Buy Syrma SGS Technology Ltd for the Target Rs.820 by Motilal Oswal Financial Services Ltd

Business mix change fuels margin expansion

Operating performance beats our estimates

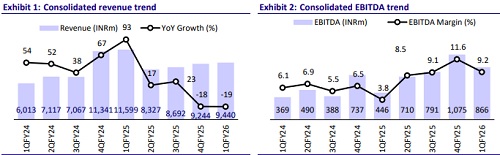

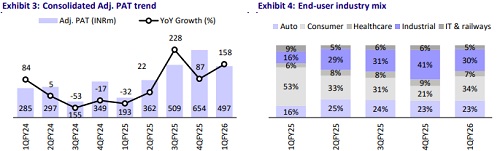

* Syrma SGS Technology (SYRMA) reported a strong operating performance, with EBITDA up ~94% YoY in 1QFY26. EBITDA margins expanded 530bp YoY due to a favorable business mix (lower share of low-margin consumer business at 34% in 1QFY26 vs. 53% in 1QFY25). Revenue declined 19%, largely led by a decline in the Consumer/IT and Railways businesses by 49%/50% YoY.

* With the order book continuing to improve to INR54-55b as of 1QFY26 (up ~21% YoY) and margins expanding, we expect SYRMA to witness a stronger FY26. Management has guided for 30-35% revenue growth and ~8.5%-9% EBITDA margins for FY26 (vs 8-8.5% margin earlier).

* Factoring in strong operating performance and changing business mix to higher-margin segments, we raise our earnings estimate for FY26/FY27 by 7%/10%. We reiterate our BUY rating on the stock with a TP of INR820 (35x FY27E EPS).

Growth in Automotive and Industrial supports margin expansion

* Consol. revenue declined 19% YoY to INR9.4b (est. in line) owing to a decline in Consumer/IT and Railways by 49%/50% YoY. This was offset by an increase in the Automotive/Industrial business by 18%/54% YoY. The Healthcare business declined marginally (down 1% YoY).

* EBITDA margin expanded 530bp YoY to 9.2% (est. 8%), attributed to gross margin expansion of 970bp YoY to 24.7%, led by a favorable business mix (lower share of high volume-low margin business). EBITDA grew 94% YoY to INR866m (est. INR784m). Adj. PAT grew 2.6x YoY to INR497m (est. INR457m).

* The order book stood in the range of INR54-55b as of Jun’25 vs. INR45b as of Jun’24. The Consumer/Industrial/Automotive/Healthcare, IT, and Railways segments accounted for ~25-27%/25-27%/35-40%/remaining portion of total orders as of Jun’25

* Gross debt amounted to ~INR7.8b as of Jun’25 from INR6.1b as of Jun’24. Net debt was ~INR3.1b as of Jun’25 vs. INR1.2b as of Jun’24. Net working capital days stood at 69 days as of Jun’25, with management targeting to reduce it to below 65 days by the end of the year.

Highlights from the management commentary

* JV: The company entered into a JV with Shinhyup Electronics to manufacture PCBs. The project entails a capex of ~USD90m over the next 3-5 years (phase 1 of capex amounts to USD35m; will be done over the next 12-18 months). Commercial production is expected to start from 4QFY27/1QFY28. Post stabilization, management expects to achieve an EBITDA margin of 15-18%, with potential to scale up to ~20%.

* Exports: Export revenue grew 27% YoY to INR2.4b. Management guides full-year FY26 exports to cross INR10b. However, tariff uncertainty is holding back customers from booking large orders; a more aggressive stance is expected from customers once tariff decisions are finalized.

* Capex: The company incurred a capex of ~INR350m in 1QFY26, with FY26 capex guidance of less than INR1b. With major new plants currently operating at less than 50% capacity, management expects significant revenue growth potential from existing plants. Annual capex for the EMS business is estimated at ~INR0.8- 1b.

Valuation and view

* SYRMA continued its margin recovery, driven by a favorable shift in the business mix in 1QFY26. We expect this trend to continue through FY26, led by strong growth in higher-margin segments, such as automotive and industrial.

* We believe that the company’s long-term trajectory will continue to remain strong, backed by: 1) its focus on low-volume, high-margin business; 2) an increase in exports; 3) increasing share of revenue in the industrial and automotive segments; and 4) a foray into bare PCB manufacturing through its JV.

* We estimate a revenue/EBITDA/adj. PAT CAGR of 30%/40%/55% over FY25-27, driven by strong revenue growth and margin expansion. We reiterate our BUY rating on the stock with a TP of INR820 (premised on 35x FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412