Buy Cipla Ltd For Target Rs.1,730 by Prabhudas Liladhar Capital Ltd

Strong US sales guidance

Quick Pointers:

* Plans to launch Advair in H2FY26. Guided for $1bn of US revenues in FY27

* Reiterate margin guidance at 23.5%-24.5% in FY26.

CIPLA’s Q1FY26 EBITDA (Rs17.8bn; 25.6% OPM) was 6% ahead of our estimates. Cipla managed to deliver strong margins during the quarter. During the quarter company witnessed price erosion for its generic products which was offset by new launches such as gAbraxane. Mgmt guided strong US revenues of $1bn for FY27 despite gRevlimid erosion. We expect Cipla to maintain its existing US sales run-rate. This will be aided by several high value niche launches in the US like gAbraxane, Nilotininb, gAdvair. Further, Cipla’s strong net cash position of +$1.5bn provides flexibility to pursue strategic M&A opportunities. Our FY26E/27E EPS broadly remain unchanged. At CMP, stock is trading 23x FY26E EPS. We maintain our ‘BUY’ with TP of Rs1,730/share. Timely launch of critical high-value products in the US in FY26E/27E will be key.

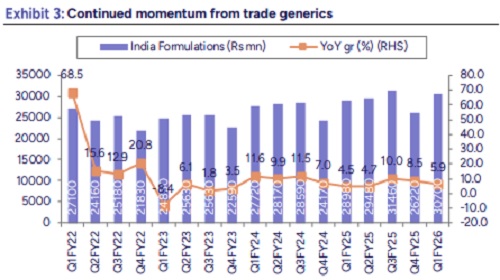

* Revenue growth backed by export volumes YoY: CIPLA’s Q1FY26 revenues were up 4% YoY to Rs69.6bn, in line with our estimate. Domestic formulation reported growth of 6% YoY, below our est. Key therapies such as Respiratory, Cardiac, Urology and Anti diabetic outpaced the market. US sales came in at $226mn, up 2% QoQ. The QoQ growth was largely aided by new launches like gAbraxane and Nilotinib. One Africa and EM markets reported healthy growth of 14% and 11% YoY respectively. API revenues were up 4% YoY.

* Margin surprise: GMs came in at 68.3%, up 135bps YoY and 140bps QoQ. CIPLA delivered EBITDA of Rs17.8bn, 6% beat to our estimate. OPM stood at 25.6%, flat YoY. R&D expenses stood at Rs4.32bn, 6.2% of revenue, up 22% YoY. Ex R&D cost other expenses were up 2% YoY. Resultant PAT stood at Rs13bn; 9% above our estimates. Reported EPS of Rs 16.1/share during Q1.

* Key concall takeaways: Domestic formulation: New introductions and key therapies supported performance during the quarter. Muted growth in respiratory and anti-infectives segment impacted growth in Rx segment however Cipla continued to outperform market. Its Chronic share was maintained at 61.5% during Q1. The growth in the trade generic segment was strong given the low base. Cipla launched 7 products in Q1FY26. Guided for in -line IPM growth over the next three quarters of FY26.

* Consumer health: Brands such as Nicotex, Omnigel, and Cipladine continued to hold market leadership positions in their respective categories.

* US business: Price erosion in old products was offset by new launches. The company launched Nano Paclitaxel vials (ANDA) and Nilotinib Capsules (NDA) during the quarter which boosted US revenues. The Q1 does not reflect the full benefit of these launches. Albuterol share stood at 19.5%. Lanreotide market share at 30%. Holding both 505(b)(2) and generic ANDA versions.

* New launches: Plans to commercialize gAdvair in H2FY26. The company is on track launching couple of inhalation assets and has started working on gSymbicort launch in FY27. Focus remains on launching 2-3 peptides during FY26.

* Biosimilar: First launch of Filgrastim expected in Q2FY26 (oncology therapy). Cipla will launch its own pipeline from FY30. Cipla will be investing $100Mn of investment with Kemwell JV over next three years, 20-30% of that already being incurred by Cipla.

* Pipeline: GLP-1 Aims to be in first wave through hybrid supply chain (own + partner). Not in first wave in Canada but assessing Brazil market. Preparing both for India and RoW markets.

* One Africa: Private market was up 5.6% YoY. This growth was propelled by an uptick in key therapies followed by expansion in tender business as well as new launches.

* Other highlights: PLI incentives are reported in other income for the quarter. R&D focus areas remain peptides, respiratory, biologics, and complex/longacting injectables. Indore facility: Prepping up for expected re-inspection in FY26. Remediation costs from Indore to normalize in coming quarters. Confident about achieving $1bn in revenues from US business in FY27. Debt: Rs 4.59 bn; Cash stands at Rs 104bn. Margin guidance maintained at 23.5– 24.5%; Q1 margin may be peak due to phasing of high-value products like gRevlimid.

Above views are of the author and not of the website kindly read disclaimer