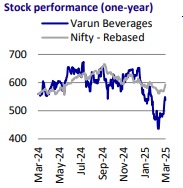

Buy Varun Beverages Ltd For Target Rs. 680 by Motilal Oswal Financial Services Ltd

Expanding boundaries, elevating innovation, strengthening tomorrow

CY24 was a transformative year for Varun Beverages Limited (VBL), marked by strong growth, global expansion, and unwavering sustainability commitments. The company continued its upward trajectory, strengthening its market leadership in India and internationally, all while maintaining operational excellence and a futureready approach. Let us dive into the key highlights from the past year.

* Despite facing short-term headwinds from unfavorable weather and weakened consumption trends, VBL achieved ~12%/23% YoY volume growth in the domestic market/consolidated basis, driven by deeper market penetration. Revenue/EBITDA increased 28%/31%, with EBITDA margins expanding 100bp to 23.5% in CY24.

* VBL expanded its manufacturing footprint with a total capex of INR26b, commissioning three new greenfield facilities in Supa (Maharashtra), Gorakhpur (Uttar Pradesh), and Khordha (Odisha) in India. Additionally, the company invested INR6b in a new greenfield facility in the Democratic Republic of Congo (DRC).

* VBL’s aggressive international expansion, particularly in Africa, was a key highlight, further strengthening its presence in high-growth markets. The company entered into share purchase agreements to acquire PepsiCo’s businesses in Tanzania and Ghana, further reinforcing its footprint in East and West Africa.

* A key milestone for VBL in CY24 was its strategic entry into the food snacking segment, driving long-term growth. The company secured exclusive agreements to manufacture and distribute Cheetos in Morocco and Simba Munchiez in Zimbabwe and Zambia, with operations set to begin between 2025 and 2026. This expansion is expected to strengthen VBL’s portfolio while maximizing synergies with its existing infrastructure.

* Factoring in strong fundamentals and potential for future growth, we expect 18%/16%/27% revenue/EBITDA/PAT CAGR over CY24-26. We reiterate our BUY rating for the stock.

Resilient growth: Expanding horizons amid market challenges

* In CY24, the Indian soft drinks industry faced a challenging landscape. Despite being a traditionally high-growth market fueled by urbanization, a growing middle class, and shifting consumer preferences, demand remained subdued due to unforeseen weather patterns and weakened consumption trends. However, VBL overcame these short-term headwinds, achieving ~12% YoY volume growth in the domestic market and ~23% YoY growth on a consolidated basis.

* VBL has demonstrated strong growth momentum in recent years, with a revenue/volume CAGR of ~33%/28% over CY20-24. This expansion was primarily driven by volume growth in the international business, which recorded a CAGR of around 36%.

Enhancing product offerings with snack market expansion across Africa

* VBL is strategically expanding into the food snacking market, which has the potential to become a key long-term growth driver for the company. It aims to diversify its portfolio through strategic partnerships in snacks and value-added beverages.

* Through its wholly-owned subsidiary, VBL has entered into an Exclusive Snacks Appointment Agreement to manufacture and package Cheetos in Morocco. The manufacturing facilities are expected to be operational by May’25, with an anticipated capex of INR1b. This agreement complements VBL’s existing distribution arrangement for PepsiCo’s snack portfolio, which includes Lays, Cheetos, and Doritos in the region.

* Varun Zimbabwe and Varun Zambia, subsidiaries of the company, have signed an Exclusive Snacks Franchising Agreement with Premier Nutrition Trading LLC, Dubai (a subsidiary of PepsiCo Inc.) to manufacture, distribute, and sell Simba Munchiez in Zimbabwe and Zambia. Distribution began on Feb’25 and manufacturing facilities are expected to be operational by Oct’25 in Zimbabwe and Apr’26 in Zambia

* The expansion into the snacks market across these three countries marks a significant step in strengthening VBL’s existing portfolio and maximizing synergies with its current infrastructure in Africa

Steady expansion backed by resilient financial strength

* VBL has demonstrated consistent growth, achieving a revenue CAGR of 23% over the past five years, supported by a volume CAGR of 18% during the same period. This growth has been primarily driven by the Carbonated Soft Drinks (CSD) segment, which recorded a revenue CAGR of 16% and a volume CAGR of 23%.

