13% growth, which implies a manageable 18% growth in 2H.

* Margins 40bps above JMFe, EV grows 2.3% QoQ: The 7% growth came with a favourable product mix shift towards, as non-par, annuity and individual protection grew 41%/50%/24%. As a result, product mix shift drove a 110bps margin expansion. As a result, margins improved (100bps YoY, 40bps QoQ) to 27.9%. Management also called out an 80bps impact on 1H margins due to GST 2.0. Of the 80bps, only a 20bps impact was due to the policies underwritten post-22nd September, implying a 174bps impact on full-year basis. The remaining impact, of ~60bps, was attributed to the unavailability of ITC on renewals of policies underwritten during FY26 but before 22nd September. Also, against the exchange disclosure of 0.2% impact on its EV due to GST 2.0, the insurer called out an impact of 0.4%. WIth increased rider attachment and an uptick in protection, the company expects to counter the entire impact of GST 2.0 on its margins, within FY26 itself. The company maintained its guidance of 26-28% VNB margins for the year – we expect it to deliver at the upper end at ~28%.

* Expect the stock to compound with EV: We do not change our growth and margin estimates - we expect 13%/14% YoY growth in individual APE/total APE over FY25-FY28e, and stable margin at ~28% levels. At CMP, the stock trades at 2.2x/1.8x FY26e/FY27e EVPS, implying 17x/15x on FY26e/FY27e EVOP. We believe these are inexpensive for 17%+ EV CAGR, which the insurer has consistently delivered. We maintain our target price at INR 2,222 valuing SBI Life at 2.3x Mar’27 EVPS of INR 972. We maintain BUY.

Key concall takeaways:

* GST 2.0 Impact

* Total impact of 0.80% on 1H margins

* without GST 2.0; 1H margins would be 28.5%; - GST 2.0 came on 22nd Sep, those 9 days constitute only 11-11.5% , if extrapolated the impact would be of only 1.74% on margins;

* The company will not hit customer benefits or distribution payouts with GST 2.0;

* Not negotiating with distributors, the company will manage the impact of GST 2.0 by improving product mix, raising product-level margins and operational levers;

* The company expects to absorb the entire margin impact within FY26 itself.

* FY26 growth & margin targets maintained

The company maintained its growth targets for the year,

* Individual APE growth of 13-14% for FY26,

* Margins of 26% to 28% in FY26,

* Protection segment would be the focus area with introducing product lines, to contribute 10% of total APE in the near term.

* Channel growth

* SBI group productivity on APE growth: INR 4.6 mn , reported 6% growth,

* Added 64,000 agents on a gross basis in 1H,

* Opened 44 new branches in 1H.

* Protection business

* Credit life business grew +25% and stood at INR 1.3bn for 1H,

* Pure protection (ex-ROP) category saw exceptional growth of 143% on APE basis,

* Rider attachment for the protection stood at 38%.

* New Products

* Smart Shield Plus

* individual protection product

* 11% to the total protection sum assured;

* Smart Moneyback Plus - participating product

* 8500+ opted for the product in 15 days of launch

* Others

* 13th Month persistency stands at 87.1% , an improvement of 70 bps

* Peer insurers have seen a drop here in the last two quarters as the strong cohorts from Mar’23 pre-sales is no longer reflecting that,

* SBI life did not have any bumper sales in Mar’23, so, no fall in persistency.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361