Life Insurance Sector Update : Uptick in growth; loss of ITC credit to drag margin by Prabhudas Lilladher Ltd

Uptick in growth; loss of ITC credit to drag margin

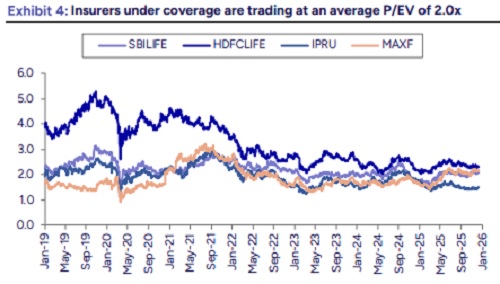

Private life insurers are seeing a pick-up in Oct/ Nov-25 volumes (+21% YoY) with GST exemption kicking in. We expect the boost in retail protection volume to provide a strong tailwind for growth in Q3. Expect 3QFY26E VNB margin to be subdued due to the loss of Input Tax Credit. Valuations continue to remain undemanding. Maintain BUY on Max FS (TP of Rs 1,925 at 2.1x FY27E P/EV) and HDFC Life (TP of Rs 900 at 2.6x FY27E P/EV). Key monitorable from 3QFY26E results are: (1) Growth guidance for Q4FY26/ FY27E (2) Margin outlook and impact of GST exemption.

Private life insurers have seen a pick-up in Oct and Nov-25 volumes (+21% YoY) as pent-up demand due to the GST exemption kicks in. Max FS and SBI Life have seen a robust growth of 21%/ 26% YoY while growth for HDFC Life and IPRU Life remains modest (+11%/ 8% YoY). We expect the boost in retail protection volume to provide a strong tailwind for growth in Q3. This, coupled with a pick-up in credit protect and steady NPAR volume to drive growth in the quarter.

* HDFC Life has reported an APE growth of 11% YoY on YTD basis; we expect ~12% in Q3. While uptick in term volumes and recovery in the Credit life segment to drive growth, it is likely to be offset by muted growth in ULIP and NPAR. The company has indicated a gross impact of ~300 bps on FY26 margin due to the loss of Input Tax Credit on GST. However, it is engaging with distributors to mitigate the same over the next 2-3 quarters. We build a VNB margin of 22.5% in Q3.

* IPRU Life has seen a de-growth (-6% YoY YTD) impacted by a slowdown in ULIP and flat growth in protection; we expect the de-growth to continue. Company is evaluating several cost optimisation measures to mitigate the impact of the recent GST exemption on FY26 VNB. Higher sum assured/ rider attachment and favourable movement of the yield curve are likely to offset the drag on profitability. We factor in the same with a VNB Margin of 23% for Q3.

* Axis Max Life has outperformed peers with APE growth of 18% YoY on a YTD basis. We expect the outperformance to continue (+16% YoY) with strong growth in retail protection volume and recovery in credit life disbursals. Newly launched products - Smart VIBE (NPAR), SWAG 2.0 (PAR) and SWAG Pension (Annuity) are seeing strong traction. On the margin front, we build a VNB margin of 22.5% in Q3, considering the drag from GST exemption.

* SBI Life: SBI Life has seen a strong recovery in Oct and Nov-25 volumes (+14% YoY on a YTD basis); we build a growth of 5% YoY in Q3, factoring in a highbase from last year. Expect margin to remain intact (vs. Q3FY25), with a negligible impact of GST exemption.

Loss of Input Tax Credit to impact Q3 margin: With the benefit of Input Tax Credit not available to insurers, we expect a drag of 200-300 bps on FY26E VNB Margin across players. In our view, covered companies are likely to mitigate the drag with commission cuts. Moreover, strong growth in retail protection volume in H2, improved margin profile in ULIP and repricing in NPAR is likely to offset some of the drag.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271

More News

Cement Sector Update: Prices steady with full GST benefits; pet coke rears its head By Emkay...