Neutral Alembic Pharma Ltd for the Target Rs. 930 by Motilal Oswal Financial Services Ltd

Exports outshine; API witnesses gradual recovery

Building peptides category of products for regulated markets

* Alembic Pharma (ALPM) delivered a better-than-expected performance in 4QFY25. A strong performance in export markets was offset partly by a muted show in domestic formulation (DF) segment. API business also witnessed healthy recovery during the quarter.

* ALPM plans to build a product pipeline in the peptide space for regulated markets and scale up its injectables and ophthalmics product offerings.

* We largely maintain our estimates for FY26/FY27. We value ALPM at 21x 12M forward earnings to arrive at a TP of INR930.

* ALPM ended FY25 with a modest 7%/8% YoY growth in revenue/EBITDA and an earnings decline of 7% YoY. A weak performance in DF and API segment, coupled with financial leverage, impacted its FY25 performance.

* Having said this, ALPM is enhancing its product offerings in the US market and implementing effortsto improve growth in the DF market. Accordingly, we estimate a 23% earnings CAGR over FY25-27. We maintain Neutral rating due to limited upside from current levels.

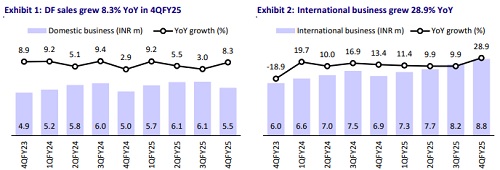

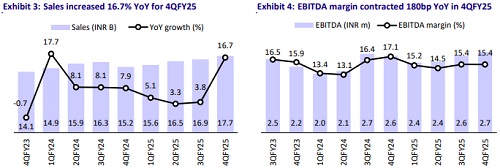

Segmental mix/geography mix dent margins YoY

* ALPM sales grew 16.7% YoY to INR17.6b (our est: INR16.4b). US generics sales rose 20% YoY to INR5b (USD61m; 29% of sales). Ex-US generic export sales grew 43% YoY to INR3.8b (21% of sales). DF sales increased 4% YoY to INR5.5b (31% of sales). API sales grew 4% YoY to INR3.4b (19% of sales).

* Gross margin contracted 500bp YoY to 70% due to an inferior product mix.

* EBITDA margin contracted at a lower pace of 180bp YoY to 15.4% (our est: 14.1%), as lower gross margin was offset by better operating leverage (employee costs down 420bp as % of sales). R&D expenses rose 100bp YoY as % of sales to 9% for the quarter.

* Consequently, EBITDA grew 4.6% YoY to INR2.7b (our est: INR2.3b).

* Adj. PAT declined 12.3% YoY to INR1.6b (our est: INR1.1b) owing to higher tax burden (18.3% in 4QFY25 vs. 2.5% in 4QFY24).

* FY25 revenue/EBITDA grew 7%/8% to INR66.7b/INR10b, while PAT declined 7% YoY to INR5.7b.

Key highlights from the management commentary

* For FY26, ALPM expects mid-teens YoY growth in US revenue and 10% YoY growth in DF.

* Out of INR5.5b-INR6.5b spent on R&D, 30-35% was spent on complex products like peptides/ophthalmics.

* About 45% of new filings would be for injectables and the remaining for ophthalmics/oral solids dosage form in FY26.

* ALPM expects better operating leverage and lower R&D spending to drive profitability in the coming years.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412