Buy Mahindra & Mahindra Ltd for the Target Rs.3,643 by Motilal Oswal Financial Services Ltd

Well placed to outperform auto and farm segments

Healthy launch pipeline to drive market share gains in Auto segments

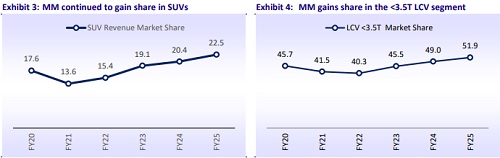

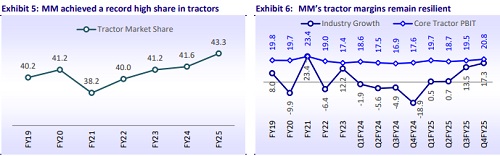

In this note, we present the key insights from Mahindra & Mahindra (MM)’s Annual Report. Some of the company’s key achievements from the Auto segment in FY25 include: 1) a 210bp YoY rise in revenue market share to 22.5%; and 2) a segment RoCE of 45.2%. MM’s similar achievements in the FES segment included market share improvement of 170bp+ to reach a record high of 43.3%, with improved profitability. Going forward, in the auto segment, the company intends to: 1) fortify its leadership in the ICE SUV segment, aided by a healthy launch pipeline that includes 23 new products by 2030 across SUVs and LCVs; and 2) target an improved contribution from eSUVs to 20-30% of its portfolio by 2027. In tractors, MM aims to: 1) further strengthen its domestic market share while maintaining its profitability; and 2) target a quantum growth in farm machinery by investing in new products and brand building. While management has outperformed its targets of earnings growth and RoE of 18% each for FY24 and FY25, it remains committed to delivering 15-20% EPS growth and 18% RoE. These ensure sustained profitability and shareholder value. We reiterate our BUY rating with a TP of INR3,643 (based on Jun’27E SoTP).

Auto segment update

* Key achievements by the Auto sector in FY25 include: 1) a 210bp YoY rise in revenue market share in SUV segment to 22.5%; MM retained its numero uno position in SUVs; 2) a 51.9% share in the <3.5% LCV segment, up 290bp YoY; 3) a turnaround of its Truck and Bus division, which has achieved positive EBITDA; and 4) a segment RoCE of 45.2%.

* FY25 had seen a series of high-impact launches, including the XUV 3XO, Thar ROXX, XEV 9e, and BE 6. MM also launched Mahindra Veero in the < 3.5T LCV category, bolstering its LCV product line.

* MM has added capacity of 5K per month in ICE SUVs and 7.5K per month for BEVs (5k operationalized).

* MM’s automotive sector exported 34,709 vehicles in FY25, clocking a 41% growth. The XUV 3XO was launched in South Africa. Subsidiaries in South Africa and Australia posted their highest-ever volumes, with retail growth of 40% and 27%, respectively. In South Asia, MM retained its leadership position in the pickup segment.

* Overall, MM produced over 0.8m PV and CV units in FY25, with capacity utilization exceeding 85%. A dedicated capacity of 90,000 units annually has been created for its next-generation EVs.

Update on MLMML

* In the Last Mile Mobility business (LMM), MM sold 108,661 vehicles in FY25, a growth of 7.6% YoY.

* Within this, the company sold 78,524 EVs (domestic plus exports) in FY25, a growth of 18.6% YoY.

* Additionally, with the launch of Mahindra Zeo, MLMML has successfully entered the 4W electric small commercial vehicle (SCV) segment, offering a superior customer value proposition.

MEAL update

* With INGLO and Mahindra Artificial Intelligence Architecture (MAIA), MM has redefined the blueprint of electric mobility.

* Designed from the ground up as a bold, all-electric architecture, INGLO offers unmatched vehicle dynamics, NVH refinement, and a 5-star BNCAP safety rating.

* MAIA introduces India’s first Software Defined Vehicle (SDV) platform with world-class tech like VisionX, Eye-dentity, and Dolby Atmos.

* In Nov’24, Mahindra Electric Automobile Limited (MEAL) launched two electricorigin SUVs — the BE 6 and XEV 9e. Both models come with 79 kWh and 59 kWh battery options, delivering certified ranges of up to 683 km (MIDC P1+P2). Manufactured at its state-of-the-art Chakan facility, they represent a major step forward in building world-class electric vehicles—Made in India, for the world.

* These EVs have received a very strong response in the market and garnered 30k+ bookings on Day 1 of the launch.

* Management has approved an investment of INR120b in MEAL to accelerate the growth of this business and fund the EV journey over the next three years. The funds will be infused from internal accruals.

* Further, MM and British International Investment (BII) jointly assessed the funding requirement for MEAL in FY25 and mutually agreed that the final tranche of BII’s investment would be INR6.5b (Vs INR7.25b planned earlier). Consequently, the total investment by BII in MEAL would be INR18.5b, resulting in BII’s shareholding being in the range of 2.64% to 4.58% in MEAL on a fully diluted basis. This reduction in investment by BII will have no bearing on MEAL’s overall business plan. MEAL has received full funding from BII and Jongsong Investments (Temasek) as of 31st Mar’25.

