Neutral Cipla Ltd for the Target Rs. 1,500 by Motilal Oswal Financial Services Ltd

Pace of earnings growth on a downtrend

Efforts underway to navigate the g-Revlimid cliff

* Cipla’s 2QFY26 financial performance was slightly better than our expectations. This was fueled by higher-than-expected sales from the North America (NA) segment and higher other income. Cipla stepped up R&D expenses to INR5.4b in this quarter vs INR3.9b/INR4.4b YoY/QoQ.

* Cipla showed better traction in certain products in NA, offsetting the impact of reduced business from g-Revlimid and driving higher sales QoQ to USD233m.

* The company’s comprehensive approach in India, with a focus on Prescription (Rx) and trade generics as well as consumer health, was partly offset by weakness in acute therapy sales for the quarter. Agreement with Eli Lilly to distribute/promote Terzepatide would provide further growth prospects in the Rx segment.

* Cipla had weak 4% YoY growth in CC terms in the African private market segment. Even the tender segment, as well as OTC, had modest YoY growth for the quarter. Having said this, the secondary sales in the Rx segment outperformed the industry in 2QFY26.

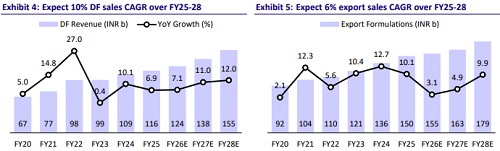

* We cut our earnings estimates for FY26/FY27/FY28 by 1%/6%/6%, factoring in 1) higher R&D expenses over the near-to-medium term, 2) a limited scope of NA business growth in FY27 due to a higher base of g-Revlimid in FY26, and 3) the moderation in acute therapy growth in the Domestic Formulation (DF) segment.

* We value Cipla at 24x 12M forward earnings to arrive at our TP of INR1,500. Considering a modest 3% earnings CAGR over FY25-28 and current valuation adequately factoring this upside, we reiterate our Neutral rating on Cipla.

Operating deleverage drags profitability on a YoY basis

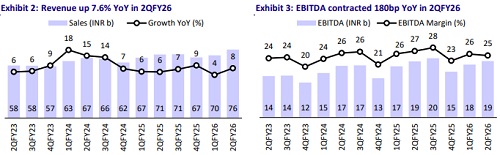

* Cipla’s 2QFY26 revenue increased 7.6% YoY to INR75.9b.

* DF sales (41% of sales) grew 6.7% YoY to INR31.4b. SAGA sales (16% of sales) grew 10% YoY (6% in CC terms) to INR11.8b.

* EM sales (13% of sales) grew 20% YoY to INR9.7b. API sales (2% of sales) declined 7.5% YoY to INR1.5b.

* The US sales (27% of sales) dipped 2.7% YoY to INR20.3b (USD233m, down 1.7% in CC terms). We estimate g-Revlimid sales to be USD40-45m for 2Q.

* Gross margin contracted 50bp YoY to 67% (our est: 66.7%).

* EBITDA margin dipped 180bp YoY to 25%, due to higher R&D expense (up 160bp as a % of sales). Assuming a 65-70% EBITDA margin for g-Revlimid, we estimate ex-gRevlimid EBITDA to be INR16.2b (22.5%) for 2QFY26.

* EBITDA was stable YoY to INR18.9bn (above our est. INR18.3bn).

* PAT grew 3.7% YoY to INR13.5b (our est: INR13.1b).

* R&D spending for the quarter is INR5.3b (7.1% of sales).

* The net cash available as of Sep’25 was INR99b.

Key highlights from the management commentary

* Cipla revised its EBITDA margin guidance from 23.5-24.5% earlier to 22.75- 24.0%. This is due to higher R&D spending towards potential opportunities.

* Cipla’s current MD-Global CEO, Umang Vora, has expressed his intention not to seek reappointment as the MD & Global CEO upon completion of his current term on 31st Mar’26.

* Mr. Achin Gupta, Global Chief Operating Officer, has been elevated and appointed as the MD & Global Chief Executive Officer of the Company with effect from 1st Apr’26 for a term of five years up to 31st Mar’31.

* G-Revlimid sales have been lower in 2Q vs. 1QFY26 and are expected to trend further lower in the coming quarters.

* Despite lower sales of g-Revlimid, the overall NA sales grew QoQ, driven by market share gain in albuterol, lanreotide, and other potential products.

* Given the deal with Eli Lilly to distribute and promote Terzapatide in India, Cipla would evaluate the Semaglutide opportunity post regulatory approval for the Indian market.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412