Neutral KNR Constructions Ltd for the Target Rs. 190 by Motilal Oswal Financial Services Ltd

Weak execution leads to a sharp miss; outlook muted, estimates cut

* KNR Constructions (KNRC)’s revenue dipped 42.4% YoY to ~INR4.9b in 2QFY26 (16% below our estimate).

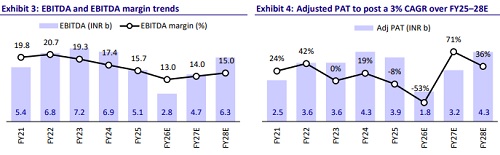

* EBITDA margin contracted 520bp YoY to 10.9% in 2QFY26 (vs. our estimate of 13.4%). EBITDA dipped 61% YoY to INR536 (vs. our estimate of INR785m).

* In line with its weak operating performance, KNRC’s APAT decreased 81% YoY to INR INR279m (vs. our estimate of INR550m).

* During 1HFY26, KNRC’s revenue/EBITDA/APAT declined 42%/58%/69%.

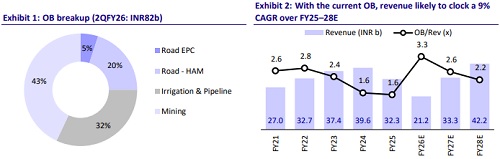

* The company’s current order book stands at ~INR82b, excluding the recently won projects of ~INR5.3b.

* KNRC delivered a disappointing performance in 2QFY26, missing estimates by a wide margin as execution slowed sharply and revenue declined. The quarter was hit by muted activity due to extended monsoon conditions across key project regions.

* Given the subdued execution in 2QFY26 and a thin order book, we now expect a tepid revenue CAGR of 9% over FY25–28E. EBITDA margin assumptions are also revised downward to 13-15% (from 14-15% earlier), in line with the weak outlook. Due to a bleak execution outlook in the near term, we cut our revenue estimates for FY26/FY27 by ~16%/9% and EBITDA estimates by ~20%/15%. We also roll forward our valuation to FY28. We reiterate our Neutral rating on the stock with an SoTP-based TP of INR190. We value its EPC business at a P/E of 10x on FY28E EPS and its BOT assets at 1x investment value.

Key takeaways from the management commentary

* As of Sep’25, the order book stood at ~INR82b, excluding the recently won order of INR5.3b, comprising 25% roads, 19% irrigation, 13% pipeline, and 43% mining projects. Client-wise, 78% were government projects (75% state govt, 3% central govt), 2% private sector, and 20% captive HAM projects. Excluding mining, the order book is executable over the next 18-24 months.

* Of the revised INR9.9b equity requirement for HAM projects, INR6.9b has been infused to date, with the balance of INR2.9b to be deployed over FY26 and FY27.

* Management expects INR8-9b of revenue in the 2HFY26, implying ~19b of revenue in FY26 against the earlier guidance of INR20-25b.

* FY26 EBITDA margin is expected at 13-14%.

* The company targets order inflows of INR80–100b by the end of FY26, driven by a balanced mix of NHAI, irrigation, and state government projects.

Valuation and view

* Factoring in the subdued execution in 2QFY26 and a thin order book, we now expect a tepid revenue CAGR of 9% over FY25-28. The EBITDA margin assumptions are also revised downward to 13-15% (from 14-15% earlier), in line with weak guidance. With a bleak execution outlook in the near term, we sharply reduce our revenue estimates for FY26/FY27 by ~16%/9% and EBITDA estimates by ~20%/15% and roll forward our valuation to FY28.

* We reiterate our Neutral rating on the stock with an SoTP-based TP of INR190. We value its EPC business at a P/E of 10x on FY28E EPS and its BOT assets at 1x investment value.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412