Buy Dr. Reddy's Laboratories Ltd For Target Rs. 1,370 by Centrum Broking Ltd

During Q4FY25, DRRD’s Revenue/EBITDA/PAT were in-line while EBITDA margin missed our estimates. Revenue grew 20% YoY (ex-NRT: 12% YoY) to Rs85bn. US business grew 9% YoY to Rs35.6bn witnessing strong volume growth with new product launches partially offset by continued price erosion. EU grew 2.5x YoY (ex-NRT: 30% YoY) to Rs12.8bn largely due to integration of NRT portfolio. India sales grew 16% YoY to Rs13bn driven by in-licensed vaccine portfolio, new product launches and price increases, partially offset by lower volumes. Russia grew 31% YoY to Rs6.5bn led by volume growth/new product launches. GM contracted 300bp YoY to 55.6% due to higher price erosion, lower manufacturing overhead leverage and milestone income accrued in the Q4FY24. Adj. EBITDA margin was flat YoY at 25% (our est. 26.9%) with EBITDA growing 20% YoY to Rs21.3bn. Adj. PAT was Rs15.3bn (+18% YoY). Management guided for double-digit revenue growth in FY26E aided by strong performance across all segments. Also, it expects EBITDA margins to be 25%+. We are positive on DRRD that despite gRevlimid going off-patent in Jan’26, there are multiple growth levers over the near-to-medium-term such as a) new product launches in the US, b) Semaglutide launch in early-2026 which we expect is a USD1-1.5bn market in Canada, c) net cash surplus of ~Rs25bn, DRRD is actively looking for inorganic opportunities in addition to organic investments in innovation and biosimilars. Accordingly, we have revised our FY26E/FY27E EPS estimate by 6%/2%. We expect revenue CAGR of 4% while EBITDA/PAT to witness CAGR decline of 6%/9% with margins contracting 510bps to 22.2% over FY25-27E. We value base business at 1Y-fwd EPS of 24x (v/s 27x earlier due to uncertainty over US tariffs) and adding NPV of Rs100 for gRevlimid to arrive at revised TP of Rs1,370. The stock is currently trading at 20x FY27E EPS. Upgrade to BUY.

US: gRevlimid loss to be offset by base business/niche launches over near-to-medium term

In 4QFY25, US revenue was USD418mn (+7% YoY/4% QoQ) led by 7 new product launches and increased traction in base business offset by stable price erosion. At the end-FY25, there are 73 ANDAs and 3 NDAs under the 505(b)(2) route awaiting approval. Of these ANDAs, 44 are Para IVs, and 20 can secure the 'First to File' status. Also, post FY27E, there are several major patent expires in the US, of which, Abatacept (bOrencia) is an interesting opportunity. DRRD plans to file by Dec’25 and expects approval in 12 months with a launch planned by 1QFY28. We expect US revenue CAGR decline of 8% to USD1.4bn over FY25-27E.

Semaglutide: DRRD to make first entry in Canada in 2026E/India in 2027E

Semaglutide, the largest GLP-1 product, will start to go off-patent in EMs and select developed markets such as Canada from 2026E. DRRD plans to be the first to enter Semaglutide market in Canada in 2026E which we see as a limited competition market in the near-term. Also, DRRD’s plans to enter into Semaglutide market in India once it goes off-patent in 2027E.

NRT portfolio drives EU/In-licensed product portfolio drives India business

In 4QFY25, EU/India sales grew 2.5x/16% YoY respectively. In EU, Germany/UK grew 26% YoY/43% YoY. During 4QFY25, 10 new products were launched taking the FY25 total to 39. We expect EU segment to deliver 21% revenue CAGR over FY24-27E. Additionally, DRRD ranks 10 in IPM as per IQVIA. DRRD launched 23 products in FY25. Going forward, we expect India segment to deliver revenue CAGR of 11% over FY24-27E.

Upgrade to BUY

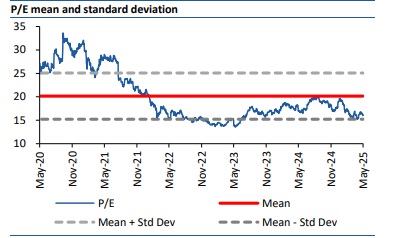

We have revised our FY26E/FY27E EPS estimate by 6%/2%. We expect revenue CAGR of 4% while EBITDA/PAT to witness CAGR decline of 6%/9% with margins contracting 510bps to 22.2% over FY25-27E. We value DRRD on SOTP basis (24x 12M forward P/E for the base business and adding NPV of Rs100 for gRevlimid) to arrive at revised TP of Rs1,370.

Valuations

We expect revenue CAGR of 4% while EBITDA/PAT to witness CAGR decline of 6%/9% with margins contracting 510bps to 22.2% over FY25- 27E. We value base business at 1Y-fwd EPS of 24x (v/s 27x earlier due to uncertainty over US tariffs) and adding NPV of Rs100 for gRevlimid) to arrive at revised TP of Rs1,370. Upgrade to BUY.

For More Centrum Broking Disclaimer https://www.centrumbroking.com/disclaimer/

SEBI Registration No.:- INZ000205331