Buy ACME Solar Holdings Ltd for the Target Rs.347 by Motilal Oswal Financial Services Ltd

Strong quarter; BESS rollout and timely execution to drive growth

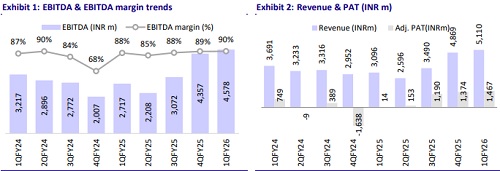

* ACME Solar Holdings (ACME) reported a robust performance in 1QFY26, with EBITDA growth of 68% YoY/5% QoQ to INR4.6b (3% beat), driven by capacity additions and improved capacity utilization factor (CUF). Adj. PAT of INR1.5b was 27% above our estimate, supported by higher other income.

* The company has continued to execute well and remains on track to scale up its installed capacity to ~7GW by FY27, which is expected to drive an EBITDA CAGR of 68% over FY25-27E.

* Key monitorables include: 1) ACME expects to sign PPAs for majority of its remaining capacity by 2025 end, 2) early commissioning plan of BESS for the 2.3GW projects (under construction contracted), which will enable sales in the merchant market during peak hours to boost earnings, and 3) the company has outlined a phased BESS rollout—installing 3 GWh by end-2025, followed by an additional 3-3.5 GWh in the first half of 2026 and the remaining 3-3.5 GWh in the second half of 2026, which could pose upside risks to our current EBITDA estimates for 4QFY26 and FY27.

* Reiterate BUY with a TP of INR347, implying an 18% upside potential.

Strong PAT beat; revenue in line

* Consol. revenue was in line with our est. at INR5.1b (+65% YoY, +5% QoQ), driven by capacity additions and improved CUF.

* EBITDA came in 3% higher than our est. at INR4.6b (+68% YoY, +5% QoQ), with an EBITDA margin of 90% vs. our est. of 86%, supported by favorable operating leverage and operational efficiency.

* Adj PAT was 27% higher than est. at INR1.5b (vs. INR14m in 1QFY25) on account of higher-than-expected other income. An exceptional loss of INR159m included ancillary costs of INR180.4m related to the prepayment of borrowings by subsidiaries and contingent consideration received related to investments disposed of in the previous year, amounting to INR39.6m.

* Net debt stood at INR78b. The net debt-to-net worth ratio remained at 1.7x, while net debt-to-EBITDA improved to 4.2x (4QFY25: 4.4x).

Operational highlights:

* Generation stood at 1,636MUs in 1QFY26 (+107% YoY). The company recorded CUF of 28.5% (27% in 1QFY25).

* Operational capacity reached 2,890MW as the company commissioned 300MW solar and 50MW wind projects, up 115.7% from 1QFY25.

* Secured 550 MWh of standalone BESS projects contracted with NHPC at a weighted average tariff of INR2.20 lakhs/MW/month.

* PPAs have been signed for 250 MW of FDRE, 300 MW of solar, and 550 MWh of standalone battery projects, covering over 55% of the underconstruction capacity.

* The company tied up INR10.7b in refinancing at a fixed interest rate of ~8.5% p.a. for five years for its 250 MW operational project in Rajasthan, resulting in a ~95bp reduction in interest cost. Standard Chartered Bank, Bank of America, and India Infradebt have been added as new lenders to the debt portfolio.

* ACME’s recently commissioned 4×300 MW SECI ISTS solar projects have received a rating of CRISIL AA-/Stable rating, while the 250 MW Acme Aklera project (SECI offtake) has been upgraded to ICRA A+/Stable.

Highlights of the 1QFY26 performance

* ACME commissioned 350MW of renewable projects, including its first 50MW wind project in Gujarat, taking the total operational capacity to 2890MW.

* PPAs have been signed for ~55% of the under-construction capacity, covering 2,240MW out of the total 4,080MW.

* Power generation increased by 107.1% to 1,636MUs, driven by higher CUF and additional new capacity.

* 1QFY26 net operational debt to EBITDA: 4.2x (within guided cap of 5.5x).

* Net debt to net worth improved to 1.7x.

* FY26/FY27 capex plan: INR120-140b annually. INR8b spent in 1Q.

* For Omega Urja project (300MW Solar project) with SJVN and ACME Renewtech (300MW Hybrid project SECI), PPA signing should happen by Aug’25. PPA for ACME Marigold (400MW FDRE project with NTPC) is also expected to be signed soon. Urja and Platinum Urja (FDRE projects with SECI), having respective unsigned capacity of 190MW and 200MW, are also in advanced stages for signing. ACME is positive to conclude PPA signing for this pipeline in the next four months.

* All FDRE projects signed before Dec’24 are scheduled to be commissioned by Dec’26.

* The company has ordered 3.1 GWh of battery storage, covering ~50% of its 2.3 GW contracted under-construction portfolio. Total requirement for the full 4GW pipeline is ~10 GWh, with additional orders planned soon.

* Approvals secured for early commissioning of BESS will enable merchant market sales during peak hours, enhancing near-term revenues. Since BESS is classified as a storage asset (not generation) under FDRE, early power dispatch is not restricted by PPA terms. In cases without explicit PPA provisions, NOCs have been obtained from offtakers.

Valuation and view

* We reiterate our BUY rating on ACME. We assign 10x FY28E EV/EBITDA (discounted by 1 year). Adjusting for the net debt, we derive our TP of INR347, implying an 18% potential upside.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)