Strategic imperatives

Key focus areas of the management in the Auto segment include:

* ICE SUV leadership: MM continues to fortify its leadership in the ICE SUV segment driven by new launches. The company aims to launch 23 new products by 2030 across SUVs and LCVs, of which six have already been launched in FY25. These include seven ICE SUVs, five BEVs, and five LCVs. Of these, MM targets to launch 3 ICE SUVs (including two mid-cycle enhancements), two BEVs, and two LCVs (one ICE and one EV in the <3.5T segment). On the back of these launches, management is focused on building a legacy of SUV leadership and customercentric innovations.

* Pioneering eSUVs: Leveraging its proprietary INGLO and MAIA capabilities, MM targets eSUVs' contribution to rise to 20-30% of its portfolio by 2027.

* Focus on maintaining its LCV leadership with continuous innovation and product enhancements.

* MM targets to scale up its international operations multi-fold in its markets of choice.

Farm segment update

Key highlights – FY25

* New product launches: The OJA series and Target have successfully addressed the white space of lightweight small tractors with tremendous ramp-up post their launch in FY24.

* MM achieved its highest ever market share at 43.3% in FY25, up 170bp YoY.

* Market share increased with improved profitability, with EBIT margin rising 200bp YoY to 19.7%.

* Net spare part sales for FY25 grew 18.5% YoY to INR13.3b (including exports of INR1.7b).

* Global farm business: Tractor exports grew 27% YoY to 17,547 units, fueled by OJA’s success in North America, turnaround in South Asia markets, and the opening of new markets in Africa and ASEAN. While exports were strong, its overall Farm International results were weighed down by weak markets in the US, Europe, and Japan.

* This segment achieved an RoCE of 53.7% for FY25.

Farm machinery update

* This business is well-positioned to play a significant role in India’s farm mechanization journey. This business delivered 18% YoY revenue growth to reach INR10.2b.

* In Harvesters, MM gained momentum with the recent launch of the Swaraj 8200 and the Mahindra 2100 Crawler Harvester launched during FY25.

* The company has also built a successful base in other products such as Loaders, Straw Reapers, Threshers, Balers, et al., which are likely to boost its revenue in the coming years.

* MM also launched various products that further strengthen its presence in the rotavator category; it also launched new Loaders and Backhoes for the North American market.

* MM became the highest exporter of Loaders from India, exporting to the North American market.

Strategic imperatives

MM’s Farm segment aims to deliver a substantial scale through focused strategic actions, which include:

* Product launches and channel expansion to strengthen its domestic market share while maintaining its profitability.

* Quantum growth in farm machinery by investing in product development, quality, driving channel efficiency, and brand building, as well as leveraging partnerships to boost capabilities.

* Growing international business, focusing on key markets including the US, Brazil, Thailand, and Turkey, and leveraging Centers of Excellence in Turkey. Management plans to launch the Mahindra Tractor brand in new markets across Europe and ASEAN. MM also aims to consolidate its presence in existing markets for faster growth of overall exports from India.

Update on Growth Gems

* MM has defined Growth Gems as businesses within the group with strong potential for significant growth and scale. The company has identified 10 such businesses that have a strong right to win within the sectors and align with India’s growth story, making them a strategic fit within the group’s bold vision of ‘Delivering Scale’. These gems are likely to be future value creators with a path to build the next set of multi-billion-dollar enterprises within the group.

* In FY25, six of these have been identified as ‘Scalable Growth Gems’ (Logistics, Hospitality, Real Estate, LMM, Susten, and Trucks & Buses), which have demonstrated a clear competitive advantage and are witnessing positive momentum with a path to achieving a USD2-3b valuation each by FY30.

* Similarly, four have been identified as Emerging Growth Gems (Accelo, Aerostructure, Classic Legends, and Cars & Bikes), which have a path to a USD1b valuation each by FY30. As and when an emerging growth gem lays out a clear roadmap to USD2b or more of value, it would move up to scalable.

* By nurturing these scalable growth gems and continuing to invest in the capabilities of the emerging growth gems, MM remains committed to transforming these businesses into major drivers of the group’s future.

Key M&A activities

* MM has agreed to acquire a 43.96% and 15.0% equity stake of SML Isuzu from Sumitomo Corporation and Isuzu Motors, respectively, for an aggregate consideration of INR5.55b for the combined 58.96% stake. Further, MM will make an open offer for the acquisition of up to 26% stake of SML, for cash consideration, from the eligible public shareholders of SML.

* During the year under review, Mahindra North American Technical Centre, Inc., Mahindra Heavy Engines Limited, Mahindra Two Wheelers Limited, Trringo.com Limited, Holiday Club Resorts Rus LLC, and Fifth Gear Ventures Limited have ceased to be the subsidiaries of MM.

