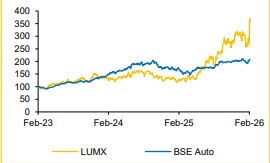

Add Lumax Industries Ltd for the Target Rs. 7,100 by Choice Institutional Equity

Impressive Growth in LED Lighting & Strong PV Order Book: As of Q3FY26, the company’s order book stood at INR 17,590 Mn (~52% of FY25 sales), of which the passenger vehicle segment contributed 66%. In Q3FY26, LUMX launched lighting systems for Tata Motors (Sierra and Punch), Mahindra (Erickshaw) and TVS (Apache RTX 300). The LED segment made up 81% of the order book and accounted for 61% of revenue in Q3FY26. We expect the LED share to reach 65–70% in FY27E. We believe higher LED penetration and an increase in contribution by the PV segment will drive growth, as these segments have higher content value per vehicle.

Setting up a Manufacturing Facility: LUMX is setting up a manufacturing facility in Bengaluru, Karnataka, with a capital investment of approximately INR 1,400 Mn. This plant will cater to newly-secured orders from Maruti Suzuki and Toyota. It is expected to achieve a peak annualised turnover of around INR 4,500 Mn once fully ramped up and is targeted for commissioning by Q4FY27E.

LUMX Mitigating Margin Pressure through Operating Leverage and Localisation Effort: LUMX saw an improvement in EBITDA margin in Q3FY26 on YoY basis supported by higher capacity utilisation and operating leverage. It was further aided by the localisation effort undertaken by the company for some of the components for LED lighting. These components are imported (achieved localisation at 30–35% and, going forward, expected at 50–55%). We expect EBITDA margin to improve, going forward, driven by operating leverage and increasing localisation effort to source components for the LED segment.

View and Valuation: We revise our FY26/27/28E EPS estimate upwards by 16.4%/10.4%/10.4% and arrive at a revised target price of INR 7,100. We value the company at 22x (previously 20x) on the average FY27/28E EPS and maintain our ‘ADD' rating on the stock. We assign a higher multiple to the company, supported by the planned capacity expansion at Bengaluru as well as improvement in EBITDA margin through operating leverage and localisation effort.

Revenue, EBITDA Better; PAT Lower than Estimate

? Revenue was up 18.7% YoY and up 4.4% QoQ to INR 10,527 Mn (vs CIE est. at INR 10,805 Mn).

? EBITDA was up 58.2% YoY and up 24.7% QoQ to INR 1,106 Mn (vs CIE est. at INR 962 Mn). EBITDA margin was up 262 bps YoY and up 171 bps QoQ to 10.5% (vs CIE est. at 8.9%).

? APAT was up 86.4% YoY and up 75.1% QoQ to INR 624 Mn (vs CIE est. at INR 414 Mn).

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131