Buy Lodha Developers Ltd for the Target Rs.1,870 by Motilal Oswal Financial Services Ltd

Result below est., but presales and BD momentum intact

Achieves 91% of guided BD for FY26 in 1Q itself

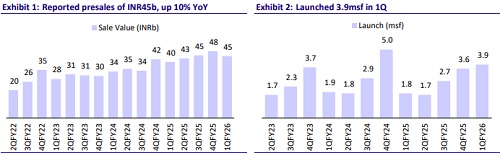

* In 1QFY26, Lodha Developers (LODHA)’s presales were up 10% YoY to INR44.5b (12% below our estimate).

* Collections rose 7% YoY to INR28.8b (34% below our estimates), and OCF improved 44% YoY to INR9.5b.

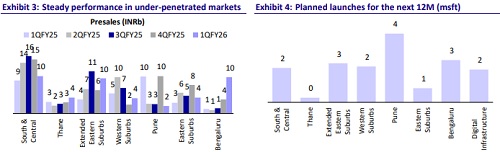

* Five new projects were added in MMR, Pune, and Bengaluru with a total GDV of INR227b. With these new projects, LODHA achieved 91% of its FY26 business development guidance in the first quarter itself.

* The company launched 3.9msf of projects with a GDV of INR83b.

* Net debt rose INR11b to INR51b in 1Q due to its notable investment in business development, though the Net Debt/Equity was below the ceiling of 0.5x.

* Financial performance: LODHA reported a revenue of INR34.9b, +23%/-17% YoY/QoQ (12% below our estimate).

* EBITDA (excl. other income) was +30% YoY/-19% QoQ to INR9.8b (13% below). The reported EBITDA margin was 28%. According to LODHA, the embedded presales EBITDA margin stood at ~33%. Adjusted EBITDA (excluding interest charge-off and capitalized interest) stood at INR12b, at a margin of 34.4%.

* Adjusted PAT came in at INR6.7b, up 42% YoY but down 27% QoQ (16% below), with a margin of 19.5%.

Key highlights from the management commentary

* LODHA reported sustained demand due to the consumers’ rising preference for quality housing; it targets a spurt in weekly sales to INR4b by FY26 (from INR2.5b in FY25), despite seasonal headwinds.

* In 1QFY26, the company launched projects worth INR84b across 3.9msf; it plans an additional 15 launches (13.3msf, INR170b GDV) through the rest of FY26, mostly in 2HFY26.

* Of INR44.5b in presales, INR15b came from new launches; the company guided ~5-6% price growth and INR50b average quarterly presales in FY26.

* It is transitioning to growth mode in Bangalore with significant BD activities (7msf, INR84b GDV), scaling the team to 400+ by 1QFY27, and targeting 15% sales contribution from the region over the next decade.

* The pilot phase in Delhi NCR would begin with team setup and land acquisition in FY26, with the first launch likely in FY27, marking its strategic northward expansion.

* Palava is expected to deliver INR80b in annual sales at a 50% EBITDA margin over the next decade; the infrastructure developments around the area (tunnel, airport, and bullet train) will boost sales further.

* Land acquisitions in NCR and Chennai (78 acres combined) have been completed; 0.2msf was leased in 1QFY26 to marquee tenants such as Tesla and DP World.

* LODHA is on track to generate INR5b in annuity income by FY26 and INR15b by FY31; a high-teen yield profile is expected, supporting the path to net debt-free status.

Valuation and view

* The company has delivered steady performance across its key parameters, and as it prepares to capitalize on strong growth and consolidation opportunities, we expect this consistency in operational performance to continue.

* At Palava, LODHA has a development potential of 600msf. However, we assume a portion of this to be monetized through industrial land sales. We value 250msf of residential land to be monetized at INR637b over the next three decades.

* We use a DCF-based method for the ex-Palava residential segment and arrive at a value of ~INR549b, assuming a WACC of 12.5%. Reiterate BUY with a TP of INR1,870.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412