Buy Page Industries Ltd For Target Rs.57,500 by Motilal Oswal Financial Services Ltd

Moderate volume growth; beat on margins

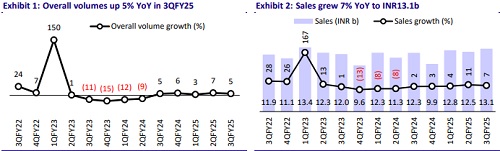

* Page Industries (PAGE) reported 7% YoY sales growth in 3QFY25 (est. 10%; 11% in 2QFY25), with 5% volume growth (est. 6%; 7% in 2QFY25) to 58m units. The festive demand in October provided an uplift, but November and December remained subdued due to overall growth weakness. Product realization was maintained at INR227/piece (similar in 2Q) and up by 2% YoY. The premium innerwear category saw strong consumer acceptance, driven by enhanced quality and product innovation. Trade inventory was reduced by 5 days to 38 days at the distributor level. Primary sales marginally lagged secondary sales in 3QFY25 but are expected to align from 4QFY25 onwards.

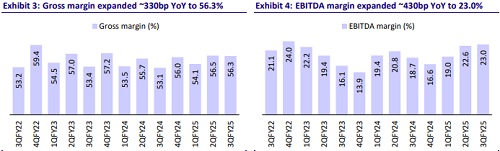

* GM expanded 340bp YoY to 56.3% (beat), supported by stable input costs. Improved operational efficiency drove a 460bp YoY expansion in EBITDA margin to 23% (11-quarter high). The company did not take any price hikes in 3Q, and none are expected in 4Q. It expects to increase IT costs for digitalization and marketing expenses. As such, management has maintained its EBITDA margin guidance of 19%-21% for FY25 despite achieving 21.6% in 9MFY25. We model an EBITDA margin of 20.5%-21% for FY25-FY27.

* The Odisha plant is set to be operational by March, along with an additional sewing facility in KR Pete, near Mysore, Karnataka, which will enhance capacity to meet rising demand and improve efficiency.

* Factors such as inventory optimization through the ARS system, new product launches, capacity expansion, and digitalization initiatives all support growth. Benign input costs and cost efficiencies are likely to offset higher marketing/digital spending to sustain margin going forward. We believe the valuation will remain rich but have comfort in both growth acceleration and margin expansion in FY26. We reiterate our BUY rating on the stock with a TP of INR57,500, premised on 65x Dec’26E EPS.

In-line sales; margin expansion leads to beat on profitability

* Volume growth at 5%: Sales grew 7% YoY to INR13.1b (est. INR13.5b) in 3QFY25. The festive demand provided an initial boost but lacked sustained momentum throughout the quarter. Sales volume was up 4.7% YoY (est. 6.5%, 6.7% in 2QFY25) to 57.8m pieces. Growth was broad-based across categories.

* Strong margin expansion: Gross margin expanded ~330bp YoY to 56.3% (est. 54%) and EBITDA margin expanded to 430bp YoY at 23% (est. 19.7%). The margin expansion was primarily due to stable input costs and improved operating efficiency. Employee expenses were up 6% YoY and other expenses were up 2% YoY.

* Beat on profitability: EBITDA grew 32% YoY to INR3.0b (est. INR2.7b). PBT grew 36% YoY to INR2.7b (est. INR2.4b). Adj. PAT was up 34% YoY to INR2.0b (est. INR1.8b).

* In 9MFY25, net sales, EBITDA, and APAT grew 7%/18%/23%, respectively

Highlights from the management commentary

* The operating environment in 3Q remained challenging due to subdued demand conditions. The festive demand provided an initial uplift but lacked sustained momentum throughout the quarter.

* The Odisha plant is set to be operational by March, along with an additional sewing facility in KR Pete, Karnataka. Together, the two plants will house 2,000 sewing machines, with the Odisha plant capable of running two shifts to meet future demand.

* The premium innerwear category saw strong consumer acceptance, driven by enhanced quality and product innovation.

* Inventory at the distributor level has been reduced by five days, with ~17.7-18m pieces of inventory in the system. Working capital days have improved to 65 days from 75 days at the end of FY24.

* The FY26 EBITDA margin guidance remains broadly unchanged at 19-21%

Valuation and view

* We largely maintain our EPS estimates for FY25 and FY26.

* We estimate a CAGR of 14%/15%/17% in sales/EBITDA/PAT over FY25-27E. Factors such as inventory optimization through the ARS system, new product launches, capacity expansion, and digitalization initiatives all support growth. Benign input costs and cost efficiencies are likely to lead to a better margin print. We believe the valuation will remain rich but have comfort in both growth and margin in the near term. We reiterate our BUY rating on the stock with a TP of INR57,500, premised on 65x Dec’26E EPS.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)