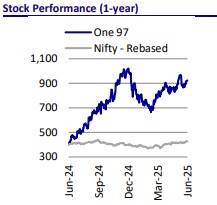

Neutral One 97 Communications Ltd for the Target Rs. 1,000 by Motilal Oswal Financial Services Ltd

Business metrics steady; earnings closer to inflection point

Contribution margin to improve to ~58% by FY28E

* Paytm’s business metrics continue to see a gradual recovery, led by healthy momentum in merchant business, while disbursement volumes and GMV are also growing at a steady rate. Resumed customer onboarding, stabilization in MTUs and continued recovery in financial services business will drive healthy growth in revenues. After a sharp decline in FY25, payment revenue is also estimated to grow by 17% in FY26E.

* The company plans to expand its merchant market share by leveraging deeper financial integration, robust device deployment and focus on high-GMV merchants alongside FLDG-backed monetization opportunities.

* Paytm’s GMV is thus expected to clock a 23% CAGR over FY25-28E and its disbursement growth rate is estimated to accelerate to 35%, led by a continued thrust on the merchant business and a recovery in consumer lending.

* We estimate a 26% CAGR in financial services revenue, with the segment’s share in total revenue expected to rise by more than 250bp to ~27% by FY28E. Healthy revenue growth and disciplined cost control will boost contribution margins to ~58% by FY28E, supporting a steady path toward long-term profitability.

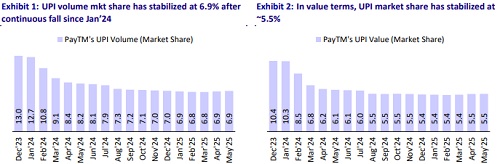

* While structural levers are strong, the fast-evolving digital payment industry, a decline in UPI market share and regulatory risks (recent government disapproval of MDR on UPI transactions) keep us cautious. Maintain Neutral with a revised TP of INR1,000.

Payment business revenues to recover gradually; estimate 22% overall revenue CAGR over FY25-28E

Paytm’s payment business revenue is set to witness a recovery, led by a stronger thrust on Merchant business expansion, while Consumer services business also gains traction. After a slowdown caused by regulatory hurdles, the company has resumed customer onboarding and is seeing a stabilization/recovery trend in MTUs after three quarters of decline. Although merchant payments remain the key revenue contributor, the consumer segment is poised for a recovery in 2HFY26. With this momentum, payment business revenue is expected to grow 17% compared with a sharp decline in FY25, signaling a healthy revival in both merchant and consumer ecosystems. We estimate a 22% CAGR in revenue over FY25-28E.

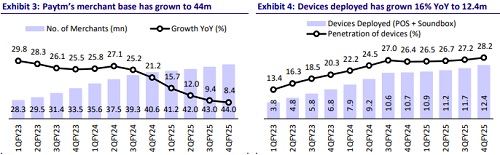

Merchant market share to strengthen as Paytm deepens ecosystem integration

Paytm is poised to expand its merchant market share by leveraging its strong device deployment and scalable tech stack and deepening financial services integration. As of 4QFY25, its merchant base grew 8% YoY to 44m, with device deployments up 16% YoY to 12.4m. With significantly higher GMV sourced from merchants, Paytm is doubling its efforts on retention and acquisition, particularly in offline markets, where it holds significant market share. Enhanced monetization through subscription revenue and faster growth in merchant loans under the FLDG model should allow faster scalability. The company’s focus on high-GMV merchants and seamless front-end and back-end integration further will further enable steady business growth.

Estimate GMV to grow at 23% cagr

Paytm’s GMV is expected to maintain strong momentum, supported by robust merchant expansion and a recovery in consumer business. The company’s continued growth in device penetration and deeper lending partnerships are key enablers. GMV is projected to post a healthy 23% CAGR over FY25-28E. On the consumer front, Paytm has resumed onboarding new users after NPCI approval, and it is enhancing app usability to drive engagement.

