Buy LT Foods Ltd for the Target Rs. 470 by Motilal Oswal Financial Services Ltd

Lower input prices drive gross margin expansion

Earnings in line with estimates

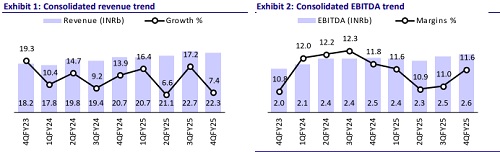

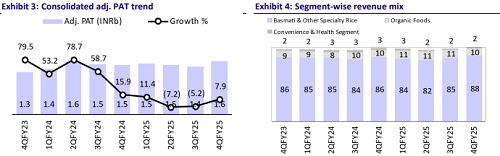

* LT Foods (LTFOODS) reported a decent quarter with revenue growth of 7%. 4QFY25 revenue growth was led by 7% YoY growth in Basmati and Other Specialty Rice (branded business volume up 13% YoY) and 10% YoY growth in Organic Foods. Gross margins expanded by 340bp YoY, aided by lower input prices, which were largely offset by higher other expenses (up 290bp YoY due to inflated freight costs and ad spends). As a result, EBITDA margins contracted 20bp YoY.

* Demand remains strong across regions, with volume expected to grow by 9-10% in FY26. With declining basmati realization due to better crop production, LTFOODS expects muted revenue growth (excl. consolidation of Golden Star). However, margins are expected to improve on the back of normalization of freight costs (down 100-200bp) and lower input prices.

* We largely maintain our EPS estimates for FY26/FY27. We reiterate our BUY rating on the stock with a TP of INR470 (17x FY27E EPS).

Volume growth continues to drive revenue

* In 4QFY25, consolidated revenue stood at INR22.3b (+7% YoY, -2% QoQ), in line with our est. EBITDA grew 5% YoY/3% QoQ to INR2.6b (in line). EBITDA margin contracted 20bp YoY, while it expanded QoQ by 60bp to 11.6% (in line).

* Adj. PAT grew 8% YoY/12% QoQ to INR1.6b ( in line).

* Basmati & Other Specialty Rice segment revenue grew 8% YoY, led by strong growth in the branded business (up 13% YoY). Gross margins expanded 340bp YoY to 36% and EBITDA margin declined 20bp YoY to 1.6% due to higher freight and advertisement costs.

* Organic Foods revenue grew 10% YoY, while gross margin remained flat at 39% and EBITDA margins contracted by 120bp YoY to 10%.

* Convenience & Health segment revenue declined 24% YoY (normalized decline was 3%), primarily due to the discontinuance of Daawat Sehat. Gross margin expanded 100bp to 38% and operating loss stood at INR23m.

* For FY25, revenue/EBITDA/adj. PAT grew 12%/4%/1% to INR86.8b/INR9.8b/INR6.1b.

* Gross debt as of Mar’25 stood at INR7.4b vs. INR5.3b as of Mar’24. CFO generation stood at ~INR4.6b in FY25 vs. INR7.6b in FY24. Net working capital days for FY25 increased by 8 days, largely due to higher inventory days (up by 35 days) on account of strategic paddy procurement, as greater demand is anticipated in key markets.

Highlights from the management commentary

* Guidance: The company expects consolidated revenue of INR100b in FY26 (including Golden Star consolidation expected in 2HFY26). EBITDA margin is targeted at ~13%. ROE, after acquisition synergies, is expected at ~20%. Capex guidance stands at INR3.4b, mainly for warehousing and RTH facility in the US.

* International Business: The US market remains resilient, with strong demand and no tariff impact. The tariff impact, if any, will be offset by lower input prices. In Europe, growth appears muted due to reporting changes (UK is now accounted separately).

* Acquisition: LTFOODS announced 100% stake acquisition in Global Greens Group (Europe) for EUR6m. The company is in the business of canned foods with a turnover of EUR40.3m in CY24 and margins in the range of 6-7%. The acquisition is expected to be completed by 2QFY26, after which the company expects improvement in margins through synergy benefits.

Valuation and view

* LTFOODS reported healthy performance in FY25, led by both India and International markets. Going ahead we expect this momentum to continue, led by 1) improving volumes in the Basmati and Other Specialty Rice segment, 2) margin expansion supported by lower input prices and freight normalization; and 3) an increasing mix of Organic and Convenience & Health segments.

* We estimate a CAGR of 16%/23%/27% in revenue/EBITDA/adj. PAT over FY25- FY27. We reiterate our BUY rating on the stock with a TP of INR470 (17x FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)