Add Motherson Sumi Wiring India Ltd For Target Rs. 60 By Emkay Global Financial Services Ltd

Steady quarter; greenfields to help outperformance vs industry

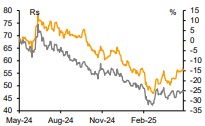

MSUMI reported an in-line Q4, with revenue growing 12% YoY (acceleration in outperformance vs MSIL to ~6% vs ~3.7% in 9M) and margin increasing by 48bps QoQ to 10.8%. Adjusted for greenfields, revenue growth stood at 9%, while the margin remained stable sequentially at 12.4%. Amid a generally tepid PV industry outlook (~5% CAGR over FY25-27E), MSUMI’s ramp-up at leading SUV-focused customers (~Rs21bn revenue potential on full ramp-up from order wins in M&M, MSIL, and TTMT for ICE and EV models) and secular kit value tailwinds (premiumization: content in SUVs is 1.5x of sedans; electrification: content in E-PVs/E-2Ws is 2.4x/5x of ICE vehicles) will aid outperformance. Our EPS estimates are largely unchanged (higher revenues negated by greenfield-related employee costs, Q4 margin miss); we retain ADD, with an unchanged TP of Rs60, at 28x FY27E PER.

Q4: Outperformance accelerates with steady profitability

Revenue grew 12% YoY to Rs25.1bn (largely in line); revenue outperformance vs key client MSIL rose to 6% in Q4 vs ~3.7% in 9M, led by scale-up at the recent greenfield. Ex-greenfield, YoY revenue growth stood at ~9%. EBITDA declined 7% YoY at Rs 2.7bn (in-line); reported EBITDA margin rose by 48bps QoQ to 10.8% (vs our 11.5% estimate), driven by lower employee costs, though GM was impacted by the mix and higher copper prices. Reported EBITDA included the Rs1.2bn impact from greenfield startup costs, adjusted for which, on a like-to-like basis, margins stand at 12.4%, stable when compared to Q3. Adjusted PAT declined 14% YoY to Rs1.65bn. The total dividend for FY25 stood at Rs0.85/sh. The company has retained its net cash status (Rs2.3bn vs Rs2.6bn in FY24), with a slight decline in the net working capital days to 53 vs 49 in FY24. The capex incurred in the year stood at Rs1.7bn, up from Rs1.1bn in FY24.

KTAs from earnings call

1) MSUMI supplies to 9 of the top 10 most popular PV models in India; it is setting up three greenfields to support future growth (Pune-already commissioned; Gujarat-2 lines, to be commissioned in Q1/Q2; Haryana-to be commissioned in Q2). 2) These greenfields are for EV as well as ICE programs of customers; company expects that upon full rampup (achieving target volumes shared by OEM clients), these will contribute Rs21bn in revenue annually; it also expects the greenfields to operate at optimum utilization in H2. 3) EVs formed 4% of revenue in Q4, and were entirely from high voltage wiring harnesses; MSUMI will continue to support all powertrain types as dictated by the market/industry. 4) Current losses from greenfields are largely due to the two and they are yet to commence production; reported numbers reflect manpower cost related to the plant already commissioned and partial manpower hiring at the other two plants; the company expects staggered addition of manpower depending on how volumes/scale at greenfields evolve. 5) It continues to look for localization opportunities for high and low voltage harnesses and has localized a few high voltage harnesses, charging connectors, etc. 6) It does not hedge copper prices; although it has pass-through arrangements with customers with a 3-6 months lag. 7) FY26 capex guidance stands at Rs2bn.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354