Buy Laurus Labs Ltd For Target Rs.720 by Motilal Oswal Financial Services Ltd

Beat on earnings; green shoots visible

4Q to witness further improvement in financial performance

* Laurus Lab (LAURUS) significantly beat our earnings estimates in 3QFY25, led by a scale-up in the CDMO segment. Commercial supplies (including launch quantities) led to strong 89% YoY growth in CDMO sales for the quarter. Apart from chemical synthesis-based CDMO, LAURUS is enhancing its capacities/capabilities in bio-based CDMO activities through a JV with Eight Roads (investment of INR1.6b to start with).

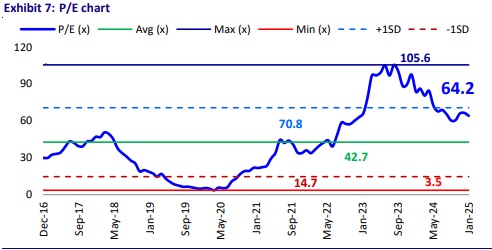

* We raise our earnings estimates by 4%/3%/3% for FY25/FY26/FY27 to factor in a) improved visibility for execution of CDMO contracts, b) a gradual uptick in ARV formulation sales, and c) better operating leverage. We value LAURUS at 40x 12M forward earnings to arrive at a TP of INR720.

* After six quarters of earnings decline, LAURUS has seen strong improvement in its financial performance. Over the past 2-3 years, LAURUS has invested considerably in the CDMO segment to build capacities to cater to customers’ manufacturing requirements. In fact, it has certain contracts in hand to be executed over the medium term. It continues to invest in fermentation capacities to enhance its CDMO offerings. We estimate a strong 71% earnings CAGR over FY25-27. Reiterate BUY.

Improved segmental mix, operating leverage drive margins YoY

* 3QFY25 revenues grew 18.4% YoY to INR14b (our est. INR13.3b). Synthesis business (28% of sales) was up 89% YoY at INR4b, led by advancing clinical project. FDF sales grew 19% YoY to INR4.4b (31% of sales). API sales (38% of sales) fell 7% YoY to INR5.6b. ARV API sales declined 11% YoY to INR3.1b due to capacity constraints. Other API segment sales grew 27% YoY to INR1.7b. Onco API sales declined 51% YoY to INR425m. Bio division sales (3% of sales) grew 14% YoY to INR480m.

* Gross margin (GM) expanded by 250bp YoY to 56.9%, due to a change in the segmental mix.

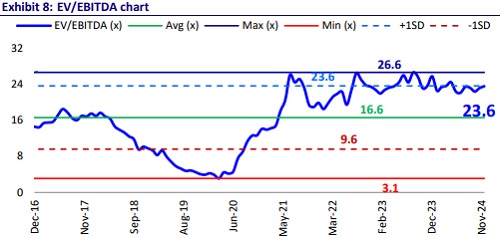

* EBITDA margin expanded by ~500bp YoY to 20.2% (our est: 17.3%) due to better operating leverage (other expenses down 280bp YoY as % of sales), offset by an increase in employee costs (up 40bp as % of sales).

* EBITDA grew 57.2% YoY to INR2.9b (est. INR2.3b).

* PAT jumped 3x YoY to INR923m (est. INR628m).

* In 9MFY25, revenue/EBITDA/PAT grew 6%/18%/44% to INR38.3b/6.3b/1.2b.

Highlights from the management commentary

* Management has reiterated 20% EBITDA margin guidance for FY25.

* It expects 4QFY25 to witness further scale-up in business compared to 3Q.

* In CDMO business, the majority of growth came from human health CDMO for the quarter.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

Ltd.jpg)