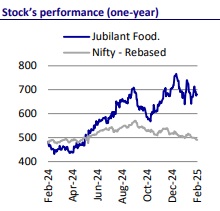

Neutral Jubilant FoodWorks Ltd For Target Rs.715 by Motilal Oswal Financial Services Ltd

Banking on value offerings and tech capabilities

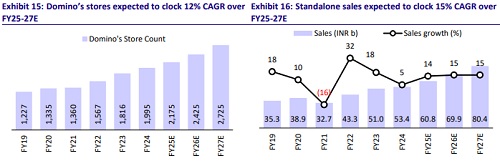

Jubilant FoodWorks (JUBI) held its maiden analyst meet in 2025 to discuss its strategic growth initiatives, store expansion opportunities, core capability development, and the way forward. The CEO emphasized the company’s three priorities: 1) Domino’s, 2) Popeyes, and 3) People, as these will continue to provide long-term value for JUBI. Store expansion remains strong in India, with plans to scale up by opening 1,000 more Domino’s stores by FY28. The company aims to reach 3,000 Domino’s stores across 700 cities by FY28 vs the current count of 2,139 stores across 466 cities. In addition, it will set up four more commissaries by FY28. Its goal is to be regional while maintaining an integrated supply chain, with in-house sourcing of key ingredients. The company is adopting a more aggressive approach to product launches across platforms, aiming to expand its consumer base and increase order frequency. New launches like Big Big Pizza and Cheesy Rice are expected in the coming months (attractive price points), alongside their value offerings. For Popeyes, the primary focus is on improving unit economics through higher ADS.

JUBI’s key strengths, such as backward integrated farm sourcing, inhouse manufacturing, and its own apps, enable smooth and quick Turnaround Time (TAT). In addition, its proprietary data tools (store.AI) support various functions, including identifying locations for store expansion, improving store efficiencies, enhancing consumer experience, etc. This gives the company a competitive edge, making it particularly valuable for managing a large network base.

The company guided double-digit revenue growth and consolidated PAT margin expansion of c200bp by FY28. Our FY26 and FY27 estimates are below consensus, but largely in-line with management’s guidance. We model our standalone EBITDA margin (pre IND AS) at 12.3% and 12.9% for FY26 and FY27. We model consolidated revenue/EBITDA/Adj. PAT CAGR of 14%/17%/40% over FY25-FY27E. We reiterate our Neutral rating on the stock with a TP of INR715.

JUBI to set up four commissaries and reach 3,000 stores by FY28

The company stated that by FY28, it will be adding four more commissaries in Ahmedabad, Mumbai, Guwahati, and Kolkata. These commissaries primarily manufacture food intermediaries, house central kitchens, and act as fulfillment centers/warehouses for majority of the ingredients. The management indicated that the commissaries have a payback period of three years. Domino’s India currently operates 2,139 stores across 466 cities, while the nearest peer has 1,185 stores as of 3QFY25. JUBI plans to have 3,000 stores across 700 cities by FY28.

Popeyes – focus on strong ADS

Popeyes offers products such as fried chicken and chicken wings. Its vegetarian menu starts at INR79, with the vegetarian product mix at 20% in South India and 25% in North India. In South India, Popeyes holds a high market share but faces low throughput, whereas in North India, the market share is lower, but throughput is comparatively higher. For Popeyes, the primary focus is on achieving a strong ADS and ensuring store profitability, rather than pursuing aggressive store expansion.

DPEU has enough headroom to grow, supported by macro factors

The management highlighted that Turkey is a fast-growing QSR market that has expanded at a CAGR of 11% over FY19-24. It is expected to clock a 12% CAGR over FY25-28E, reaching USD11b. The company has grown ahead of the market with the Group System Sales posting an 18% CAGR over FY19-24 and reaching USD344m. The growth of the Turkish market has been largely backed by franchise-led growth (90% of its business comes from franchisees), value offerings, quicker deliveries, and product and digital innovation. Domino’s is a leading pizza player in Turkey with 728 stores, while the second-largest player, Pasaport Pizza, had 241 stores and Pizza Hut had 221 stores as of FY24. Additionally, it has four commissaries in Turkey. Domino’s held a 3.7% share (2.5% in 2023) of the total F&B market as of 2024 and c51% market share in the pizza category. COFFY also focuses on providing more value to customers, in-line with Domino’s strategy. It has a single price for all cup sizes. The brand has added 144 stores over FY22-24. In the near term, the company aims to make COFFY one of the top three coffee chains in the country.

Continued thrust on strengthening its app

JUBI has a dedicated app for each of its businesses and has integrated with most leading food aggregators. Its apps focus heavily on images and videos, with an intent to evoke hunger pangs. JUBI is dynamic with its apps and personalizes them through self-learning data science models. Domino’s India has c31m loyalty members, who contribute c75% to the orders. The loyalty program has reduced churn for JUBI and increased order frequency. According to the company, Domino’s riders earn competitive wages, they stated that one should compare it with per hour earnings as compared to per hour orders. Going ahead, JUBI will be launching Popeyes Next Gen App 2.0 and AI chatbot.

Valuation and view

* We continue to maintain our estimates following the analyst meet; however, our estimates for FY26 and FY27 are below consensus. We model our standalone EBITDA margin (pre IND AS) at 12.3% and 12.9% for FY26 and FY27.

* JUBI’s long-term plans continue to remain encouraging in terms of its store and commissary expansion plans. It remains focused on providing value offerings, with gradual expansion in margins (+200bp PAT margin by FY28).

* We value the Indian business at 40x EV/EBITDA (pre-IND AS) and international business at 18x EV/EBITDA (pre-IND AS) on Dec’26E to arrive at our TP of INR715 (implied 33x Dec’26 EV/EBITDA). We reiterate our Neutral rating on the stock as we see a limited upside at the current valuation.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412