Neutral Torrent Pharma Ltd For Target Rs.3,410 by Motilal Oswal Financial Services Ltd

DF, lower interest/tax drive earnings

MR addition/increasing reach to improve outlook of India business

* Torrent Pharma (TRP) delivered largely in line earnings in 3QFY25. The superior performance in domestic formulation (DF) was offset by currency headwinds in Brazil and zero insulin CMO sales. TRP continues to strengthen its presence in DF market through the addition of MRs and enhancing its reach in the consumer health segment. The US business is yet to witness interesting approvals despite having regulatory compliance in place.

* We trim our EPS estimates by 4%/5%/5% for FY25/FY26/FY27, factoring in currency challenges in Brazil business and a subdued outlook for the US market. We value TRP at 38x 12M forward earnings to arrive at a TP of INR3,410.

* TRP continues to focus on profitable growth by outperforming the industry in the branded generics segment of DF/Brazil. Further, the free cash flow is expected to either reduce the financial leverage or provide cushion for inorganic opportunities. Accordingly, we estimate a CAGR of 15%/18%/28% in revenue/EBITDA/PAT over FY25-27. This earnings upside is priced in at the current valuation. Maintain Neutral.

Segmental mix partly offset by higher opex on YoY basis

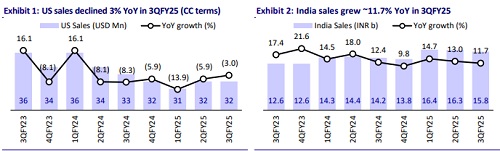

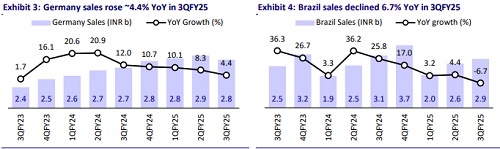

* Sales grew 2.8% YoY to INR28b (vs our est: INR29b). DF revenue grew 11.7% YoY to INR15.8b (56% of sales). Germany sales grew by 4.4% YoY to INR2.8b (10% of sales). US generics were stable YoY to INR2.7b (USD32m; 10% of sales). LATAM business declined by 6.7% YoY to INR2.9b (10% of sales) as the BRL depreciated by 17%. ROW+CDMO sales declined 16.7% YoY to INR3.8b (14% of sales) due to no insulin CMO sales during the quarter.

* Gross margin expanded 160bp YoY to 76% due to a better product mix.

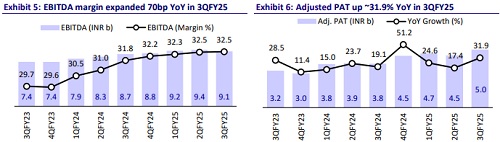

* EBITDA margin expanded by 70bp to 32.5% YoY due to lower other expenses (down 60bp as % of sales), offset by an increase in employee expenses (up 140bp as % of sales).

* Accordingly, EBITDA grew 5.2% YoY to INR9.1b (vs our est: INR9.6).

* Adj. PAT grew 32% YoY to INR5b (in line).

* In 9MFY25, revenue/EBITDA/PAT grew 7.2%/11.8%/24.6% YoY to INR85.6b/INR27.8b/INR14.3b.

Highlights from the management commentary

* TRP would commence the dispatches of insulin CMO sales in Jan’25. 4QFY25 would witness additional business due to the spillover from the earlier quarter.

* TRP aims to maintain 32.5% EBITDA margin in 4QFY25.

* It has about 20 products under ANVISA review for the Brazil market.

* The company expects high-single-digit YoY growth in Germany revenue in FY25, led by incremental tender wins.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412