Neutral Westlife Foodworld Ltd for the Target Rs. 775 by Motilal Oswal Financial Services Ltd

Steady performance; expect recovery to be gradual

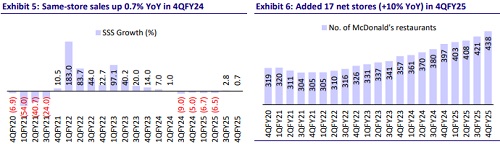

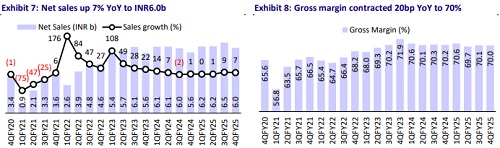

* Westlife Foodworld (WLDL) reported a revenue growth of 7% YoY to INR6b in 4QFY25, with same-store sales growth (SSSG) of 0.7% YoY (est. 1%) on a favorable base (-5% in 4QFY24). Adjusted SSSG (excluding the leap year benefit in base) was at 1.7%. Average sales per store declined 6% YoY to INR59m (annually).

* Growth was broad-based. On-premise sales grew 8% YoY, while offpremise sales rose 5% YoY. While the eating-out frequency largely remained unchanged in 4QFY25, management expects a gradual recovery in dining-out frequency.

* WLDL added a net of 17 new stores (+10% YoY) in 4Q (47 stores in FY25). Its store expansion spree will continue as the company maintains its target of opening 45-50 new stores annually. It also aims to expand its network to 580-630 restaurants by 2027, with a focus on South India, smaller towns, and drive-thru stores.

* GM contracted marginally by 20bp YoY to 70% (est. 69.6%). Restaurant operating margin (pre-IND-AS) contracted 80bp YoY to 13.6% (est. 14.7%) due to operating deleverage. EBITDA (pre-IND-AS) declined by 5% YoY, margin down by 100bp to 7.6% (est. 8%). FY25 EBITDA margin (pre-IND-AS) was at 8.2% we expect it to be 10% for FY26 and 11% for FY27.

* Over the last couple of years, the dine-in format has seen more pressure than the delivery format. While in the last two quarters, there have been signs of improvement in dine-in, albeit on a lower base, further recovery is expected in the space. However, moderating urban consumption can weigh on recovery. Demand improvement and ADS recovery will be key monitorables, which can aid in an improvement in unit economics. We reiterate our Neutral rating with a TP of INR775, based on 35x FY27E EV/EBITDA (pre-IND-AS).

In-line revenue; pressure on margin sustains

* Flattish reported SSSG: Sales grew 7% YoY to INR6b (est. INR6.1b), led by store addition of 10% YoY. The same-store-sales growth was 0.7% YoY in 4QFY25 (est. +1%, 2.8% in 3QFY25, -5% in 4QFY24). Adjusted SSSG (excluding the leap year benefit in base) was 1.7%. WLDL opened 17 net stores (opened 18 stores and closed one), taking the count to 438 stores in 69 cities. Average sales per store declined 6% YoY to INR59m (ann.).

* Pressure on operating margin persists: GM contracted marginally by 20bp YoY to 70% (est.69.6%). EBITDA grew by 3% YoY to INR794m (est. INR721m) backed by targeted cost efficiencies and normalization of marketing spends. EBITDA margin (pre-IND-AS) was down 100bp YoY to 7.6%. ROM (pre-IND-AS) was down 80bp YoY to 13.6% (est. 14.7%).

* APAT growth surged: APAT grew 96% YoY to INR15m (est. loss of INR58m).

* In FY25, net sales rose 4% YoY, while EBITDA/PAT declined 13%/82% YoY.

Key takeaways from the management commentary

* Consumption trends remained soft, though the company expects a gradual recovery in dining-out frequency. Eating out frequency largely remained unchanged in 4QFY25.

* Over the next couple of years, the company expects to reach a mid-to-highsingle-digit SSSG level.

* West continued to do well for WLDL, while the company continued to gain healthy traction in the South, aided by various initiatives undertaken by the company in that region.

* The company opened 47 new restaurants in FY25 and aims to expand its network to 580-630 restaurants by 2027.

* Input costs remained stable in 4QFY25. WLDL expects gross margin to be ~70% in the near term.

Valuation and view

* We maintain our EBITDA (pre-IND-AS) estimates for FY26 and FY27.

* Demand remained stable in 4Q, with volume-led SSSG improvement YoY, albeit on a low base. WLDL has been aggressive in store additions, which was not the case historically. The current demand environment is not conducive to aggressive expansion. Therefore, the benefits of the same can be back-ended.

* The revenue gap between dine-in and delivery has narrowed, with improvement in dine-in footfall. Weak underlying growth will continue to weigh on operating margin, leading to pressure on restaurant margins and EBITDA margins.

* We reiterate our Neutral rating with a TP of INR775, based on 35x FY27E EV/EBITDA (pre-IND-AS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)