* Operational efficiency remained a key focus for VBL, with continued investments in backward integration to streamline production and reduce reliance on external suppliers.

* VBL has maintained stable margins in the range of 18.6%-23.5% over the past five years, despite challenges such as rising freight costs. In CY24, the EBITDA margin for the Indian business stood at ~25.7%, while the African business reported an EBITDA margin of ~23.8%.

* The expansion of chilling infrastructure and distribution networks further enhanced the company’s supply chain resilience. These strategic measures have reinforced VBL’s position as a market leader, ensuring high-quality, costeffective, and efficient production.

* Management remains confident in sustaining high margins within the Indian business segment while anticipating margin expansion in its international operations. This growth is expected to be driven by entry into new and larger markets, consolidation and backward integration of operations, and a strategic shift towards general trade, which offers higher margins compared to modern trade.

* VBL generated a CFO of INR34.4b in CY24 vs INR23.5b in CY24. It has been generating positive CFO for over a decade, with an average run rate of INR14b/INR19.9b in the last 10/five years. CFO/EBITDA stood at 79% in CY24 (vs 66% in CY23). The five-year average CFO/EBITDA stood at 74% over CY20-24.

* ROE and ROCE declined in CY24 to 18.4%/16.3% from 34.2%/22.1% in CY23. ROE was below the five-year average of 22.6%, while ROCE was in line with the fiveyear average of ~16.4%. The decline was largely due to the acquisition of Bevco in CY24.

* Working capital days improved slightly to 38 days in CY24, compared to 40 days in CY23, primarily due to an increase in payable days (up by 9 days in CY24 vs CY23). This was partially offset by higher receivable days (up by 7 days), despite the company’s inorganic expansion into new markets.

* In terms of key subsidiaries, Varun Beverages (Zimbabwe) reported revenue growth of ~13% YoY to INR16b (~8% of the total consolidated revenue in CY24), while PAT declined ~1% to INR2b. Varun Beverages Lanka witnessed robust revenue/PAT growth of ~40%/~75% to INR3.9b/INR627b, while Varun Beverages (Nepal) reported the highest PAT growth ~92%, witnessing a revenue growth 3% YoY to INR6.8b.

Navigating a resilient and sustainable growth path

* In line with VBL’s commitment to sustainable growth, the company achieved a water usage ratio of ~1.56x in CY24, compared to 1.54x in CY23, driven by the stabilization of two new greenfield plants in 2023 and additional plants in 2024. VBL aims to further improve this ratio to ~1.4x by CY25.

* Considering environmental sustainability, VBL recycled ~88% of PET used in finished products (PET bottles, shrink film, plastic closures, labels, and laminates) in CY24 vs. 86% in CY23 and intends to recycle ~100% by CY25.

* It used ~7,300MT rPET recycled plastic for Pepsi Zero and Sting in CY24.

* Additionally, the company is focused on reducing its carbon footprint and is committed to achieving net-zero greenhouse gas emissions across its value chain by CY50. It also aims to increase the use of renewable energy to 30% by CY30, compared to 16% in CY24.

Valuation and view

* We expect VBL to maintain its growth momentum, aided by: 1) strengthening its foothold in Africa, 2) expanding into snacks to diversify its revenue stream, 3) investing in new greenfield facilities, and 4) focusing on new product launches.

* Factoring in strong fundamentals and potential for future growth, we build in 18%16%/27% revenue/EBITDA/PAT CAGR over CY24-26 and reiterate our BUY rating for the stock. We value the stock at 55x Mar’27E EPS to arrive at a TP of INR680.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412