Buy Inox Wind Ltd India Ltd for Target Rs.144 by Systematix

Inox Wind Ltd.

Profitability supported by strong margins; despite slower execution

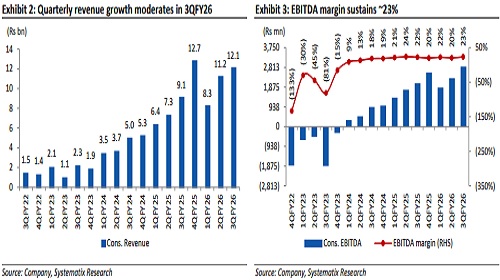

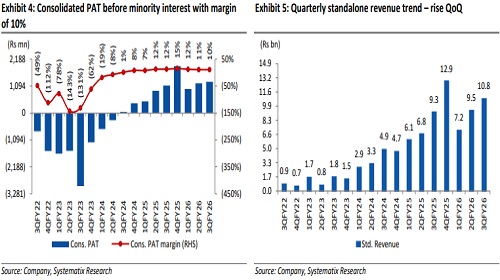

Inox Wind’s (INXW) 3QFY26 revenue of Rs 12bn (+33% YoY/+8% QoQ) was 16% below our estimate primarily due to lower order execution. EBITDA (excl. other income) at Rs 2,816mn grew by +38%/+24% YoY/QoQ, 3% above our estimate. EBITDA margin for the quarter came in at 23%, up 97bps YoY and 298bps QoQ. INXW’s interest costs increased by 46% YoY but were broadly flat QoQ at Rs 503mn in 3QFY26. INXW executed 252MW orders in 3QFY26 versus 202MW/189MW in 2QFY26/3QFY25. Standalone revenue and EBITDA were reported at Rs 10.82bn (+17%/+14% YoY/QoQ) and Rs 2,287mn (+30%/+27% YoY/QoQ), respectively. On a consol basis, realisations averaged Rs 47.9mn/MW during the quarter (-1%/-14% YoY/QoQ). The company’s Operations and Maintenance (O&M) subsidiary Inox Green Energy Services Ltd. (INOXGREE: NOT RATED) reported 3QFY26 revenue and EBITDA (incl. other income) of Rs 818mn (+34%/-5% YoY/QoQ) and Rs 526mn (+85%/+1% YoY/QoQ), respectively. We maintain BUY rating on the stock with a revised TP of Rs 144/share based on FY28E SOTP P/E.

Outlook and view: INXW’s 3QFY26 performance highlighted recurring divergence from guidance. While execution continued to lag expectations, resulting in a topline miss, margin outperformance largely offset the impact on EBITDA. Management attributed the execution miss primarily to customer side site readiness delays, particularly on turnkey contracts, leading to deferred commissioning and lower EPC share. Against this backdrop, management has shifted its guidance from operational parameters to absolute financial metrics, reflecting increasingly unpredictable customer-controlled timelines. The company now guides for ~Rs 50bn revenue in FY26 with EBITDA margins of ~22% and 75% YoY revenue growth in FY27 with EBITDA margins of 20-22%. The revised guidance inherently translates into lower MW execution than earlier expectations, however, the upward revision in margin guidance underscores structural improvement in cost efficiency, supported by backward integration, and expanding contribution from the higher margin O&M business. Based on the revised guidance, we factor in 1,000MW execution in FY26 and 1,552MW in FY27, and cut our FY26/FY27 revenue estimate by 14%/11% while PAT remains broadly unchanged with superior EBITDA margin assumptions.

Valuation: Despite sustained EBITDA margin strength, weaker execution momentum and relatively moderate order inflows, versus key peers, continue to constrain rerating potential. However, following the recent correction, INXW offers a favorable risk reward, even on conservative earnings assumptions and valuation multiples. We introduce FY28 estimates and value INXW 20x FY28E SOTP P/E, resulting in a revised target price of Rs 144/share (earlier Rs 181/share), implying 43% upside from CMP. The stock trades at 24x FY26E P/E. Strong order inflows can be a key re-rating driver while a dynamic policy environment could pose challenges. Maintain BUY.

Key takeaways from the 3QFY26 earnings conference call

* Guidance recalibrated to financial metrics: Management has transitioned from MW-based guidance to revenue and margin guidance due to contract complexity and customer site-dependent execution. FY26 revenue is guided at Rs 50bn with ~22% EBITDA margin (versus 18-19% earlier), whereas FY27 revenue is expected to grow 75% YoY with 20-22% margins. Working capital cycle is guided at 200 days in FY26, improving to 120-150 days in FY27. Capex is guided at Rs 2bn for FY26 and FY27 each, with Rs 1.5bn already incurred in 9MFY26.

* Product and technology roadmap: INOXGREE is exploring AI-led automation for routine O&M activities, aimed at improving execution speed and margin sustenance. For INXW, approvals for the 4X/4.45MW turbine platform are expected in CY2026, with commercial launch targeted thereafter.

* Orderbook visibility: Current order book stands at 3.2GW, with ~600MW added in YTD FY26, offering 18-24months execution visibility. Inox Clean Energy’s plan to develop ~3GW hybrid IPP capacity annually which provides recurring order visibility for INXW and sustained portfolio expansion for INOXGREE.

* O&M scale-up and margin accretion: INOXGREE's portfolio stands at ~13.3GW (10GW wind, 3.3GW solar) spread across 17 states. Ongoing portfolio additions, operating leverage, and post demerger removal of substation related depreciation are expected to materially improve ROCE, ROE, and cash generation.

* Demerger and inorganic growth update: The acquisition of 6.5GW of operational wind O&M assets is nearing completion. The demerger of INOXGREE's substation business and its merger into Inox Renewable Solution is in the final stages of NCLT approval, post which IRSL is expected to be listed.

* Sector demand skewed towards C&I; offsets PSU tender delays: Management highlighted that over 50% of current project execution is driven by the C&I segment, amid intermittent delays in PSU tendering and project awards. Increased participation from newer states and gradual ramp up in transmission infrastructure are expected to improve medium term project visibility.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Buy Astra Microwave Products Ltd for the Target Rs. 1,150 by Motilal Oswal Financial Service...