FLDG model to support disbursement growth; PL disbursements may witness an uptick in 2HFY26

Paytm’s lending momentum is set to accelerate, particularly in 2HFY26, supported by the FLDG model and improved risk appetite in the personal loan business. Moreover, the credit environment has also improved after the RBI reduced riskweights. With over 18 partners onboarded, the company is witnessing steady traction in merchant loans, which should grow 30-50% annually. The blended disbursement run rate is thus likely to grow at a healthy pace, while the FLDG model allows Paytm to maintain healthy take rates. As the mix tilts toward high-repeat merchant loans and select consumer credit offerings, FLDG will be helpful in driving scalable and profitable loan growth. We estimate a 26% CAGR in financial services revenue and a 35% CAGR in disbursements in FY25-28E.

Contribution margin to improve to ~58% by FY28E

* Paytm’s contribution margin is estimated to expand to 55-58% in the coming years, powered by diversified revenue streams and strong cost controls. The company is benefiting from a multi-channel approach spanning merchant payments, consumer services, financial products and advertising. As the highmargin financial services business gains further scale, aided by FLDG-backed lending and expanded merchant loans, the revenue mix is shifting favorably.

* Simultaneously, operating expenses remain under control, with marketing spends rationalized and AI-led efficiencies reducing indirect costs. Direct expenses are projected to grow slower than revenue, supporting margin expansion. We thus estimate the mix of financial services business to improve by more than 250bp to ~27% by FY28E.

* This strategic balance of revenue diversification and operational discipline is expected to lift contribution margins steadily to ~58% by FY28E, reinforcing Paytm’s path to sustainable profitability.

Focus to remain on core business as MDR on UPI remains distant

* The recent reduction in UPI incentive had raised hopes of potential MDR levy on UPI transactions. However, the Finance Ministry’s clarification confirmed that MDR on UPI remains off the table for now. This decision limits the revenue potential in payments business driving company to limit at other business opportunities.

* In FY24, Paytm received INR2.9b in UPI incentives, which has declined to INR700m currently. While the absence of this support slightly tempers nearterm revenue, Paytm remains firmly focused on its dual-core strategy of scaling up its payments business and financial services businesses.

* With merchant payments and FLDG-backed lending gaining ground, the company continues to work on sustainable profitability, targeting EBITDA breakeven by FY26E, even in the absence of MDR-linked incentives.

Reassessing the profitability path of new-age tech firms; Will improving profitability drive superior shareholder returns?

* The evolving trajectory of Paytm bears a resemblance to the profitability path of few other new age tech companies (Zomato, PB Fintech etc.). Despite regulatory challenges in FY24 and early FY25, Paytm has shown resilience with focused execution, leaning on a stable merchant base, improving consumer monetization and strong cost discipline.

* We note that the market has rewarded such transitions to sustained and improving profitability with both Zomato and PB Fintech witnessing robust returns as the companies became profitable (Zomato: 245% returns in past two years | PB Fintech: 156% returns in same period). In contrast, companies like Paytm and Swiggy, which are still loss-making, are yet to unlock returns and have relatively underperformed since listing.

* With contribution margins set to cross 55% and adjusted EBITDA projected to turn positive in FY26E, the glide path to sustainable profitability is becoming clearer. Paytm is well-positioned among new-age tech firms to report a sharp rise in profitability over the next few years and we estimate the company to deliver FY28E PAT of INR16.2b.

Valuation and view

Paytm is making steady progress toward profitability, underpinned by its strategic shift toward financial services and disciplined cost management. With financial services expected to contribute 27% of revenue by FY28E (~25% in FY24), the business model is becoming more margin-accretive. An estimated revenue CAGR of 22% over FY25-28E (to INR126b) and continued merchant-centric growth should help the company achieve EBITDA breakeven by FY26E. Key catalysts include loan growth via FLDG-backed partnerships, continued thrust on merchant expansion, and exemplary cost control. However, regulatory overhangs, market share volatility in UPI, and execution risks in the rapidly evolving digital payment space keep us cautious. Although Paytm’s INR156b cash cushion offers comfort, consistent delivery is critical for sustainable shareholder returns. We maintain a Neutral rating with a revised TP of INR1,000, reflecting 20.0x FY27E EBITDA, balancing near-term uncertainties while maintaining long-term stability.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412