Neutral Tata Chemicals Ltd for the Target Rs.970 by Motilal Oswal Financial Services Ltd

India/UK basic chemistry and specialty products drive operating performance

Operating performance beats our expectations

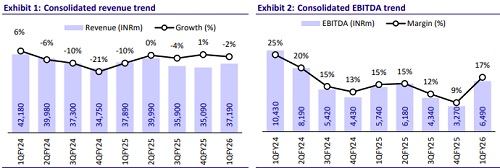

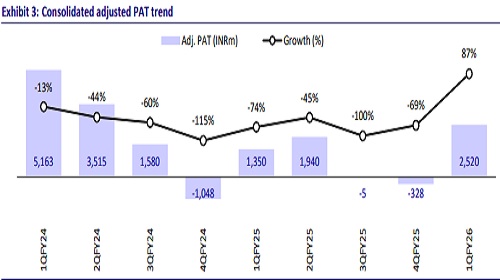

* Tata Chemicals’ (TTCH) 1QFY26 consolidated EBITDA grew 13% YoY, led by lower power and fuel costs (reduction in coal prices) and cost rationalization initiatives. India/UK/Rallis delivered a healthy performance (EBITDA up 15%/78%/56%), while US/TCAHL showed a subdued performance (EBITDA down 5%/32%). Revenue declined marginally by 2% YoY due to flat volume (higher volume in India offset by lower volume in the US/UK/Kenya).

* The soda ash demand-supply balance continues to be soft in the short-term owing to tariff changes and excess supply across regions. However, we believe the company will see a gradual improvement on the back of cost rationalization initiatives, soft input prices and capacity additions.

* We largely maintain our FY26/FY27 EBITDA estimates despite increasing Rallis India and UK estimates which largely offsets the reduction in estimates of Africa and US business. Reiterate Neutral with an SoTP-based TP of INR970.

Operating performance - a mixed bag

* TTCH reported total revenue of INR37.2b (est. INR39.8b) in 1QFY26, down 2% YoY, due to a slight decline in soda ash volumes (down 3%). Sodium bicarbonate/salt volumes grew 8%/1%. EBITDA margin expanded 230bp YoY to 17.5% (est. 14.3%), led by lower variable costs and favorable operating leverage. EBITDA stood at INR6.5b (est. INR5.7b), up 13% YoY.

* TTCH reported an adj. net profit of INR2.5b vs. ~INR1.4b in 1QFY25 (est. ~INR1.8b)

* Basic Chemistry Products business was down 8% YoY at INR27.2b. EBIT was flat YoY at INR3b. EBIT margins stood at 11%.

* Specialty Products business grew 22% YoY to INR10b. EBIT was up 85% YoY at INR3b. EBIT margins stood at 11%.

* India standalone/Rallis revenue grew ~12%/22% YoY to INR11.7b/INR9.6b. TCNA/TCEHL/TCAHL fell 6%/28%/9% YoY to INR12.1b/INR3.8b/INR1.3b.

* EBITDA for India standalone/TCEHL/Rallis grew 15%/78%/56% to INR2.7b/INR320m/INR1.5b, while the same for TCNA/TCAHL declined 5%/32% YoY to INR1.9b/INR1.7b.

* EBITDA/MT of TCNA remained flat YoY at ~USD40.6, while for TCAHL it declined 26% YoY to USD32. EBITDA margin for India standalone expanded 70bp YoY to 23.1%.

Highlights from the management commentary

* Demand-supply scenario: The demand-supply balance continues to be soft, coupled with uncertainties in soda ash trade due to tariff changes. Demand is not a concern, excess supply of unviable capacities remains a major concern. A large unit in China may begin a long-term maintenance haul – if this happens, the dynamics will turn favorable.

* European business: Margin improvement was led by a better product mix. Going forward, the pharma salt business and inhouse manufacturing of CO2 would be the key growth drivers. The company expects the bicarb business to break even this year, as TTCH has to recalibrate the business after the cessation of soda ash capacity. Additionally, the cessation of the Lostock business led to a decrease in costs.

* Capex: TTCH has guided for an annual maintenance capex of INR10b for FY26. No major expansion is expected after the expansion in Kenya (~50kpta capacity). Trial runs of the said capacity are going on, and it is expected to be commissioned in 2HFY26.

Valuation and view

* TTCH is expected to benefit from near-term tailwinds of a reduction in coal prices, capacity additions in Kenya, and growth drivers from the European business. Further, its strategic focus on specialty products positions TTCH well for long-term growth once global demand recovers.

* We expect the company will see a gradual improvement on the back of cost rationalization initiatives, soft input prices and capacity additions.

* We largely maintain our FY26/FY27 EBITDA estimates despite increasing Rallis India and UK estimates which largely offsets the reduction in estimates of Africa and US business. Reiterate Neutral with an SoTP-based TP of INR970.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

Top News

India cenbank gives ICICI AMC approval to raise stake in HDFC Bank to 9.95%

.jpg)