Buy MIDWEST Ltd for the Target Rs.1700 by Motilal Oswal Financial Services Ltd

Miss on earnings; FY26 estimate cut

* Revenue for 3QFY26 stood at INR1.3b (against our est. of INR1.9b), rising 10% YoY but declining 19% QoQ.

* Black galaxy granite production stood at 15.3k cbm (-3% QoQ) during 3QFY26, while absolute black granite stood at 9.5k cbm (-10% QoQ). The company sold 15k cbm of black galaxy granite (-6% QoQ) and 9k cbm of absolute black granite (-17% QoQ).

* During the quarter, the blended granite ASP was INR 53,842/cbm (-7% QoQ).

* EBITDA stood at INR305m (against our est. INR545m), up 31% YoY but down 34% QoQ. EBITDA margin corrected to 23.7% in 3QFY26 vs 20% in 3QFY25 and 29.3% in 2QFY26, which was attributed to higher employee benefits and other expenses during the quarter.

* APAT came at INR183m (vs our est. INR377m), increasing 29% YoY but declining 34% QoQ.

Key highlights from the management commentary

* The company has been awarded a 10.9-hectare galaxy mine, which is adjacent to existing operations, and production is expected to commence in 4QFY26.

* The company has received a 30-year quarry lease work order from the government of Andhra Pradesh for the extraction of colored quartzite blocks.

* China (largest export market) saw strong demand, driven by a reduction in legacy real estate inventory, completion of stalled construction projects, strong RMB (~6.9 vs historical ~6.2), and improving import economics.

* Phase I has revenue potential of ~INR2-2.1b, with Phase 2 expected to add a similar scale, taking the quartz vertical revenue potential to ~INR4-4.2b. The HPQ addition could take the total quartz revenue potential to ~INR5.5- 6b over time.

* The company has repaid INR0.5b debt using the IPO proceeds, thereby reducing the borrowings to INR1.6b.

Valuation and view

* Midwest Limited (MIDWEST) delivered muted performance, mainly due to weak volumes and lower ASP during 3QFY26. For FY26, we trimmed our revenue/EBITDA/APAT estimates by 22%/25%/29%, respectively, as we incorporate the muted volumes of 3QFY26 and the current earnings mix. We expect the quartz segment to contribute to the revenue in the coming quarters.

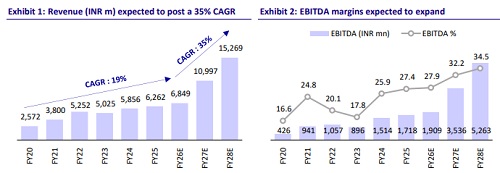

* We expect MIDWEST to clock a 35% revenue CAGR over FY25-28, led by the new business venture (Quartz and Heavy Sand Minerals), translating into a CAGR of 45% in EBITDA and 54% in PAT. We expect the quartz segment to contribute ~34% of the total operational revenue in FY28, thus reducing dependency on granite.

* The company’s debt/equity ratio is expected to remain at favorable levels. The recent debt repayment of INR0.5b further strengthens the company’s financial position. At CMP, MIDWEST trades at 15x EV/EBITDA on FY27E. We reiterate our BUY rating on the stock with a revised TP of INR1,700, valuing the stock at 12x EV/EBITDA on FY28 estimates.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412