Indian General Insurance Sector Update : Strong vehicle sales lift OD premiums; pricing pressure persists by Motilal Oswal Financial Services Ltd

* Motor insurance enters a period of strong volume momentum, as the recent GST cut (Sep’25) on select vehicle categories, the extended festive season, and improved consumer sentiment have significantly boosted auto sales across 2Ws, passenger vehicles, and commercial vehicles over the last two months.

* This broad-based acceleration in vehicle registrations is leading to a meaningful pickup in Motor Own Damage (OD) premiums, with insurers reporting healthier new business issuances, particularly in the 2W and mid-PV segments, where the impact of improved affordability is the most pronounced.

* Despite strong tailwinds from the auto sector, the motor insurance industry continues to face intense competitive pressure, with several insurers aggressively discounting Motor OD premiums and offering higher distributor payouts to capture market share, which is preventing premium rates from strengthening in line with rising demand.

* As a result, combined ratios remain structurally elevated, as price competition, rising repair inflation, higher claim severity, and increased acquisition costs are offsetting the benefits of volume growth and keeping underwriting profitability under sustained pressure.

* ICICIGI remains well-positioned, retaining leadership in both OD and TP despite an intensely competitive market. Its disciplined underwriting, strong distribution depth, and diversified portfolio provide resilience as auto sales strengthen and pricing gradually normalizes. We reiterate our BUY rating with a one-year TP of INR2,300 (premised on 30x Sep’27E EPS)

Key industry trends

* The motor industry is witnessing a broad-based recovery, led by strong festive demand, improved affordability following GST rationalization, and better financing availability. This has translated into a meaningful uplift in new vehicle registrations across the 2W, PV, and CV segments.

* 2Ws have led recovery with sharp growth (145%/98% in Oct’25/Nov’25 from Sep’25 levels when GST rationalization was done), benefiting from improved affordability, rural sentiment recovery, and better availability of consumer financing, while passenger vehicles continue to post healthy traction (up 85% /32% in Oct’25/Nov’25 from Sep’25 levels), driven by sustained demand for SUVs and new-model launches.

* Commercial vehicle volumes have also strengthened (up 54%/32% in Oct’25/ Nov’25 from Sep’25 levels), aided by higher freight movement, infrastructure activity, and pre-buying ahead of expected regulatory transitions, indicating a broad-based improvement across vehicle categories.

* Together, these drivers expanded the insurable base significantly, with Motor OD premium growth of 47%/14% in Oct’25/Nov’25 from Sep’25 levels.

* Motor insurance premium growth remained healthy, with OD premiums closely tracking the rise in new vehicle registrations, especially in the 2W and mid-PV segments. However, Third-Party (TP) premium growth is relatively subdued, as regulatory price hikes have been modest (no hike seen since 2018) and insufficient to fully reflect rising loss costs.

* Renewals remain broadly stable, but the incremental uplift is largely coming from new business issuances rather than higher yields. At the same time, claims inflation persists, driven by rising repair costs (particularly for technology-rich vehicles), elevated labor charges, and increased claim frequency in high-density regions, all of which continue to weigh on profitability.

Motor insurance premium growth led primarily by OD

* Within the motor segment, overall industry premium growth of 36%/14% in Oct’25/Nov’25 (from Sep’25 levels) is largely driven by the OD category (47%/14% in Oct’25/Nov’25), which is tracking the strong recovery in retail vehicle registrations. The uplift is particularly visible in 2Ws and lower to midtier passenger vehicles, where improved affordability and higher demand have translated into a larger flow of new policy issuances. The renewal book remains broadly stable. However, incremental premium growth in the sector is being fueled by first-year policies rather than material improvements in yield.

* Third-Party (TP) premium expansion, on the other hand, has been more subdued, with key players experiencing elevated combined ratios (private players maintaining combined ratios in the 110-120% range, whereas PSUs continue to record ratios above 125%). Regulatory TP rate revisions have remained modest (not seen a hike since 2018) and do not fully reflect the underlying escalation in loss costs. This has created a structural disconnect between rising claim severity—especially in the commercial vehicle segment— and the pricing environment.

