Buy DCB Bank Ltd for the Target Rs. 165 by Motilal Oswal Financial Services Ltd

Healthy NII and lower provisions drive earnings beat

NIM expands 3bp QoQ

* DCB Bank (DCBB) reported 18.3% YoY growth in PAT at INR1.84b (30% beat) amid better NII and controlled provisions.

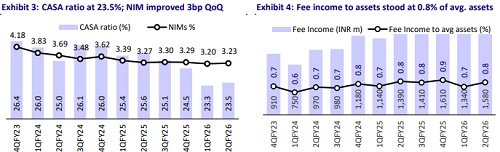

* DCBB’s NII grew 17.1% YoY to INR5.9b (5% beat, up 2.7% QoQ), while NIM improved 3bp QoQ to 3.23% vs. our expectation of 10bp QoQ decline.

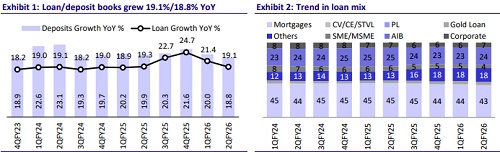

* Business growth was healthy with an advances growth of 19% YoY/3.4% QoQ to INR530b, whereas deposits grew 19% YoY/4.4% QoQ to INR648b. CASA mix stood at 23.5%. Cost to average assets stood healthy at 2.43%.

* Fresh slippages moderated to INR4b (from INR5.8b in 1QFY26). The GNPA/ NNPA ratios improved 7bp/1bp QoQ to 2.91%/1.21%. PCR declined to 59.2% from 59.7% in 1QFY26.

* We tweak our earnings estimates for DCBB and project an RoA/RoE of 1.01%/ 15.3% for FY27. Reiterate BUY with a TP of INR165 (based on 0.8x FY27E ABV).

Business growth healthy; credit costs guided at <45bp

* DCBB reported 18.3% YoY growth in PAT at INR1.84b (30% beat) amid better NII and controlled provisions.

* NII grew 17.1% YoY to INR5.9b (5% beat, up 2.7% QoQ), while NIM improved 3bp QoQ to 3.23%. Other income declined 9% YoY to INR1.9b (8% miss), resulting in 9.6% YoY growth in total revenues (largely in line). Treasury gains stood at INR230m vs. INR1b in 1QFY26.

* Opex grew 4.3% YoY to INR4.8b (5% lower than MOFSLe). PPoP thus grew 19% YoY to INR3b (14% beat). Provisions declined sequentially to INR605m (33% YoY, 20% lower than MOFSLe). The C/I ratio stood at 61.2% in 2QFY26.

* Advances grew 19% YoY/3.4% QoQ, whereas deposits rose 19% YoY/4.4% QoQ. MSME dipped 4% QoQ, while corporate grew 8.4% QoQ. Disbursements in mortgages have reduced as DCBB has raised the ticket size and has not compromised on yields and product mix. DCBB’s CD ratio stood at 81.8%.

* Fresh slippages moderated to INR4b (from INR5.8b in 1QFY26). The GNPA/ NNPA ratios improved 7bp/1bp QoQ to 2.91%/1.21%. PCR eased slightly to 59.2% from 59.7% in 1QFY26. Credit costs stood at 31bp in 2QFY26, and the bank expects full-year credit costs to be below 45bp.

Highlights from the management commentary

* Bank expects to close FY26-27 with RoE of 13.5% and close FY27-28 with RoE of 14.5% adjusted for potential capital raise.

* DCBB’s yields reduced 13bp, and the cost of deposits reduced 17bp in 2QFY26. The benefit of the reduction in the cost of deposits will be witnessed gradually, as the average duration of term deposits stands at 14- 15 months.

* Disbursement in mortgages has decreased as they have increased the ticket size and have not compromised on yields and product mix (higher LAP vs. home loans). A large number of mortgages are coming from DSA, and the bank has reduced this to bring down the costs.

* The opex-to-avg. asset ratio is likely to moderate slightly and will stabilize at ~2.42-2.43%.

Valuation and view

DCBB reported a steady quarter with a beat in earnings amid lower provisions, healthy NII, and controlled opex. Margin improved 3bp QoQ, and the bank expects it to improve further going forward if no further rate cut occurs. Business growth was healthy with increased focus on gold loans and co-lending. Asset quality improved with slippages moderating sequentially, and management expects credit cost to remain below 45bp for the full year. We tweak our earnings estimates for FY27 and project an FY27E RoA/RoE of 1.01%/15.3%. Reiterate BUY with a TP of INR165 (based on 0.8x FY27E ABV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412