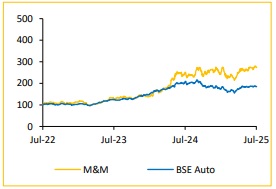

Buy Mahindra & Mahindra Ltd For Target Rs. 4,400 By Choice Broking Ltd

A Strong SUV-Led Growth and Premiumization Drive Market Share Gains and Margin Expansion: MM delivered strong revenue growth across its core Auto and Farm segments, with consolidated topline rising 25.6% YoY. A key contributor to this performance was the 22.4% growth in SUV volumes, outpacing industry growth of 3.8% YoY and driving a 570bps revenue market share gain to 27.3%. This shift was not merely volumetric — it was strategic, as higher-margin models continued to see robust demand. The traction gained by recently launched vehicles and a disciplined focus on premiumization has translated into higher ASPs, supporting better operating leverage and a margin-accretive topline.

View and Valuation: We maintain our FY26/27 EPS estimates and introduce FY28 projections, factoring in the ongoing global macroeconomic volatility, including persistent inflation. We revise our target price to INR 4,400, valuing the company at 25x (unchanged) the average of FY27/28E EPS, along with subsidiary valuation. We reiterate our ‘BUY’ rating, supported by MM strategic focus on premium product portfolio expansion and the anticipated recovery in rural demand.

MM Delivers Strong Beat on Margins and Profit, Powered by Robust SUV Sales:

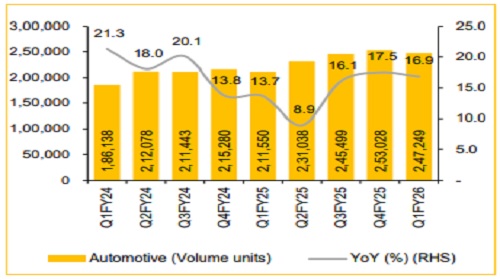

* Standalone revenue for Q1FY26 stood at INR 3,41,430Mn, reflecting a 25.8% YoY and 8.0% QoQ growth (vs consensus est. of INR 3,39,800 Mn), driven by a 16.9% YoY increase in auto volumes, a 10.4% YoY rise in tractor volumes, with a 12.7% YoY growth in auto ASP and 2.2% YoY growth in tractor ASP. Total volumes reached 3,81,328 units.

* EBITDA was reported at INR 47,954 Mn, (vs consensus est. INR 40,711 Mn), up 16.5% YoY and 13.7% QoQ. EBITDA margin was down 113bps YoY and up 70bps QoQ to 14.0% (vs consensus est. of 12.0%).

* PAT for Q1FY26 was reported at INR 34,498Mn, (vs consensus est. INR 31,009 Mn), up 32.0% YoY and 41.6% QoQ.

Automotive Volume growth of 16.9% YoY

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131