Corporate governance

* The Chairman, while serving as a Professional Director, is also a Promoter and Non-Executive Director. Additionally, the number of Independent Directors constitutes half of the total number of Directors.

* Dr. Anish Shah, Group CEO and Managing Director, and Mr. Rajesh Jejurikar, Executive Director and CEO (Auto and Farm Sector), are the Wholetime Directors of MM.

* The remaining Non-Executive Directors consist of five Independent Directors, including three women Directors.

* In FY25, MM won the “Golden Peacock Global Award” for Excellence in Corporate Governance 2024 (under the automobile sector).

Other highlights

* Launched in FY25, MATRIX is an organization-wide program embedding multimodal, scalable AI into every manufacturing layer. Through MATRIX, MM has established a new standard for intelligent manufacturing – factories that think, learn, and adapt.

* According to its stated dividend policy, MM would endeavor to maintain a total dividend payout ratio in the range of 20% to 35% of the annual standalone PAT. Accordingly, MM's dividend payout for FY25 was 26.5%.

Financials

* For FY25, while MM’s revenue grew 17% YoY to INR1,165b, adjusted PAT grew 11% YoY to INR118.6b. EBITDA margin expanded 140bp YoY to 14.7%.

* On a segmental basis, while auto segment margins improved 90bp YoY to 9.5%, tractor segment margins improved 220bp YoY to 18.4%. Adjusted for the farm machinery business, core tractor margins are up 300bp YoY to 19.7%.

* Further, while the auto segment delivered 45.2% RoCE, the tractor segment delivered 53.7% RoCE in FY25.

* On a consolidated basis, MM posted an adjusted PAT growth of 20% YoY and delivered an RoE of 18%, in line with its guidance.

* For FY25, MM incurred capex of INR51.15b (previous year INR50b), mainly on new product development and capacity enhancement. This included INR42.4b invested in the auto business and INR792m in tractors.

* Borrowings have reduced from INR15.8b in FY24 to INR11.4b in FY25 due to repayments.

Valuation and view

* MM likely to continue outperforming industry growth: MM’s recently unveiled XUV 3XO and Thar Roxx have received a healthy response. The company will continue to maintain a robust launch pipeline in the long run, targeting seven ICE SUVs (two mid-cycle enhancements), five BEVs, and five LCVs (two of which will be EVs) by 2030. Of this, in CY26, it targets to launch three ICE SUVs (two mid-cycle enhancements), two BEVs, and two LCVs (one of which will be EVs in <3.5T segment). Driven by a strong order backlog and new launches, we expect MM to continue outperforming industry growth in FY26. We have assumed MM to post an 11% volume CAGR in passenger UVs over FY25-27E.

* Tractor industry to continue witnessing a healthy momentum in FY26: Farm sentiments are now positive, supported by: 1) a good kharif output; 2) healthy reservoir levels; 3) healthy rabi sowing; and 4) positive terms of trade for farmers, where output inflation is higher than input inflation. Considering these factors and the current demand momentum, management expects the tractor industry to continue posting high single-digit growth in FY26E. Further, with favorable market conditions (MM’s strong markets—South and West—are seeing strong demand), MM is likely to continue outperforming industry growth in FY26E. We have factored in MM to post 7% volume CAGR over FY25-27E.

* MM to capitalize on market leadership in the below-3.5T LCV category: MM maintains a dominant position in the below-3.5T segment, where its market share improved 290bp to 51.9% in FY25. While the pick-up segment has experienced subdued demand in FY25, we anticipate its growth to rebound from FY26 onwards. The resurgence will be backed by the ongoing e-commerce boom in India and demand stemming from the hub-and-spoke transport arrangement within the industry. We assume MM to clock an 8% volume CAGR over FY25-27E in this segment on a corrected base.

* Strategy in place for EV transition: MM has outlined a clear roadmap for its EV transition, including a partnership with VW. Under this partnership, VW will supply components of its MEB platform to MM’s INGLO platform. Under this platform, MM plans to launch five all-electric SUVs in India, two of which have already been launched and are seeing a strong response. MM has INR120b of investments lined up in EVs for the next three years. It expects EVs to contribute 20-30% to its mix over the next five years.

* Value unlocking in growth gems provides option value: MM has identified nine businesses as its growth gems and has set an ambitious target of achieving 5x growth in 5-7 years for each of these segments. Any incremental value unlocked in any or all of the growth gems in the coming years is likely to provide additional returns for MM shareholders.

* Valuation and view: We believe MM is well-placed to outperform across its core businesses, led by a healthy recovery in rural and new product launches in both UVs and tractors. We estimate MM to post a CAGR of ~14%/13%/16% in revenue/EBITDA/PAT over FY25-27E. While MM has outperformed its own targets of earnings growth and RoE of 18% in FY24, it remains committed to delivering 15-20% EPS growth and 18% ROE, ensuring sustained shareholder value. Reiterate BUY with a TP of INR3,643 (based on June27E SoTP).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412