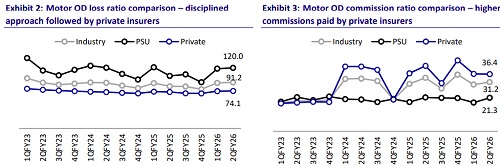

Competitive intensity continues to pressure motor OD pricing

* Despite the favorable backdrop of rising vehicle sales, pricing conditions within the motor insurance industry remain challenging. Insurers are engaged in aggressive price competition, particularly in the Motor OD segment, as they seek to capture incremental volumes or defend market share.

* This competitive dynamic is especially pronounced in 2Ws and mid-level passenger vehicles, where price sensitivity is high and customer churn is elevated.

* At the same time, acquisition costs continue to trend upward. Insurers are compelled to offer higher commissions to distributors to remain competitive, while digital acquisition spends—ranging from paid marketing to aggregator integration fees—remain elevated. As a result, expense ratios have remained stubbornly high despite healthy growth in underlying volumes.

* This trend has steered the industry towards volume-led expansion rather than margin optimization, prolonging the environment of subdued pricing and elevated competitive intensity.

Combined ratios remain elevated across most insurers

* Combined ratios within the motor portfolio remain higher than comfortable levels (in the range of 115%-136% over the last 10 quarters), despite the improvement in premium volumes. For PSU players, the combined ratio ranged between 125% and 170%, whereas for private players, it ranged between 107% and 119%.

* Loss ratios have exhibited only marginal signs of moderation, as rising repair costs, technology-heavy vehicle components, and increased labor charges continue to elevate claim severity. In high-density urban areas, the frequency of claims remains elevated, further contributing to sustained loss pressures.

* Expense ratios have also remained sticky, with acquisition and servicing costs rising due to the competitive market environment. Higher distributor commissions and continued investment in digital acquisition channels have prevented any notable reduction in operating costs. The combination of modest improvement in loss ratios and persistent pressure on expense ratios has kept combined ratios elevated, thereby delaying any meaningful recovery in motor underwriting profitability.

ICICIGI: Reiterate BUY; strong positioning to capitalize on the motor insurance growth opportunity

* ICICIGI remains the largest private insurer in the motor segment, holding a market share of ~10.7% in YTDFY26. Its Motor OD share stands at ~13.5% (the highest in the industry), while the Motor TP share is ~8.8% (the largest among private insurers), underscoring its strong competitive positioning.

* Motor OD growth remained flat YoY in 2Q, compared to 6% for the industry, primarily due to temporary softness in automobile sales and heightened discounting, particularly by PSUs. Despite these headwinds, the company maintained its market-leading position. With auto sales now rebounding on the back of GST reductions, festive season demand, and improving retail sentiment, Oct’25 and Nov’25 numbers recorded a strong 10%/12% YoY increase, a trend likely to sustain. As pricing discipline gradually returns, despite elevated combined ratios across the sector, OD premium growth is expected to improve steadily over the coming quarters.

* Motor TP premiums grew ~4% YoY in 2Q, compared to ~6% YoY for the industry. With TP rates revising upwards, the company is well-positioned to capitalize on its extensive distribution network and regain market share as pricing normalizes.

* We expect premiums in the motor OD segment to post a 12% CAGR over FY25- 28, while the motor TP segment is expected to clock an 8% CAGR. Loss ratio is expected to be ~69%, leading to a combined ratio of ~101.5% in FY28.

* Apart from growing traction in retail health, we expect some semblance in group health pricing, which will support group health profitability. The company maintains a dominant position in the fire segment, and the growth trajectory is expected to be consistent following the price correction.

* We reiterate our BUY rating with a one-year TP of INR2,300 (premised on 30x Sep’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

Life Insurance Sector Update : Ending the year on a `healthy` note ! By Motilal Oswal Finan...