Neutral Dr Reddy`s Labs Ltd for the Target Rs.1,190 by Motilal Oswal Financial Services Ltd

Out-licensing income/lower R&D spend drive better-thanexpected EBITDA

Canada Semaglutide opportunity hinged on timely approvals

* Dr Reddy’s Labs (DRRD) reported sales in line with our estimates in 1QFY26, while EBITDA/PAT came in higher than expected, primarily led by higher outlicensing income and lower R&D expenses.

* North America sales declined for the first time in 16 quarters in 1QFY26, partly due to volatility in sales of certain products and rising competition in g-Revlimid.

* Growth momentum remained intact in the domestic formulation (DF) market in 1QFY26, aided by new launches and price hikes.

* DRRD witnessed healthy off-take in volume and newer introductions, driving growth in Europe market for the quarter. There was a steady pick-up in NRT business post acquisition.

* Moderate demand and price erosion affected the performance of the pharmaceutical services and active ingredient (PSAI) segment in 1QFY26.

* We reduce our earnings estimates by 5%/4% for FY26/FY27, factoring in a) higher competitive intensity in g-Revlimid, b) moderate weakness in PSAI segment, c) growth-oriented opex in NRT and Nestle JV. We value DRRD at 18x 12M forward earnings to arrive at a TP of INR1,190.

* We expect that the semaglutide opportunity for Canada market and other markets like India/Brazil would be able to offset the impact of a reduction in g-Revlimid business 3QFY26 onward. However, considering the strong contribution from g-Revlimid in FY25, we expect a 3% compounded decline in earnings over FY25-27. Hence, we maintain Neutral rating on the stock.

Product mix impact marginally offset by lower R&D spend

DRRD’s 1QFY26 revenue grew 11% YoY to INR85.4b (est. of INR84.4b). Europe sales jumped 1.4x YoY to INR12.7b (15% of sales). Excluding NRT acquisition, Europe sales grew by 13% YoY, supported by Germany/UK, which grew 13%/10% YoY to INR3.2b/INR1.7b. India sales grew 11% YoY to INR14.7b (17% of Sales). Emerging markets sales grew 23% YoY to INR9.1b (11% of sales). US sales decreased by 11% YoY to INR34b (~USD397; 40% of sales) on higher price erosion in certain products, including Lenalidomide.

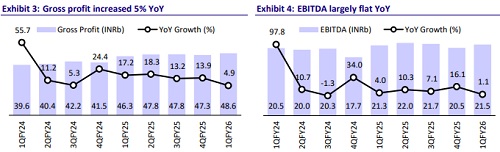

* Gross margin (GM) contracted 350bp YoY to 57%, largely due to lower margins in PSAI (down 1200bp YoY) and Global Generics (down 375bp YoY). This was partly offset by higher gross margin in other segments.

* EBITDA margin contracted 260bp YoY to 25% (our est: 22.6%) as lower GM was offset by lower expenses (R&D down 76bp YoY as % of sales).

* EBITDA was largely stable YoY at INR21.5b (est. of INR19.1b). Income from the innovative product segment was higher at INR1.6b in 1Q vs. INR1.5b in FY25. Adj. for this income, EBITDA would be INR20.3b for the quarter. R&D spend was lower at 7.3% of sales in 1Q vs. 8.4% in FY25.

* PAT grew 2% YoY to INR14.2b.

Highlights from the management commentary

* DRRD expects g-Revlimid sales to be stable in 2QFY26 and then decline sharply due to competition.

* Semaglutide opportunity for Canada market is subject to litigation outcome in India and regulatory approval in Canada.

* DRRD has a single pen version product for Canada market. It intends to sell 12m pens in FY26.

* Its own capacity of manufacturing pens would be available from FY28 onward.

* The R&D expenditure for FY26 is expected to be in the range of 7-7.5% of total sales (~8.5% in FY25).

* PLI income is expected to be minimal in FY26 and scale up in FY27-28.

* DRRD’s work on phase III trials related to abatacept is on track, with read-out expected in Nov’25. DRRD intends to launch the product in CY27. The subcutaneous version is expected to be launched a year later. Both launches are subject to timely approval for US market.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412