Buy Gravita India Ltd for the Target Rs. 2,300 by Motilal Oswal Financial Services Ltd

Growth supported by volume uptick in aluminum and lead

Earnings in line with estimates

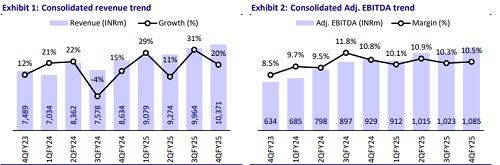

* In 4QFY25, Gravita India (GRAVITA) recorded a strong 20% YoY revenue growth, underpinned by a 13% YoY rise in overall volumes. The aluminum business led the performance with a sharp 73% YoY growth, followed by a 19% increase in lead revenues, whereas the plastic segment witnessed a 16% YoY decline.

* Adj. EBITDA/kg increased 4% to INR20.3 in 4QFY25 despite a higher share of domestic scrap procurement at 43%, compared to 30% last year, driven by certain arbitrage opportunities.

* GRAVITA remains on track to achieve its ‘Vision 2029’ targets, supported by capacity expansion initiatives across both domestic and overseas markets. Future growth will be driven by planned entry into new geographies within India, a continued focus on increasing the share of value-added products, and rising contribution from non-lead business segments.

* We broadly maintain our FY26E/FY27E EPS and reiterate our BUY rating on the stock with a TP of INR2,300 (31x FY27E EPS).

Flat margins attributed to higher domestic sourcing of scrap

* Consolidated revenue grew 20% YoY to INR10.4b (in line with est.) in 4QFY25. Consolidated sales volume rose 13% YoY to 53KMT.

* Adjusted EBITDA margin contracted 30bp YoY to 10.5% (est. 10.9%), while adjusted EBITDA grew ~17% YoY to INR1b (in line with est.). Adj. PAT grew 38% YoY to INR951m (in line with est.).

* For FY25, consolidated revenue/Adj. EBITDA/Adj. PAT grew 22%/22%/31% YoY to INR38.7b/INR4b/INR3.1b, while consolidated volumes grew 19% YoY to 203KMT.

* Lead business revenue grew 19%/23% YoY to INR9.1b/INR34.2b in 4QFY25/FY25, led by volume growth of 12%/21% YoY to 45KMT/173KMT in 4QFY25/FY25. EBITDA/kg in 4QFY25 stood at INR20.5 (up 1% YoY).

* Aluminum business revenue grew 73%/34% YoY to INR1b/INR3.4b in 4QFY25/FY25, while volumes jumped 62%/14% YoY to 5.2KMT/17.5KMT. EBITDA/kg rose 30% YoY to INR20.

* Plastic business revenue declined 16% YoY to INR191m in 4QFY25, while revenue in FY25 increased 8% YoY to INR845m. Volumes declined 26% YoY to 2.6KMT in 4QFY25, while volumes in FY25 were up 3% YoY to 12KMT. EBITDA/kg stood at INR10 (down 12% YoY).

Highlights from the management commentary

* Outlook: GRAVITA is well-placed to realize its ‘Vision 2029’ targets, maintaining its guidance of a ~25%/35% CAGR in sales volume/PAT, with RoIC of more than 25%. Further, the company aims to increase its nonlead business/value-added products mix to 30%/50% over the next three to four years.

* Rubber: The company remains optimistic about the rubber segment, both in India and overseas, and plans to commission ~60KMT of additional capacity in FY26. Management is targeting a revenue CAGR of ~70% from this segment over the next two to three years.

* Domestic scrap procurement: In FY25, GRAVITA witnessed a 60% increase in domestically sourced scrap, driven by the Battery Waste Management Rules (BWMR), Extended Producers Responsibility (EPR), and stricter GST enforcement.

Valuation and view

* As a leading player in India’s rapidly expanding recycling industry, GRAVITA is well-positioned to deliver strong earnings growth over the medium term, supported by: 1) strategic capacity expansion across verticals and geographies, 2) an increased focus on value-added products, 3) higher growth in new segments (rubber), and 4) increased domestic scrap availability, driven by favorable regulatory tailwinds.

* We expect a CAGR of 30%/29%/32% in revenue/Adj. EBITDA/Adj. PAT over FY25-27E. We maintain our FY26E/FY27E EPS estimates. We reiterate our BUY rating on the stock with a TP of INR2,300 (31x FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)