Neutral Anand Rathi Wealth Ltd for the Target Rs.2,100 by Motilal Oswal Financial Services Ltd

Strong start toward FY26 guidance

* Anand Rathi Wealth (ARWM) reported operating revenue of INR2.7b in 1QFY26, up 15% YoY/24% QoQ, primarily driven by 27% YoY growth in MF revenue. Revenue exceeded our estimate by 12%, led by a 23% beat in revenue from the distribution of financial products, while MF revenue was in line.

* Opex rose 5% YoY/12% QoQ to INR1.5b in 1QFY26, driven by a 6% YoY increase in employee costs, while other expenses grew 3% YoY. Improved operational efficiency resulted in EBITDA of INR1.3b, up 30% YoY/41% QoQ, with EBITDA margin expanding to 46.6% from 41.3% in 1QFY25.

* 1Q PAT grew 28% YoY to INR939m (35% beat), driven by better-thanexpected revenue. PAT margin expanded by 335bp YoY to 34.3% (est. 28.5%).

* The company is on track to meet its FY26 guidance, as it has already achieved 25% of its full-year PAT target and 24% of its revenue target in 1QFY26. It is also just 14% short of reaching its INR1t AUM goal.

* We expect a CAGR of 24%/22%/28% in AUM/revenue/PAT during FY25- 27E, with robust cash generation (INR9.2b of OCF during FY25-27E), RoE of 40%+, and a healthy balance sheet. We reiterate our Neutral rating with a one-year TP of INR2,100 (premised on 36x Mar’27E P/E).

Highest-ever quarterly net inflows recorded in 1QFY26

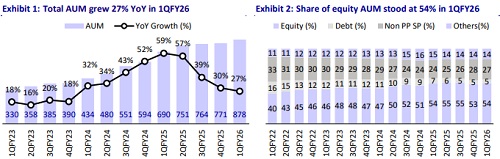

* Total AUM stood at INR878b (+27% YoY), led by steady strong inflows and an increase in the ticket size of clients. The share of equity in the AUM mix remained stable YoY at 54%, with equity AUM market share rising to 1.41% in Jun’25 from 1.02% in Mar’19. Private Wealth/Digital Wealth AUM grew 27%/19% YoY to INR857b/INR21b.

* The company recorded its highest-ever quarterly net inflows at INR38.3b in 1QFY26, up 14% YoY, supported by favorable market sentiment. Monthly SIP flows have increased 51% YoY to INR750m.

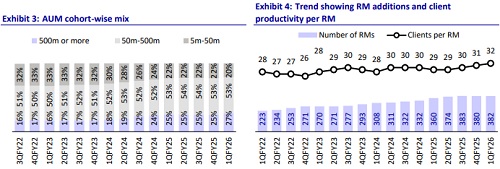

* The share of customers with AUM of INR500m+ has increased to 27% in 1QFY26 from 25% in 1QFY25. It onboarded 598 net new client families in 1Q, taking the total count to 12.3k families.

* Operating expenses grew 5% YoY, while the cost-to-income ratio (CIR) improved to 53.4% in 1QFY26, compared to 58.7% in 1QFY25 and 59.1% in 4QFY25, reflecting enhanced cost efficiency.

* Other income increased 31% YoY but declined 47% QoQ to INR102m.

* The company reported one of the lowest client attrition rates in the industry, with only 0.11% of AUM lost in 1QFY26. RM attrition remained minimal, with two exits during the quarter.

* AUM per RM increased to INR2.24b in Jun’25 from INR1.87b in Jun’24, driven by continued association of RMs with the organization. Additionally, clients per RM improved to 32 from 29 in 1QFY25. The company has guided for further improvement toward the cap of 50 clients per RM, supported by investments in technology.

Highlights from the management commentary

* On the potential impact of Jane Street on volumes, management has indicated that there will be no effect on the upcoming INR1.5-2t AUM pipeline.

* On the international front, the company is in the process of establishing new offices in London and Bahrain, marking nearly a decade since the Dubai office was set up. Management remains optimistic about international capital inflows into Indian markets and is looking to expand into additional geographies.

Valuation and view

* ARWM is one of the few companies in the listed space that has consistently outperformed its stated guidance. For FY26, management guided for revenue/PAT of INR11.75b/INR3.75b vs. our estimates of INR11.4b/INR3.8b.

* We expect ARWM to report a CAGR of 24%/22%/28% in AUM/revenue/PAT during FY25-27E, with robust cash generation (INR9.2b of OCF during FY25-27E), RoE of 40%+, and a healthy balance sheet. We reiterate our Neutral rating with a one-year TP of INR2,100 (premised on 36x Mar’27E P/E).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)